ARTICLE AD BOX

On August 7, multi-assets investing and trading platform Robinhood announced its Q2 results for 2024.

The firm reported a 40% year-over-year increase in total net revenues, reaching $682 million. A significant surge in options and crypto revenue largely drove this growth.

Crypto and Options Revenues Propel Robinhood’s Earnings Growth

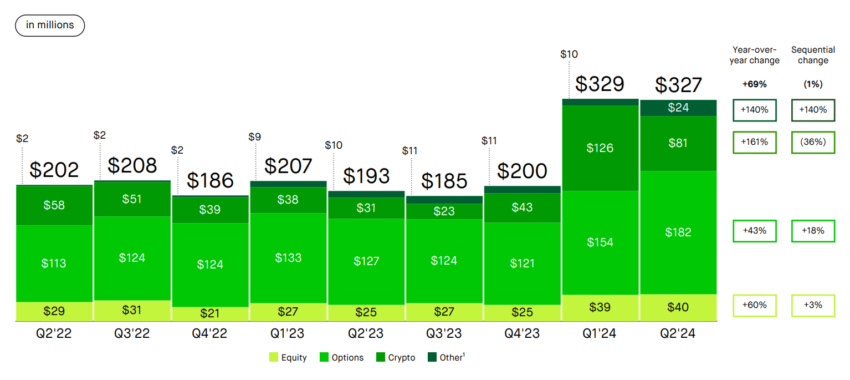

The earnings report highlighted a 69% rise in transactions-based revenues to $327 million, with crypto revenue jumping by 161% to $81 million in this segment. Additionally, options and equities revenues grew by 43% and 60%, respectively. For Q2 2024, net income soared to $188 million, or $0.21 per diluted share, up from $25 million, or $0.03 per diluted share, in Q2 2023.

Read more: How to Buy and Sell Crypto on Robinhood: A Step-by-Step Guide

Robinhood’s Transaction-Based Revenue from Q2 2022 to Q2 2024. Source: Robinhood Investor Relations

Robinhood’s Transaction-Based Revenue from Q2 2022 to Q2 2024. Source: Robinhood Investor RelationsComparing Q2 2024 to Q1 2024, Robinhood saw a 10% sequential increase in net revenues from $618 million to $682 million. However, crypto transaction-based revenue experienced a slight decline from $126 million in Q1 to $81 million in Q2.

Robinhood’s user base and assets under custody (AUC) also experienced significant growth. Funded customers increased to 24.2 million, and AUC surged by 57% year-over-year to $139.7 billion. Furthermore, the company’s 1% bonus program drove over $3 billion in asset transfers, averaging approximately $130,000 per customer.

Robinhood’s strategic initiatives and acquisitions have played a crucial role in its recent success. BeInCrypto reported that Robinhood agreed to acquire European crypto exchange Bitstamp, Ltd in June. Meanwhile, it acquired Pluto Capital Inc., an AI-powered investment research platform, in July.

These acquisitions are expected to enhance Robinhood’s capabilities and provide additional liquidity for crypto trading. Jason Warnick, Robinhood’s Chief Financial Officer (CFO), pointed out that the acquisitions are also part of a broader strategy to drive growth and innovation.

“We’re excited to share more as we make progress here. And finally, we announced a $1 billion share repurchase authorization, which we started executing in July and currently expect to execute over a two- to three-year period,” Warnick added during the company earnings call.

Following the report, Robinhood’s stock, HOOD, saw a notable increase. During the trading after-hours at 17:16 ET, it rose to $17.61 from the daily low of $16.58. HOOD’s price has increased by 38.4% year-to-date.

These achievements are particularly noteworthy given that Robinhood faced legal challenges in the US. The Securities and Exchange Commission (SEC) issued a Wells notice to the company in May.

Looking ahead, Robinhood executives expressed their hopes for regulatory clarity and improvements in the US. They opined that if the regulatory environment for crypto improved, it would significantly enable them to innovate more swiftly and introduce more of what customers would like to see in the crypto industry.

“In the current situation, we’re able to do that more in the EU than we are in the US,” Warnick opined.

Read more: Coinbase vs. Robinhood: Which Is the Best Crypto Platform?

HOOD Price Performance. Source: Google Finance

HOOD Price Performance. Source: Google FinanceVlad Tenev, Robinhood’s CEO, echoed Warnick’s statement. He believes that the US should position itself as a leader in the crypto sector, and regulatory clarity would benefit this goal.

The post Robinhood Q2 2024 Earnings Soar to $682 Million, Driven by Crypto and Options Revenue appeared first on BeInCrypto.

.png)

3 months ago

1

3 months ago

1

English (US)

English (US)