ARTICLE AD BOX

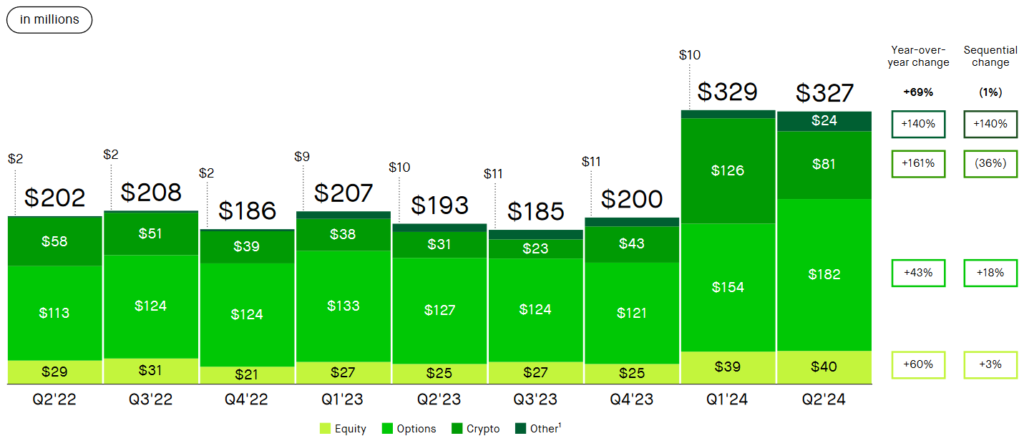

In a strong performance, Robinhood Markets Inc. announced a remarkable 161% year-over-year increase in its crypto transaction-based revenues, reaching $81 million in the second quarter. This surge comes amid a significant rise in trading volume, reflecting growing investor interest in cryptocurrencies.

Crypto Revenue Outpaces Equities

During the second quarter, Robinhood’s crypto revenue far exceeded its earnings from equities, highlighting the increasing dominance of digital assets in the trading landscape. The online brokerage’s crypto trading volume soared to $21.5 billion, a 137% increase compared to Q2 2023. However, this figure represents a 40% decline from Q1 2024, indicating some market volatility.

Fluctuating User Engagement

Robinhood CEO Vlad Tenev attributed the variations in trading volume and revenue to changes in monthly active user engagement, which tends to spike during bullish crypto markets and decline when prices fall. The platform experienced a 27% drop in total customer trades and an 18% fall in the average notional trading volume per trader, reflecting these market dynamics.

Despite these fluctuations, Robinhood’s $81 million in crypto revenues significantly outperformed its equities revenue for the quarter. The company’s largest revenue stream, however, came from options trading, which brought in $327 million.

Source: Robinhood

Source: RobinhoodExpanding Crypto Custody and Strategic Acquisitions

Robinhood reported holding $20.6 billion in crypto assets under custody, marking a 57% year-over-year increase. This growth has been driven by higher net deposits and rising crypto valuations.

The firm also made strategic moves to strengthen its position in the crypto market, including an agreement to acquire Bitstamp, a crypto exchange with over 50 active licenses and registrations worldwide. This $200 million acquisition, expected to finalize in the first half of 2025, aims to bolster Robinhood’s global presence in the crypto industry.

Additionally, Robinhood furthered its commitment to innovation by acquiring AI-powered investment research firm Pluto Capital in Q2, enhancing its capabilities in artificial intelligence and machine learning.

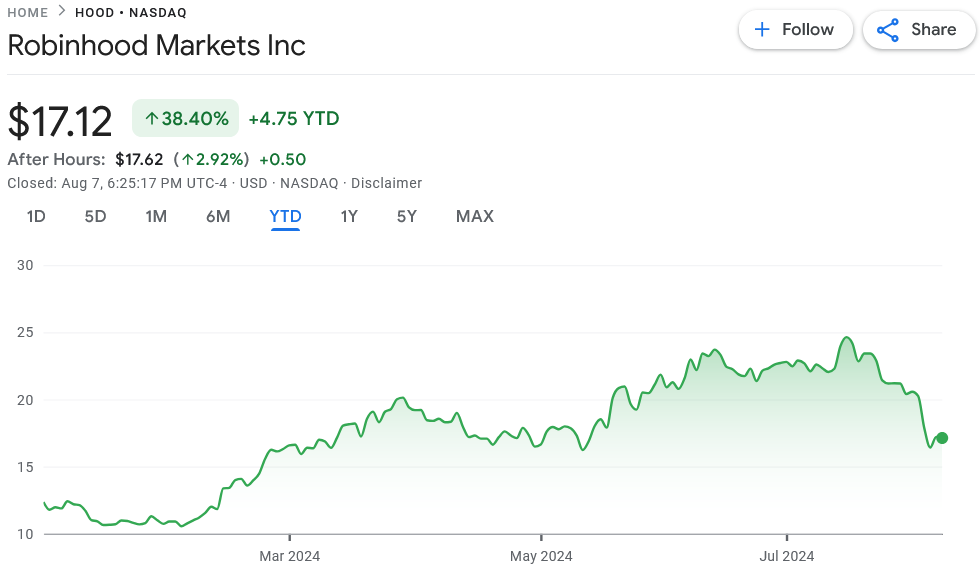

Source: Google Finance

Source: Google FinanceChallenges and Regulatory Scrutiny

Despite the positive financial results it faced some challenges. The company’s 24-hour market execution venue, Blue Ocean ATS, was temporarily suspended amid a market downturn, raising concerns among investors.

Furthermore, Robinhood’s crypto unit received a Wells Notice from the U.S. Securities and Exchange Commission (SEC) in May, signalling potential enforcement action for alleged breaches of U.S. securities laws. Robinhood’s Chief Legal, Compliance, and Corporate Affairs Officer, Dan Gallagher, strongly disagreed with the SEC’s preliminary determination, asserting that the assets listed on their platform are not securities and expressing confidence in their legal standing.

.png)

5 months ago

7

5 months ago

7

English (US)

English (US)