ARTICLE AD BOX

Amidst market challenges, Robinhood impresses with a remarkable turnaround, posting substantial profits and revenue growth in the first quarter of 2024.

Wall Street Surprised: Robinhood Exceeds Expectations

Robinhood’s Q1 earnings report shatters Wall Street predictions, with impressive revenue figures and earnings per share far surpassing analyst forecasts.

Robinhood Markets Inc. has undergone a significant transformation in Q1 2024, emerging from a period of losses to achieve a substantial profit of $157 million. This remarkable turnaround marks the company’s second consecutive quarterly profit, signalling a positive trajectory for the popular trading platform.

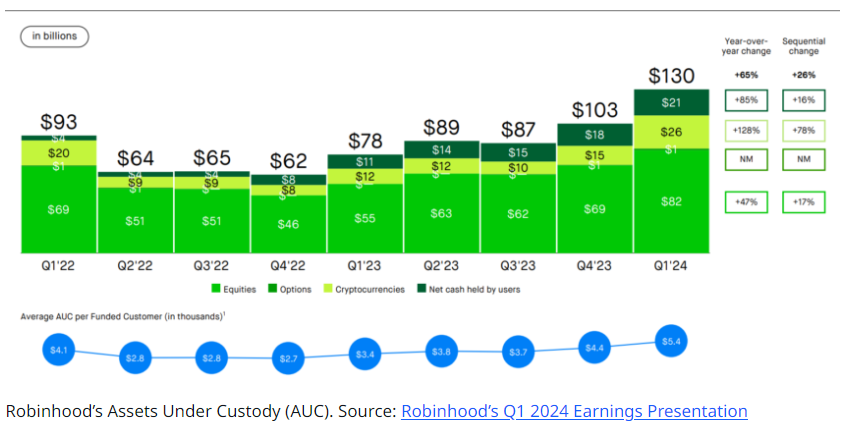

In its quarterly report released on Wednesday, Robinhood revealed a remarkable 40% increase in net revenues, soaring to $618 million. Notably, transaction-based revenues surged by 59%, largely fueled by a significant uptick in crypto transactions. Revenue from crypto transactions alone witnessed an astounding 232% increase, reaching $126 million.

Moreover, Robinhood reported a noteworthy surge in crypto assets under custody, reaching $26 billion by the end of March. This represents an impressive 78% rise from the previous quarter, highlighting the growing prominence of cryptocurrencies within Robinhood’s platform.

The company also celebrated record highs in net deposits and Gold subscribers, underscoring its strengthened user engagement and product offerings. Jason Warnick, Robinhood’s Chief Financial Officer, expressed confidence in the company’s performance, emphasizing their commitment to driving profitable growth in 2024.

The market responded positively to Robinhood’s stellar performance, with shares (HOOD) experiencing a significant surge during after-hours trading, climbing by 6.3% to $19.01.

Regulatory Challenges Loom: SEC Scrutiny Over Crypto Practices

Despite its impressive financial results, Robinhood faces heightened scrutiny from the US Securities and Exchange Commission (SEC) over its crypto practices. The SEC’s issuance of a Wells notice raises concerns regarding potential violations related to Robinhood’s crypto listings, custody, and operational procedures, potentially leading to enforcement actions.

CEO Vlad Tenev expressed frustration over the SEC’s actions, criticizing what he perceives as excessive focus on crypto. Tenev reaffirmed Robinhood’s commitment to defending its crypto business and establishing regulatory clarity in the United States.

The tension between Robinhood and the SEC underscores broader regulatory tightening within the crypto sector, with potential implications for both Robinhood’s operations and the overall market landscape. As regulatory uncertainties persist, the industry awaits further developments that could shape the future of crypto trading platforms like Robinhood.

Also Read: Robinhood’s Cryptocurrency Wallet Goes Global on Android: Store DOGE, SHIB, ETH, MATIC, and Beyond!

.png)

6 months ago

2

6 months ago

2

English (US)

English (US)