ARTICLE AD BOX

SafeMoon, the once-hyped cryptocurrency, has taken a significant plunge as it officially declares bankruptcy, sending shockwaves across the market. Over the past week, SafeMoon’s price has staggered from $0.000100 to $0.000061, experiencing an 18% decrease. The company’s filing for Chapter 7 bankruptcy was unveiled after its name surfaced on the US court website.

SafeMoon’s Bankruptcy Declaration

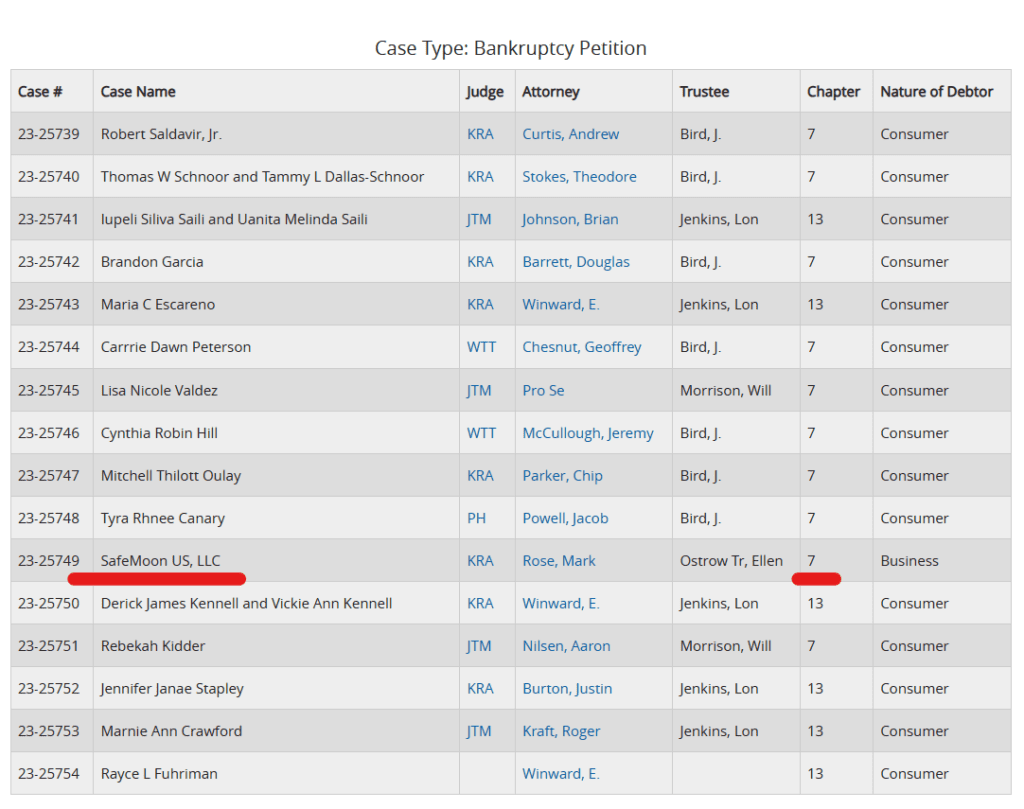

The downfall accelerated after an internal communication surfaced, indicating an impending bankruptcy. Kenneth Ehrler, the Chief Restructuring Officer, pointed out numerous operational and financial hurdles faced by SafeMoon. These challenges deemed the company incapable of sustaining its operations, leading to the decision to file for Chapter 7 bankruptcy. Confirmation of the bankruptcy arrived when SafeMoon’s name appeared on the United States Bankruptcy Court District of Utah website.

This development follows a series of setbacks for SafeMoon, including the arrests of CEO John Karony and CTO Thomas Smith by the US Department of Justice earlier in November. Allegations of defrauding customers, misappropriating investors’ funds, and the subsequent charges drastically impacted SafeMoon’s credibility and market standing.

Impact on SafeMoon’s Market Value

The market responded swiftly to SafeMoon’s bankruptcy, asserting that this outcome was inevitable due to the company’s alleged mismanagement of funds. The recent downturn in SafeMoon’s value, currently trading at $0.000061, represents a 17.79% decrease. This latest crash contributes to the ongoing downward trend experienced over the past week, plummeting the coin’s value from $0.000080.

Source: TradingView

Source: TradingViewConclusion

SafeMoon’s journey from substantial highs to this dire bankruptcy filing highlights the repercussions of alleged malpractices by its key executives. This recent decline marks one of the most significant plunges following legal troubles earlier in the year. SafeMoon’s volatility and market instability raise concerns about the security and sustainability of cryptocurrencies in the broader market.

Also Read: Safemoon LP Been Exploited for $8.9 Million; SFM Tokens Are “Protected,” Says CEO

.png)

11 months ago

6

11 months ago

6

English (US)

English (US)