ARTICLE AD BOX

The post Shiba Inu Coin Crashes 70%: Fear Grips Shib Army appeared first on Coinpedia Fintech News

Shiba Inu’s price has continued to fall and it has now dropped for three straight days, reaching a low of $0.00001271.This is the lowest level since March 1st. It has crashed by almost 70% from its highest point this year, performing worse than major coins like Bitcoin and Ethereum.

Crypto Fear and Greed Index Hits Hard

The price of Shib has fallen due to rising fear in the crypto industry. The crypto fear and greed index has now dropped to 29, its lowest level since November last year. Several factors inside and outside the crypto world have contributed to this decline. Bitcoin balances on exchanges have risen as news about the German government and Mt. Gox repayments circulated.

Rise of Competition

One another reason for SHIB’s price drop is weak fundamentals. Recent data shows that demand for SHIB has reduced. On many days, its trading volume has been surpassed by newer meme coins like Pepe and Dogwifhat. Today, Shiba Inu had a total volume of $500 million, while Pepe and Dogwifhat had $1.3 billion and $913 million, respectively. Other meme coins like Floki and Bonk are also seeing higher volumes than SHIB.

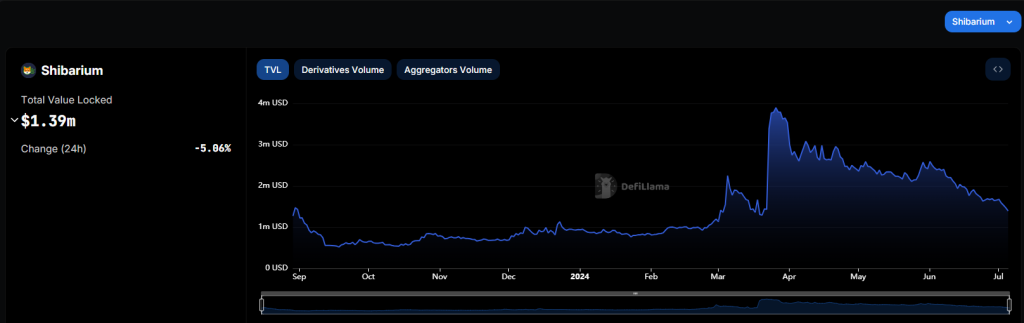

Shiba Inu’s Shibarium network isn’t getting along well either. Data from DeFi Llama shows that Shibarium’s total value locked (TVL) has dropped from its year-to-date high of $4 million to $1.39 million. All dApps on Shibarium, like WoofSwap, ChewySwap, Marswap, and DogSwap, have seen their TVL drop by over 40% in the past 30 days.

Source: defillama

Source: defillamaSimilarly, ShibaSwap’s assets have also fallen to $18.97 million from almost $2 billion at their peak in 2021.

Source: defillama

Source: defillamaShiba Inu’s current situation reflects broader market trends and specific challenges within the SHIB ecosystem. The coming days will be crucial for this meme coin’s future.

Read Also : 3 meme coins for up to 2000% gains

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)