ARTICLE AD BOX

The recent emergence of nine newly introduced US spot Bitcoin exchange-traded funds (ETFs) has marked a significant milestone, collectively amassing over 300,000 BTC in assets under management (AUM) within a span of less than two months since their inception. This accumulation, which amounts to nearly 1% of the total Bitcoin supply capped at 21 million, underscores a burgeoning interest among investors in Bitcoin and a growing acceptance of cryptocurrency investment vehicles within traditional financial markets.

The nine prominent US spot BTC ETFs encompass entities such as BlackRock (IBIT), Fidelity (FBTC), Ark 21Shares (ARKB), Invesco (BTCO), Bitwise (BITB), Valkyrie (BRRR), Franklin Templeton (EZBC), WisdomTree (BTCW), and VanEck (HODL).

Spot Bitcoin Exchange-Traded Funds Achieve Record-Breaking Milestone

According to data compiled by K33 Research, since their launch on January 11, these newly introduced spot Bitcoin ETFs have swiftly garnered traction, amassing a combined total of 303,002 BTC, equivalent to approximately $17 billion based on recent closing prices.

Leading the pack among these ETFs is BlackRock’s IBIT spot Bitcoin ETF, which has accumulated over 128,615 BTC, valued at approximately $7.2 billion in AUM. Following closely behind is Fidelity’s FBTC, with a holding of more than 94,455 BTC, equivalent to $5.2 billion, as reported by BitMEX Research.

Eric Balchunas, a Senior ETF Analyst at Bloomberg, noted the historic significance of this achievement, highlighting the escalating demand for cryptocurrency investment products. The surge in trading volumes, particularly on the first day following weekends, indicates a heightened interest, although the precise reasons behind this phenomenon remain under speculation.

It’s official..the New Nine Bitcoin ETFs have broken all time volume record today with $2.4b, just barely beating Day One but about double their recent daily average. $IBIT went wild accounting for $1.3b of it, breaking its record by about 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

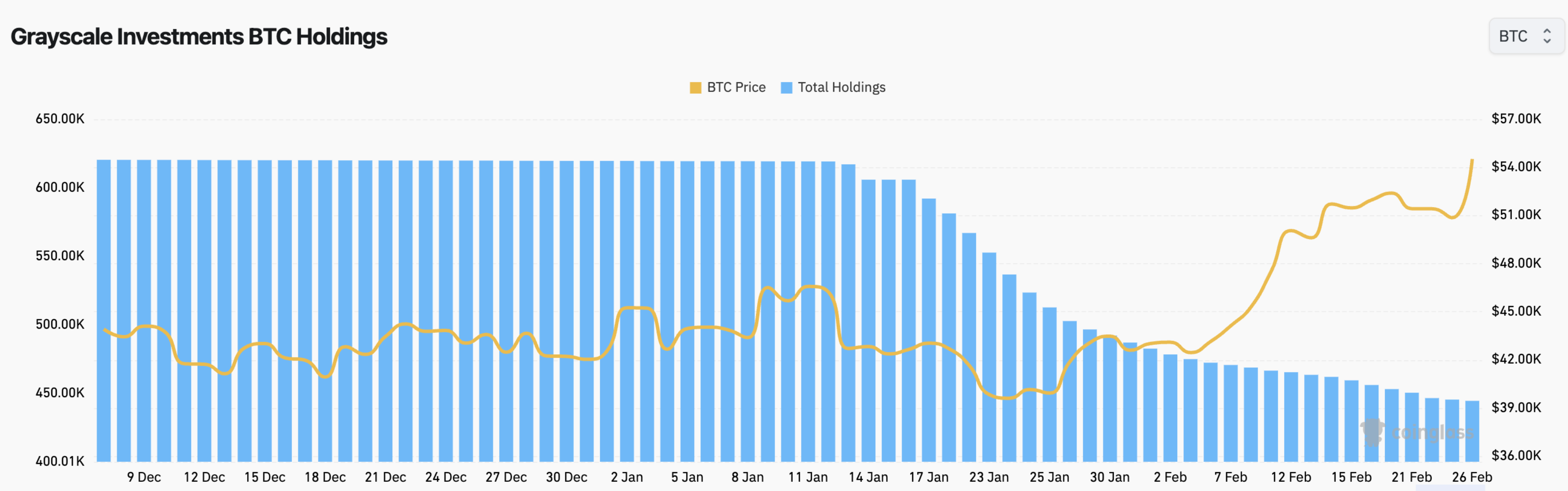

Meanwhile, data from Coinglass reveals a notable decline in assets managed by Grayscale’s converted GBTC fund, witnessing a decrease of more than 28% since January 11. The fund’s holdings have dwindled from approximately 619,000 BTC ($35 billion) to 444,000 BTC ($25 billion).

The surge in BTC ETFs has not only impacted market dynamics but also influenced inflows and outflows significantly. Total net inflows across all US spot Bitcoin ETFs surpassed $6 billion, with nearly $520 million recorded as net inflows — the highest in two weeks.

Additionally, recent data from CoinShares highlights the substantial role played by BTC spot ETFs in the overall influx of crypto investment products. Bitcoin-based funds, particularly spot ETFs, attracted a dominant share of approximately $570 million out of the total $598 million investments made over the past week alone.

Bitcoin Price

The recent surge in Bitcoin’s price to $58,000 can be attributed to heightened interest in Bitcoin spot ETFs. The introduction of nine new US spot Bitcoin exchange-traded funds (ETFs) has led to increased institutional interest and inflow of funds into the cryptocurrency market. This surge reflects growing confidence in Bitcoin as a long-term investment asset and signals broader acceptance of cryptocurrencies within traditional financial markets.

The post Significant Accumulation of Bitcoin by New Spot ETFs Signals Growing Investor Confidence appeared first on Daily Coin Post.

.png)

8 months ago

4

8 months ago

4

English (US)

English (US)