ARTICLE AD BOX

- Solana (SOL), a prominent layer-1 blockchain platform, has surged by 45% since mid-February.

- Analysts anticipate further upward movement, suggesting SOL could challenge its all-time high of $260 later this year.

- SOL appears undervalued based on its price-to-sales ratio, indicating room for growth as its network activity continues to increase.

Solana (SOL), one of the most prominent layer-1 blockchain platforms, has caught fire over the last couple weeks. The Ethereum competitor has notched a scintillating 45% price gain since mid-February, outpacing broader crypto markets.

After languishing under $100 for the latter portion of 2022 and early 2023, SOL appears to have kicked into higher gear once again. The latest push has carried Solana back above the critical $140 level, as bullish momentum accelerates.

And despite its breathless run over the last month, analysts believe Solana still has ample room left to continue powering higher in the months ahead. Both from a technical and fundamental perspective, the fast-growing network seems poised to make a run at its all-time high around $260 later this year.

How high can Solana go?

While the relative strength index (RSI) is flashing overbought readings, Solana historically has maintained an upside trajectory after entering that zone. Past rallies have reached as high as 300%, even once the RSI breached 70. More realistically, a successful break above near-term resistance around $150 could pave the way to $168 next.

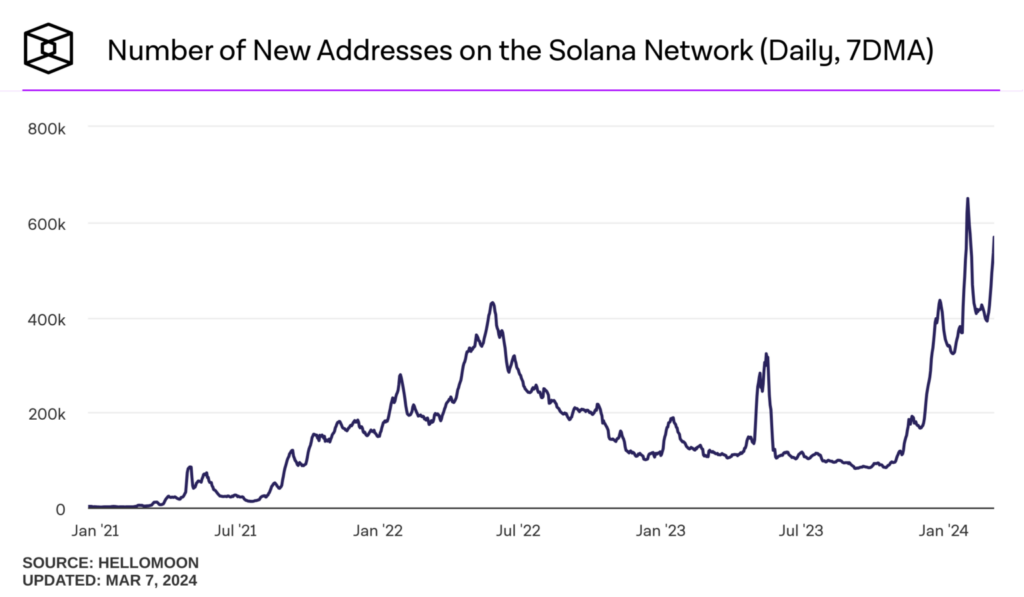

Longer-term, Solana appears significantly undervalued based on its price-to-sales ratio – an important benchmark comparing market cap with revenue. SOL’s market value failed to keep pace with growth last year, indicating the asset is still discounted relative to its network activity. As more users flock to the chain, prices should ultimately normalize higher.

Supporting that notion, Solana has registered a more than 40% jump in new addresses added over the past two weeks. Rising user growth and investor interest could propel a virtuous cycle of greater transactions, fees, and rewards, attracting even more participants to the ecosystem.

With technicals improving, valuation upside, and strong on-chain signals backing its advance, Solana seems to just be dusting itself off after an extended crypto winter chill. The stage looks set for SOL to make a triumphant push back towards its former highs exceeding $200. Buckle up for the next leg higher as Solana fires on all cylinders once again.

.png)

9 months ago

3

9 months ago

3

English (US)

English (US)