ARTICLE AD BOX

Analysts are speculating about the final decision deadline for Solana ETFs, predicting a mid-March 2025 timeline. This follows recent filings by the Chicago Board Options Exchange (CBOE) to list VanEck and 21Shares’ proposed Solana ETFs.

Mid-March Decision Deadline

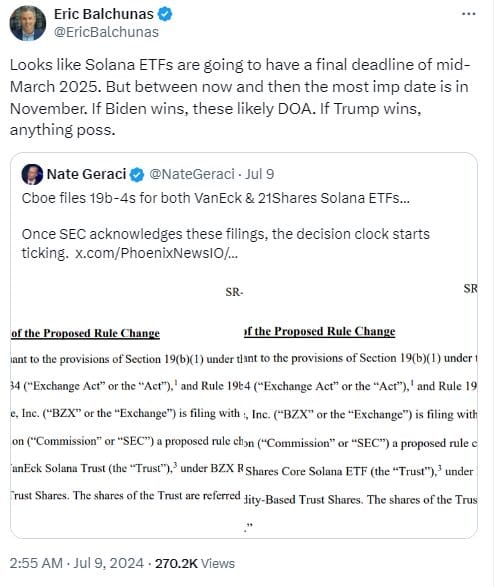

Senior Bloomberg ETF analyst Eric Balchunas noted that Solana ETFs could see a final decision around mid-March 2025. However, he highlighted the significance of the November 2024 presidential election in this timeline.

On July 8, the CBOE submitted two Form 19b-4 applications—one for the 21Shares Core Solana ETF and another for the VanEck Solana Trust. These prospective funds are compared to the previously approved spot Bitcoin and Ether ETFs, which received SEC approval in January and May, respectively.

“Much like Bitcoin and ETH, the Exchange believes that SOL is resistant to price manipulation and that ‘other means to prevent fraudulent and manipulative acts and practices’ exist to justify dispensing with the requisite surveillance sharing agreement,” both filings stated.

Nate Geraci, President of the ETF Store, noted that once the SEC acknowledges the filings, the “decision clock will start ticking.” Under SEC rules, the agency has 240 calendar days to decide whether to approve or deny the CBOE’s 19b-4 application to list the products from VanEck and 21Shares. These are the first proposed ETF products tied to the price of Solana, the fifth-largest cryptocurrency.

Also Read: Solana’s Surge: 3 Reasons Fueling the $200 Price Prediction

Political Climate Could Influence Solana ETF Approval

Senior Bloomberg ETF analyst Eric Balchunas further commented that the outcome of the November presidential election could significantly impact ETF approvals. “If Biden wins, these likely DOA. If Trump wins, anything possible,” Balchunas remarked.

Recent research by GSR Markets predicts that Solana’s price could increase ninefold with potential ETF approvals, akin to the historical price surge seen with Bitcoin. The research suggests that support for the crypto industry from figures like former President Donald Trump has softened opposition from Democrats, leading to bipartisan support for regulatory frameworks that could enable new crypto opportunities, setting the stage for Solana ETF approvals.

“We are now addressing the increasing investor interest in Solana – one of the most actively traded cryptocurrencies after Bitcoin and Ether,” said Rob Marrocco, global head of ETP Listings at CBOE.

VanEck and 21Shares initially applied with the SEC in June to launch the new products. The SEC must also approve their S-1 filings before the products can begin trading.

Also Read: How ETFs Are Reshaping the Crypto Markets

.png)

4 months ago

3

4 months ago

3

English (US)

English (US)