ARTICLE AD BOX

The outlook for United States-based Solana exchange-traded funds (ETFs) in 2024 remains grim. Recent regulatory actions suggest that these ETFs have a minimal chance of receiving approval under the current administration.

This conclusion follows the US Securities and Exchange Commission’s (SEC) rejection of necessary filings.

Solana ETF Approval Remains Uncertain

On Tuesday, the SEC reportedly declined the Chicago Board Options Exchange’s (CBOE) 19b-4 filings for two prospective spot Solana ETFs. Consequently, these documents were removed from the CBOE website. This decision came after extensive discussions between the SEC and issuers, focusing on whether Solana should be classified as a security.

The crucial 19b-4 filings necessary to initiate the SEC’s review process never reached the Federal Register. Consequently, the SEC halted any progress toward approval or denial.

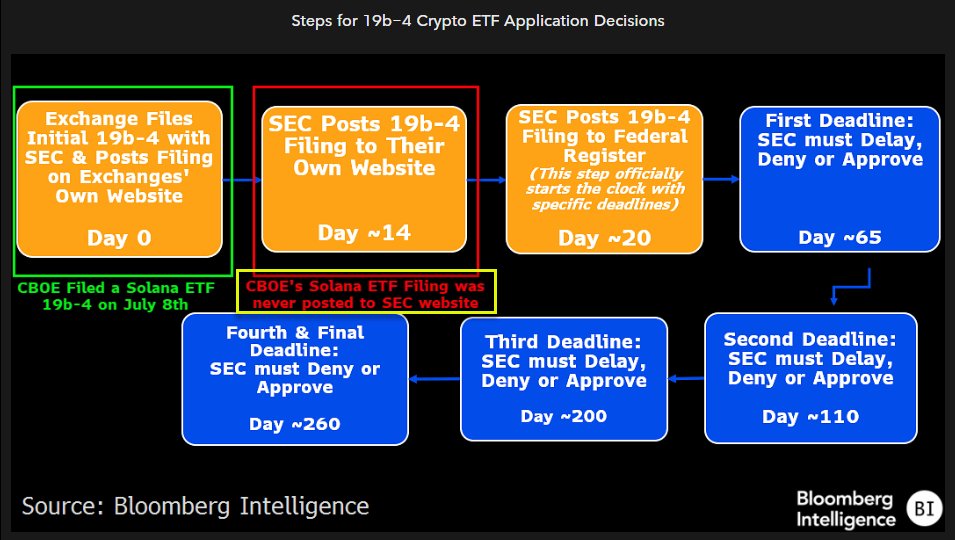

Bloomberg ETF analyst Eric Balchunas provided insight with a flowchart showing that the Solana ETFs did not advance past the second step of the process, which involves the SEC posting the 19b-4 filing on their website.

“A snowball’s chance in hell of approval unless there’s a change in leadership. Near-zero chance in 2024, and if Kamala Harris wins, there’s probably near-zero chance in 2025, too. The only hope, in my opinion, is if Donald Trump wins,” Balchunas said.

Read more: Solana ETF Explained: What It Is and How It Works

Steps for 19b-4 Crypto Application Decisions. Source: Bloomberg Intelligence

Steps for 19b-4 Crypto Application Decisions. Source: Bloomberg IntelligenceCurrently, prediction markets like Polymarket suggest a tight race. Trump has a 52% chance of winning the 2024 election, closely followed by Harris at 47%. Moreover, there are speculations that if Harris prevails, she might elevate the current SEC chief, Gary Gensler, to the US Treasury Secretary role.

Also weighing in on the discussion, Nate Geraci, President of the ETF Store, highlighted the unlikely approval of a Solana ETF shortly under the existing administration. He also pointed out the absence of CME-traded Solana futures, which are believed to be necessary for the approval.

“The only viable path for spot Solana ETF approval would be the establishment of a clear regulatory framework that distinctly classifies which crypto assets are securities versus commodities,” Geraci said.

Adding another layer to the discussion, VanEck’s head of digital asset research, Matthew Sigel, remains determined to launch a spot Solana ETF. He referred to a 2018 case involving the Commodity Futures Trading Commission (CFTC) against My Big Coin Pay.

“Courts have drawn parallels between natural gas and digital tokens. For natural gas, it doesn’t matter if the gas is delivered to different hubs like Henry Hub in Louisiana or elsewhere: if futures contracts exist for one, all types of natural gas are treated as commodities. This same logic could apply to digital assets like Solana and could shape the future of ETF regulation,” Sigel argued.

Moreover, in July 2024, CFTC Chairman Rostin Behnam said that 70-80% of cryptocurrencies are not securities. He also advocated for the CFTC’s full oversight of the crypto market.

Indeed, if the CFTC regulates the crypto market, it could open the doors for a spot in Solana ETF.

The post Solana ETF Facs Uphill Battle: Analysts Say Near-Zero Chance of Approval in 2024 appeared first on BeInCrypto.

.png)

2 months ago

1

2 months ago

1

English (US)

English (US)