ARTICLE AD BOX

VanEck and 21Shares have filed for a Solana-based exchange-traded fund (ETF). However, the outlook for approval is uncertain, with much depending on the upcoming US presidential election results.

If Donald Trump, a Republican, wins the presidency, the dynamics might shift favorably.

Solana Institutional Demand Remains High

Experts such as Bloomberg ETF analyst James Seyffart consider VanEck and 21Shares’ filings to be a long shot under the current administration. Industry analysts predict slim chances of the ETF’s approval if Democrats retain control.

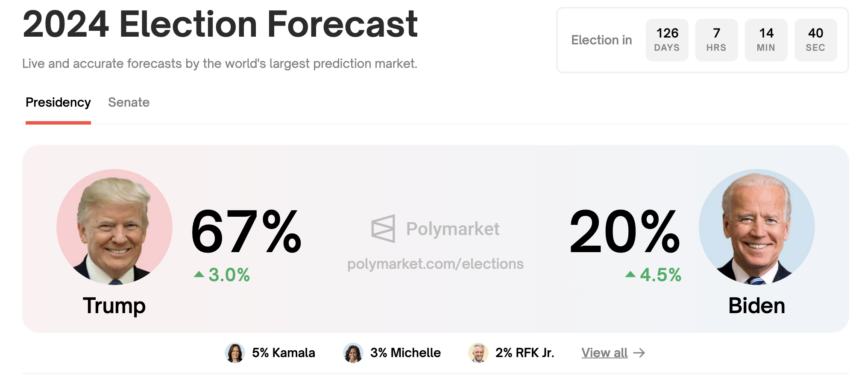

Conversely, a Securities and Exchange Commission (SEC) head, likely appointed under Trump, could improve these odds. Currently, prediction markets like Polymarket show a 67% chance of Trump winning the 2024 election.

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

2024 Election Forecast. Source: Polymarket

2024 Election Forecast. Source: PolymarketSpeculation is rife about potential replacements for Gary Gensler, the current SEC chair, should Trump reclaim the presidency. Dan Gallagher, Chief Legal Officer at Robinhood and former SEC Commissioner, is rumored to be a candidate for Gensler’s position.

Meanwhile, some industry leaders view the Solana ETF filing skeptically. Nic, CEO of CoinBureau, considers it a marketing tactic.

“It’s great to see Van Eck filing for a SOL ETF. However, I think it’s really unlikely it will get approved this year. There isn’t a CME futures market for market data to have been gathered (something the SEC explicitly requires). Moreover, ETH ETFs have yet to launch, and we don’t know what demand will be like. Also, the impact of FIT21 could speed up its running. But not this year,” Nick said.

Matthew Sigel from VanEck’s digital asset research team argues that a CME futures market isn’t mandatory for crypto-ETF approval. However, industry consensus suggests that significant regulatory acceptance might only come with new SEC leadership.

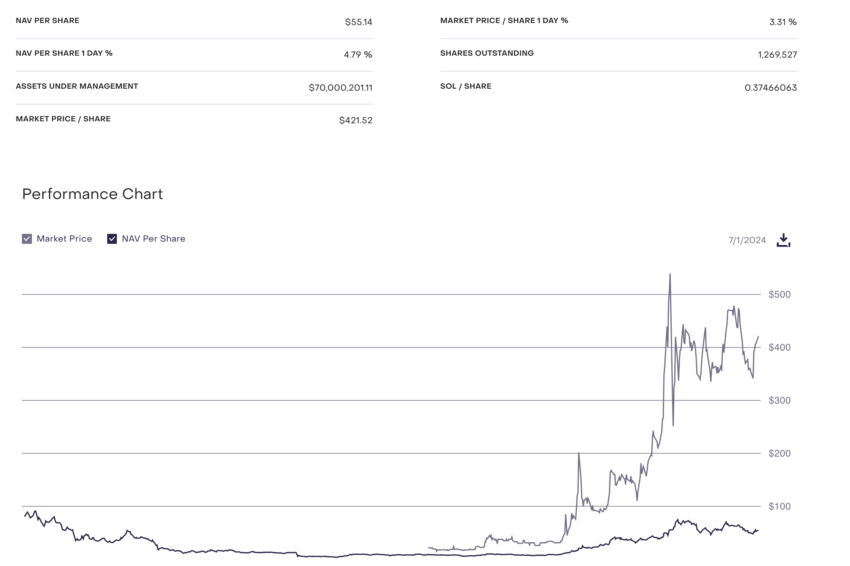

Despite skepticism, institutional interest in Solana remains strong. Grayscale’s Solana Trust (GSOL), for instance, has a market price per share that is 7.6 times its NAV, currently at $421. Nic believes that this institutional bullishness might have spurred the speculative VanEck ETF approval attempt.

Grayscale Solana Trust (GSOL) Price Performance. Source: Grayscale

Grayscale Solana Trust (GSOL) Price Performance. Source: GrayscaleMeanwhile, market maker GSR has forecasted a significant price jump for Solana if the ETFs are approved under favorable conditions.

“We can adjust our relative flow estimates under the various scenarios for Solana’s relative size to Bitcoin’s 2.3x increase due to the spot ETFs. Doing so suggests Solana may increase 1.4x under the bear flows scenario, 3.4x under the baseline scenario, and 8.9x under the blue sky scenario,” GSR analysts predicted.

Read more: How to Buy Solana Meme Coins: A Step-By-Step Guide

The complex interplay between market dynamics, regulatory challenges, and political outcomes renders the Solana ETF filings a multifaceted gamble. These filings are contingent on significant changes in the US presidential leadership.

The post Solana ETF Filing Could Be a Bet on Donald Trump appeared first on BeInCrypto.

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)