ARTICLE AD BOX

- Solana’s value is declining, with prices nearing the $100 mark.

- The recent drop is in sync with Bitcoin’s fall from $53,000, leading to widespread liquidations in the crypto market.

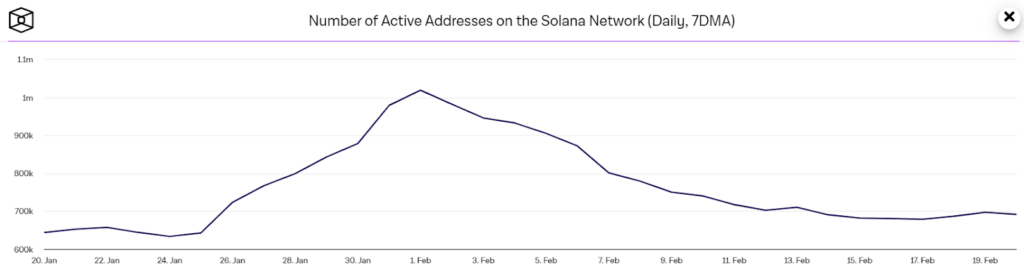

- Solana’s network activity has decreased, with a 30% drop in active addresses from a peak of 1.02 million to around 691,000.

Solana has witnessed waning investor interest recently, with prices sliding near key resistance around the $100 threshold.

The drop aligns with Bitcoin’s own rejection at $53,000 peaks that triggered cascading liquidations across crypto markets earlier this week. On-chain data now warns of additional downsides as bearish momentum builds.

In the past 24 hours alone, crypto exchanges saw total liquidations top $300 million, with bullish traders bearing the brunt at over $220 million in forced sells.

Solana itself contributed, with nearly $10 million worth of long positions unwound. The cascade of selling pressure plunged its SOL token from local highs.

Solana plunges alongside Bitcoin and Ethereum

The recent price slide stems from anxiety amongst investors following the market correction when values neared testing upside barriers.

Closely tracking Bitcoin and Ethereum, Solana similarly faced resistance, with both bellwether assets also retracting from their $53,000 and $3,000 ceilings, respectively.

On-chain statistics reveal declining network activity for Solana alongside the drop. Active addresses have plunged 30% off their 1.02 million peak in recent weeks to currently sit around 691,000 – indicating fading user demand. Whales may interpret this usage metric as a negative signal, exacerbating volatility.

However, a slight silver lining comes via the value transferred on Solana rebounding back above the $1 trillion mark after recently tagging $218 billion lows. The recovery does suggest residual exchange activity and flows, which could stabilize declines.

Presently, bears have commandeered the price charts to force SOL below critical support early Thursday. Sellers managed to conquer the key Fib line at $103 to turn that into overhead pressure now. Prices currently trade around $102—down over 6% daily.

Absent a swift reclaim of $103, downside projections eye the next demand zone at $93. Any daily close below there risks sparking a capitulation wave towards the crucial $80 floor. But a strong reaction here may stimulate a consolidation between $80-$108 until bulls regain control of the market.

To maintain positive momentum before then, SOL needs to defend $100 in the interim while setting up a push back above its 20-day exponential moving average.

.png)

9 months ago

2

9 months ago

2

English (US)

English (US)