ARTICLE AD BOX

- Solana must flip the $245 resistance into support to target higher milestones at $260 and $300.

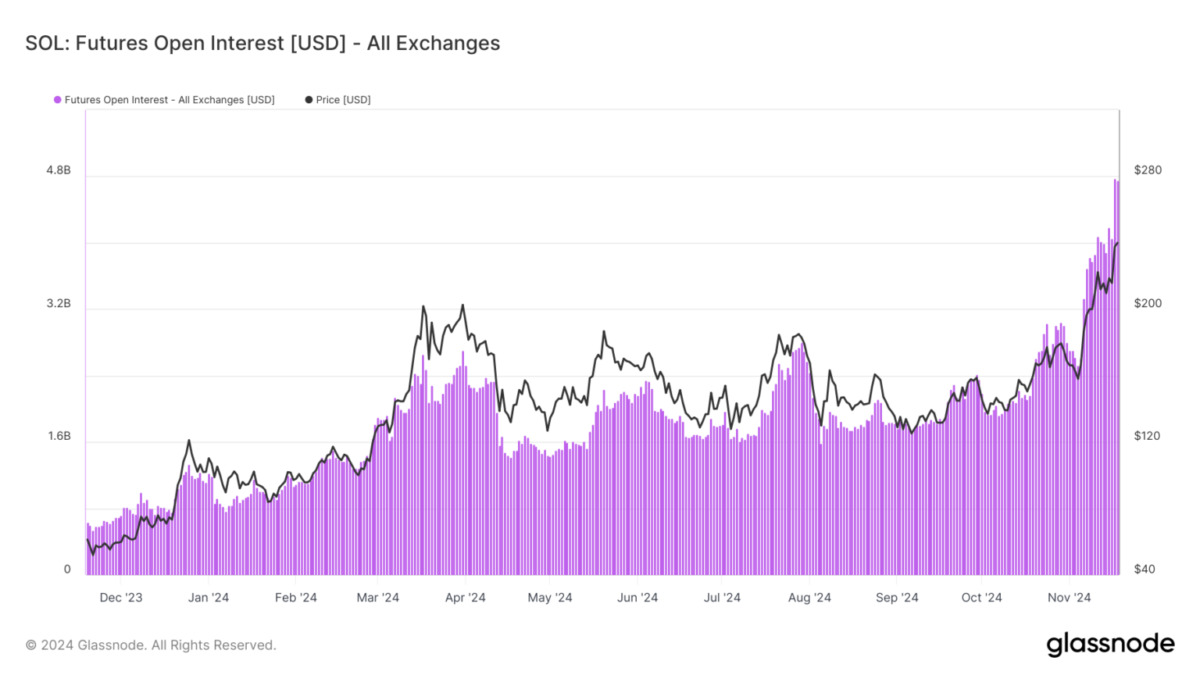

- Market activity continues to rise, with Open Interest nearing $6 billion, suggesting potential for future gains.

Solana price action has gobbled the crypto market, closing to an all-time high (ATH) with considerable resistance ahead. The altcoin rally marked considerable market activity, but it has persisted with definite obstacles at key price levels.

Solana’s Market Activity Surges

The enthusiasm in Solana among traders has shown a rise, as the Futures Open Interest (OI) for the asset has touched a record $5.6 billion, according to Coinglass data. It suggests increasing confidence and with participants pumping huge amounts of funds into SOL during its price rally. Moreover, market involvement has become more vigorous as OI is nearing $6 billion, hinting at higher prospects for future profits.

Courtesy: Coinglass

Courtesy: CoinglassDespite these positive outlooks, the divergence between increasing OI and price action in Solana can be observed. The asset’s price fails to break through crucial resistance levels even as capital commitment remains at a high. This underlines the ambiguity around the sustainable nature of the asset’s bullish momentum.

From a technical view, one can observe the Relative Strength Index (RSI) of Solana to have crossed above the neutral zone, meaning that the coin is overbought. Based on historical precedents, when RSI has demonstrated this kind of reading, price correction occurs. Solana might face short-term headwinds.

Indicators pointing at the possible repositioning of traders who may lock in their profits temporarily might hinder Solana’s upward rise. There is a possibility of price pullback that will prolong efforts to set a new ATH. A confluence of an overbought RSI and resistance at key price levels makes it difficult for Solana’s price to sustain the upward momentum.

SOL Price Levels To Watch

Solana’s price is currently trading near the $245 resistance level, a critical threshold that could determine its next move. Breaking through this level is essential for the altcoin to surpass its previous ATH and set new price records beyond $260 and even further to $300, per the CNF report. However, failure to breach this resistance could push the asset down to $221 or lower, potentially shaking investor confidence.

Courtesy: TradingView

Courtesy: TradingViewOf course, market sentiment and wider conditions are what will be decisive regarding whether $245 can act as a support level. Flipping this barrier opens the way for further pushes higher, while rejection at this level risks a more severe correction.

Although short-term indicators are showing a cautious approach, Solana price’s market momentum has been sustained by broader adoption and encouraging market cues. Some traders have also raised the prediction of an all-time high in November, reported CNF.

.png)

4 days ago

1

4 days ago

1

English (US)

English (US)