ARTICLE AD BOX

- Solana recorded its highest-ever trading volume of $3.793 billion.

- Solana’s DeFi total value locked surged by 122% in a month, hitting $4.72 billion.

While giants like Bitcoin and Ethereum are grappling with slight downward trends, Solana has emerged as a top contender for bullish momentum. Over the weekend, the Solana network witnessed a surge in activity, outpacing Ethereum, driven by a frenzied fan rush towards Solana-based memecoins.

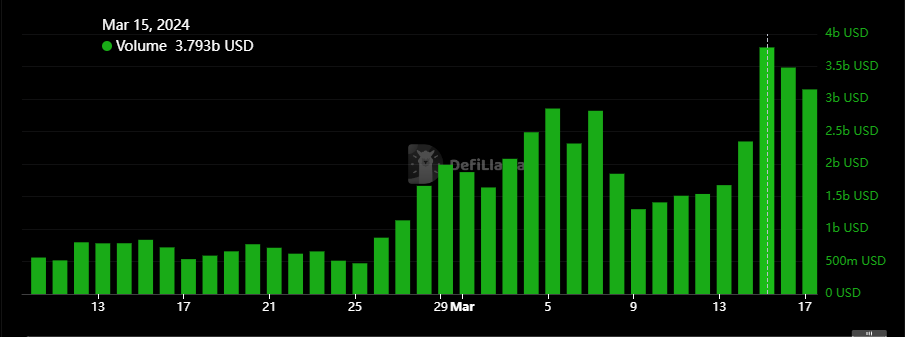

Solana Trading Volume (Source: DefiLlama)

Solana Trading Volume (Source: DefiLlama)On March 15th, trading volume on Solana climbed to a record-breaking $3.793 billion, marking the highest level in its history. For two consecutive days after that, Solana’s daily trading volume surpassed Ethereum’s around $1.4 billion, according to DefiLlama.

Solana TVL Soars 120%

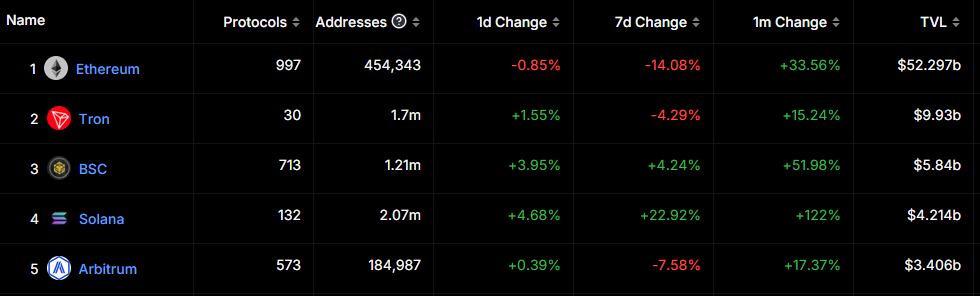

DeFi total value locked (TVL) on Solana has experienced a significant surge of over 122% in the past month alone. This surge has propelled Solana’s DeFi TVL to its highest level in two years, reaching $4.214 billion at the latest tally. Among the top five DeFi networks by TVL, Solana has displayed the most remarkable growth over the past month.

All Chains TVL (Source: DefiLlama)

All Chains TVL (Source: DefiLlama)This remarkable growth in Solana’s TVL can be attributed to the substantial increase in trading volume on DeFi protocols hosted on the Layer 1 network (L1). As a result of these developments, Solana’s native cryptocurrency, SOL, has showcased a staggering 800% surge in price over the past year, breaching the crucial resistance level of $200.

At the time of writing, SOL was trading at $203, with a market cap of $90 billion. This surge in value has propelled SOL to claim the fourth position in the market, surpassing Binance Coin (BNB).

.png)

9 months ago

3

9 months ago

3

English (US)

English (US)