ARTICLE AD BOX

Solana’s meme coins are experiencing substantial growth amidst the recent upswing in the cryptocurrency market. With Bitcoin (BTC) and altcoins witnessing bullish trends since the fourth quarter of 2023, meme coins have become increasingly popular among investors.

Analyzing Solana’s 3 Memecoins:

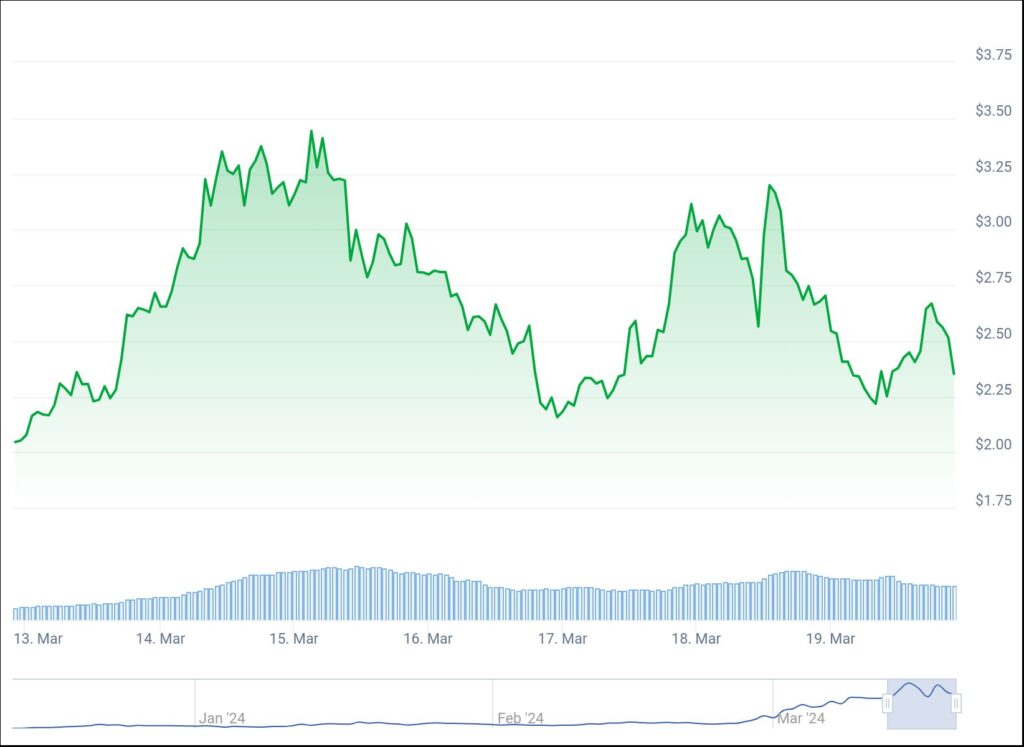

Dogwifhat (WIF)

Dogwifhat (WIF) stands out as one of the most prominent meme coins within and beyond the Solana ecosystem. Currently priced at $2.53, WIF has surged by 32% over the past week, solidifying its position atop Solana’s memecoin charts.

Its remarkable growth, including an 887% spike in a month, has outpaced even established tokens like Dogecoin (DOGE) and Shiba Inu (SHIB). Despite recent market corrections leading to a 4.9% decline in the last 24 hours, WIF boasts a market cap of $2.5 billion and a 24-hour trading volume of $621 million.

Spotlight on Bonk (BONK)

Ranked second in Solana’s memecoin landscape by market capitalization, Bonk (BONK) displays significant bullish potential. With a staggering 2,907% surge in the past year and a 69% increase in the last 30 days, BONK maintains a total market capitalization of $1.46 billion. However, recent market fluctuations have caused a 5.5% dip in the last 24 hours, leaving the asset 51% below its all-time high achieved on March 4.

Emerging Contender: Book of Meme (BOME)

Book of Meme (BOME) emerges as a noteworthy player in the Solana memecoin arena, particularly in recent trading sessions. Despite facing liquidations in the past few hours, BOME has managed to stay in the green zone, with a 1.8% increase.

Sporting a market capitalization of $646 million, BOME’s journey has been marked by high volatility, with a record high of $0.02689 on March 16 and an impressive surge of over 19,000% from its all-time low on March 14. Despite these fluctuations, its community remains actively engaged, fostering momentum across various social media platforms.

.png)

7 months ago

3

7 months ago

3

English (US)

English (US)