ARTICLE AD BOX

- Rings enables users to earn points and yield through innovative assets like scUSD, scETH, and stkscUSD.

- Sonic integrates advanced security via TRM Labs, enhancing transaction monitoring and risk management for DeFi users.

Sonic Labs has released comprehensive details about its scoring program, highlighting the assets that are eligible for earning points in the upcoming “S” airdrop.

Among the main assets on display are scUSD and scETH, both developed by Rings with respective increased multipliers of 6x and 4x. Using these resources in related applications greatly increases users’ points-earning capacity.

The focus on scUSD and scENE results from their fundamental importance in the ecosystem. Driven by a yield-bearing stablecoin protocol, Rings increases liquidity into decentralized finance (DeFi) applications on Sonic, therefore strengthening the network’s ranking as the main DeFi hub. The official blog notes that this approach seeks to maximize platform capital efficiency generally.

Only whitelisted assets are eligible. Assets with higher multipliers will give you more points than those with lower ones.

scUSD and scETH are provided by @Rings_Protocol. Learn more:

https://t.co/RxpWnkEO62 pic.twitter.com/9K3i3QND9G

https://t.co/RxpWnkEO62 pic.twitter.com/9K3i3QND9G

— Sonic Labs (@SonicLabs) January 14, 2025

How Rings Combines Yield, Governance, and Efficiency

Inspired by Veda Boring Vaults, Blast’s original yield notions, and Solidly’s ve(3,3), Rings runs on a complicated system. These elements taken together guarantee that Rings offers users a special mix of ecosystem sustainability, governance tools, and yield-generating capacity.

Automated vaults run by Veda BoringVaults use farming techniques across main Ethereum DeFi protocols to maximize the income of deployed assets. This method automates asset management, therefore improving capital efficiency.

Rings’s native yield concept lets spanned assets gain yield on their origin chain while being minted for usage on the destination chain, unlike traditional bridging systems whereby assets like ETH earn no interest while locked in contracts.

Combining governance token locking with game theory helps Solidly’s ve(3,3) model to promote long-term commitment and cooperative conduct. Users locking tokens obtain voting rights and benefits, therefore promoting the expansion of ecosystems.

Core Assets Powering Rings’ Utility

Three major assets define Rings’s usefulness: veNFTs, stkscUSD/stkscEH, and scUSD/scENE. These things have different uses:

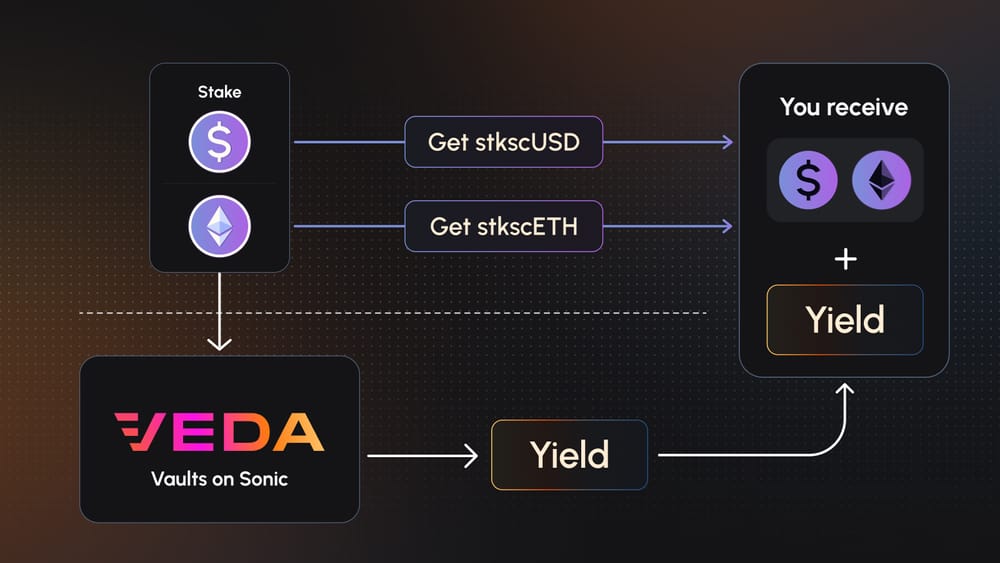

- scUSD/scETH: Users of scUSD/scETH can mint tokens by depositing stablecoins or ETH-based tokens on Ethereum or Sonic. Without paying minting costs, the placed collateral is delivered to Veda-operated vaults on Ethereum to harvest yield, therefore unlocking the value of scUSD and scETH on Sonic.

- stkscUSD/stkscETH: Staking scUSD (stkscUSD) or scETH (stkscETH) using Rings lets users obtain staked copies of these coins. By means of their DeFi systems, these staked tokens earn yield right within the Sonic ecosystem.

- VeNFTs: Users of locked stkscUSD or stksc ETH get veNFTs, which give voting rights and help to disperse liquidity among Sonic’s DeFi apps. This system generates a competitive market whereby applications provide vote incentives for veNFT holders, hence promoting liquidity and activity.

Source: Sonic Labs

Source: Sonic LabsMaximizing Rewards in the “S” Airdrop

For the “S” airdrop, participants carrying Rings assets in their Web3 wallets gain passive points. For individuals trying to maximize their rewards, nevertheless, using these assets as liquidity in affiliated apps provides extra activity points.

From lending systems to decentralized exchanges (DEXs), users have lots of chances to enhance their involvement and income. Upon launch, the airdrop dashboard will show a complete list of the collaborating apps.

On the other hand, as we previously reported, TRM Labs’ interaction with Sonic provides sophisticated transaction monitoring, real-time risk assessment, and fraud detection, so improving institutional digital asset protection.

This cooperation guarantees safer surroundings for companies using Sonic’s infrastructure, confirming its attractiveness as a DeFi center.

Meanwhile, Sonic’s native token, S (previously FTM), swapped hands at about $0.7934 at the time of writing; up 11.07% over the last 24 hours and 21.41% over the last 7 days.

.png)

2 hours ago

1

2 hours ago

1

English (US)

English (US)