ARTICLE AD BOX

South Korea’s Digital Asset Exchange Alliance (DAXA) has announced comprehensive guidelines for re-examining over 1,300 cryptocurrencies listed on domestic exchanges.

Effective July 19, 2024, this initiative seeks to dispel fears of mass delistings by establishing standardized criteria and processes for transaction support reviews.

DAXA Addresses Crypto Investor Concerns with Measures to Prevent Unfair Delistings

DAXA and 20 domestic crypto exchanges collaboratively developed these guidelines, known as the “Best Practices for Supporting Digital Asset Transactions.” The guidelines encompass transaction support review processes, termination procedures, and coin information disclosure requirements.

This move aligns with the enforcement of the Virtual Asset User Protection Act. It also aims to foster a more secure and transparent market for investors.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Implementing these best practices follows recommendations from South Korea’s financial authorities, including the Financial Services Commission and the Financial Supervisory Service. The National Assembly emphasized the necessity for a self-regulatory framework within the industry.

This prompted the creation of a task force centered around DAXA. The task force has been working on the guidelines since October 2022, incorporating feedback from various stakeholders. These include academia and legal experts.

Historically, self-regulatory proposals within the industry, such as those from the Korea Blockchain Association, faced limitations due to low participation and enforcement capabilities. However, the current best practices are comprehensive. They address internal control improvements for exchanges, Korean white papers on digital assets, and detailed disclosure methods.

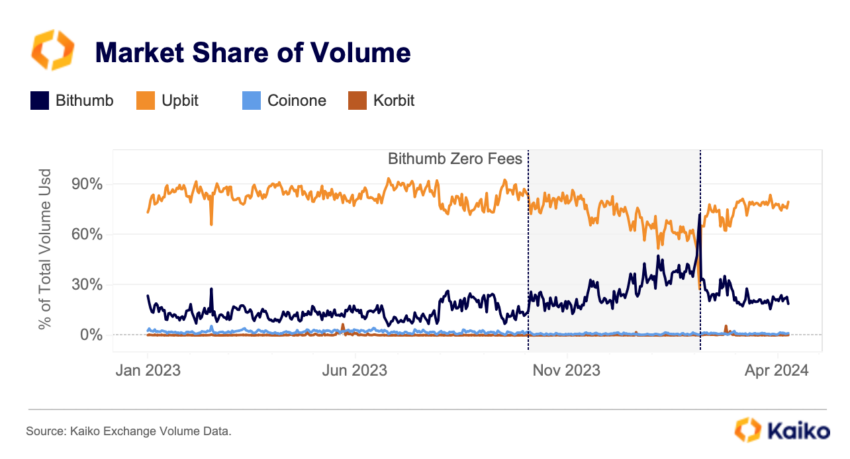

One of the primary concerns among domestic investors is the potential delisting of digital assets they have invested in. Given that altcoins account for over 60% of the South Korean market’s trading volume, the new measures may lead to a substantial contraction of the local crypto market.

Trading Volume Across Major Crypto Exchanges in South Korea. Source: Kaiko

Trading Volume Across Major Crypto Exchanges in South Korea. Source: KaikoHowever, DAXA has assured that mass delistings are unlikely. Major domestic crypto exchanges supporting Korean won (KRW) deposits and withdrawals have preemptively applied these best practice review items since late 2023.

Consequently, there should be no additional bulk delistings. Notably, in the first half of this year, these exchanges have already terminated trading support for 39 cryptocurrencies.

The six-month re-examination period aims to prevent unfair delistings. During this time, exchanges will systematically contact coin-issuing foundations or public disclosure entities to gather necessary information.

They will also allow ample time for explanations and procedures. Transaction support termination procedures will be conducted transparently, with announcements on each exchange’s homepage.

DAXA has also outlined its official stance on implementing best practices to support new and existing digital asset transactions. Exchanges will assess both formal and qualitative criteria.

Formal criteria must be met without exception, while qualitative criteria will be evaluated comprehensively. Reviews will be conducted quarterly.

The criteria focus on issuer reliability, ensuring consistent disclosures about total issuance, circulation plans, business strategies, and key investment factors without sudden changes. It also emphasizes user protection through the availability of detailed white papers and monitoring tools like block explorers.

Regarding technology and security, it’s crucial to promptly address security breaches, especially hacking, and to make the smart contract source code accessible for verification. Furthermore, all assets must comply with relevant laws and regulations, steering clear of uses in illegal activities, including money laundering and terrorism financing.

“To address the issue of non-compliance with formal criteria by assets without a specific issuer (e.g., Bitcoin), an alternative review process is established for assets traded for over two years in regulated foreign markets. These markets must be located in IOSCO [International Organization of Securities Commissions] member countries with entry regulations, supervision, and transaction support reviews,” DAXA added.

Read more: How Does Regulation Impact Crypto Marketing? A Complete Guide

The new steps by DAXA and the exchanges involved are a big move to make the crypto market in South Korea safer and more open. This effort looks to boost investor trust and create a better market by applying strict review standards and making sure information is shared openly.

The post South Korea’s DAXA Introduces Guideline for Re-examining 1,300 Cryptocurrencies appeared first on BeInCrypto.

.png)

4 months ago

6

4 months ago

6

English (US)

English (US)