ARTICLE AD BOX

- SUI surged to $3.36 despite a broader market downturn, fueled by rising ecosystem activity and capital inflow.

- Sui’s DeFi growth pushed TVL to $1.46B, with stablecoin and DEX volumes spiking, signaling strong user engagement.

The native token of the Sui blockchain, SUI, reached a price level of $3.36 on Thursday, competing with the 3-month high of $3.48. The SUI bull run comes amidst the downtrend of the broader crypto market. The token’s ecosystem’s consistent increase in activity and capital inflow has pushed its price past the key barriers.

DeFi Drives Sui’s TVL Up 10%

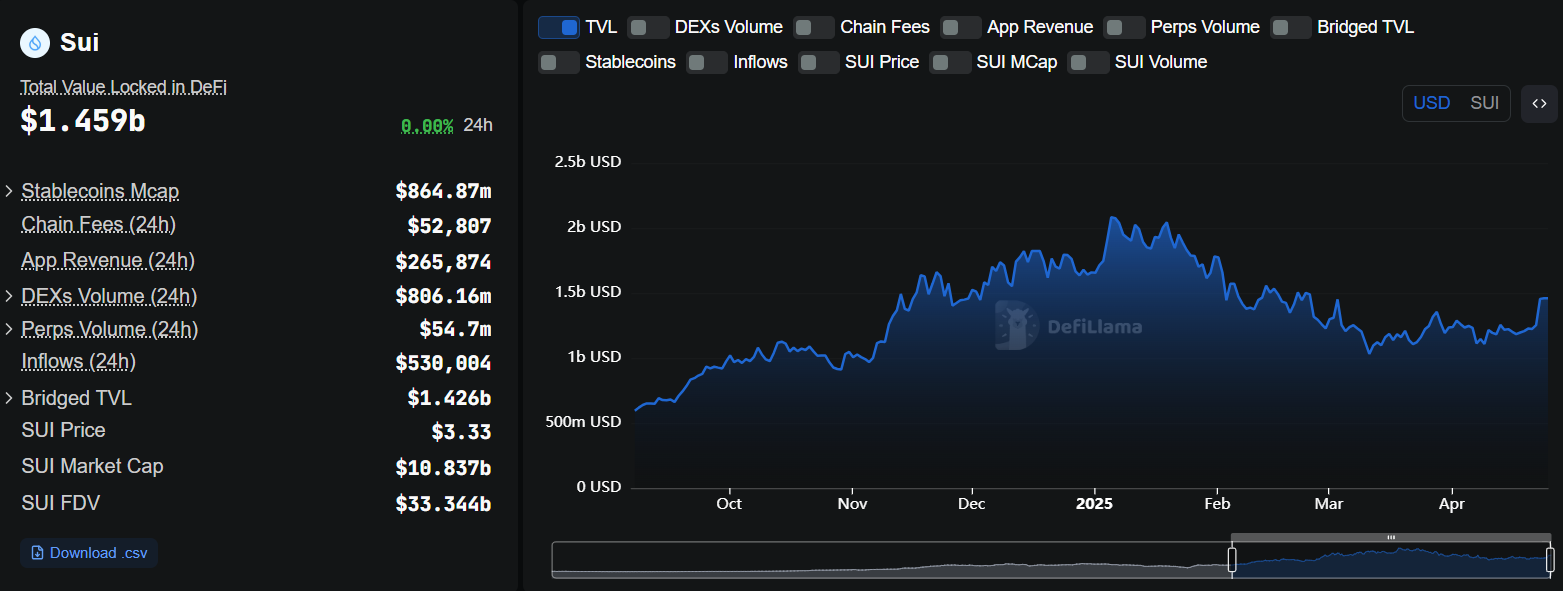

The recent price surge is also driven by the decentralized finance (DeFi) surge in the ecosystem. While checking on-chain metrics on the network, DeFiLlama data shows that the Total Value Locked (TVL) on Sui rose by 10% to settle at $1.46 billion.

Source: DeFiLlama

Source: DeFiLlamaThe value of stablecoins circulating on the Sui network also recorded a notable rise. Within seven days, the stablecoin market cap increased by 7.77%, hitting $864.87 million. USDC leads the pack here, commanding a 71% share of that total. Such a strong dominance indicates user preference for USDC’s liquidity and reliability within the Sui ecosystem.

The surging use of stablecoins aligns with a jump in trading activity on Sui’s decentralized exchanges. Over the last week, DEX volume climbed by 38.50%, amounting to roughly $2.77 billion in total trades. In just the past 24 hours, these platforms processed $806.16 million—placing Sui among the top-performing networks in recent days.

The spike in trading volume on these decentralized exchanges has helped to lift broader interest in the protocol. Market participants often view increased volume as a signal of growing user engagement and deeper market depth.

$4 Mark Could be the Next Target

With Sui’s price holding at $3.28, attention turns to the $3.50 level. A daily close above this threshold could confirm ongoing bullish sentiment and open the door for a potential test of $4—the same level last seen in February. Analysts often regard such a move as validation of a strong market structure.

Source: TradingView

Source: TradingViewHowever, some caution remains due to the current RSI nearing the overbought range. The RSI, an indicator tracking momentum, edged close to 74—suggesting an overbought market. While this points to strong bullish sentiment, it also serves as a caution for potential short-term reversals.

If downward pressure builds, a fallback to $2.80 could be on the table. This level aligns with both the 100-day and 200-day Exponential Moving Averages, serving as immediate technical support. If those fail, the next cushion may be found at the 50-day EMA around $3.

Sui’s recent growth places it among the top blockchain contenders, also aligning with the VanEck predictions of a 350% SUI surge amid an ETF catalyst. The recent SUI surge is also in contrast with Jason Pizzino’s recent predictions of the SUI crash.

.png)

4 hours ago

1

4 hours ago

1

English (US)

English (US)