ARTICLE AD BOX

SUI, the native coin of Layer-1 (L1) blockchain Sui Network, rallied to an all-time high of $2.36 on October 14. However, as profit-taking activity gains momentum, SUI has initiated a downward trend.

The altcoin trades at $2.04 as of this writing, noting a 14% decline in the past two days. Its technical setup suggests that SUI is poised to extend this fall. The question remains: how low will SUI go?

Sui Traders Sell For Profits

At its current price, SUI trades just above the resistance formed at $1.97. If rising selling pressure causes this level to fail to hold, SUI’s price will seek support at its Ichimoku Cloud, which tracks its market trends and momentum and acts as support/resistance levels.

As in SUI’s case, the Ichimoku Cloud can act as a support level if the price approaches from above. If its price enters or breaks below the cloud, it indicates a trend reversal from bullish to bearish. The cloud often acts as a transition zone; falling into or below it shows weakening momentum and could signal a potential bearish phase.

Read more: Everything You Need to Know About the Sui Blockchain

SUI Ichimoku Cloud. Source: TradingView

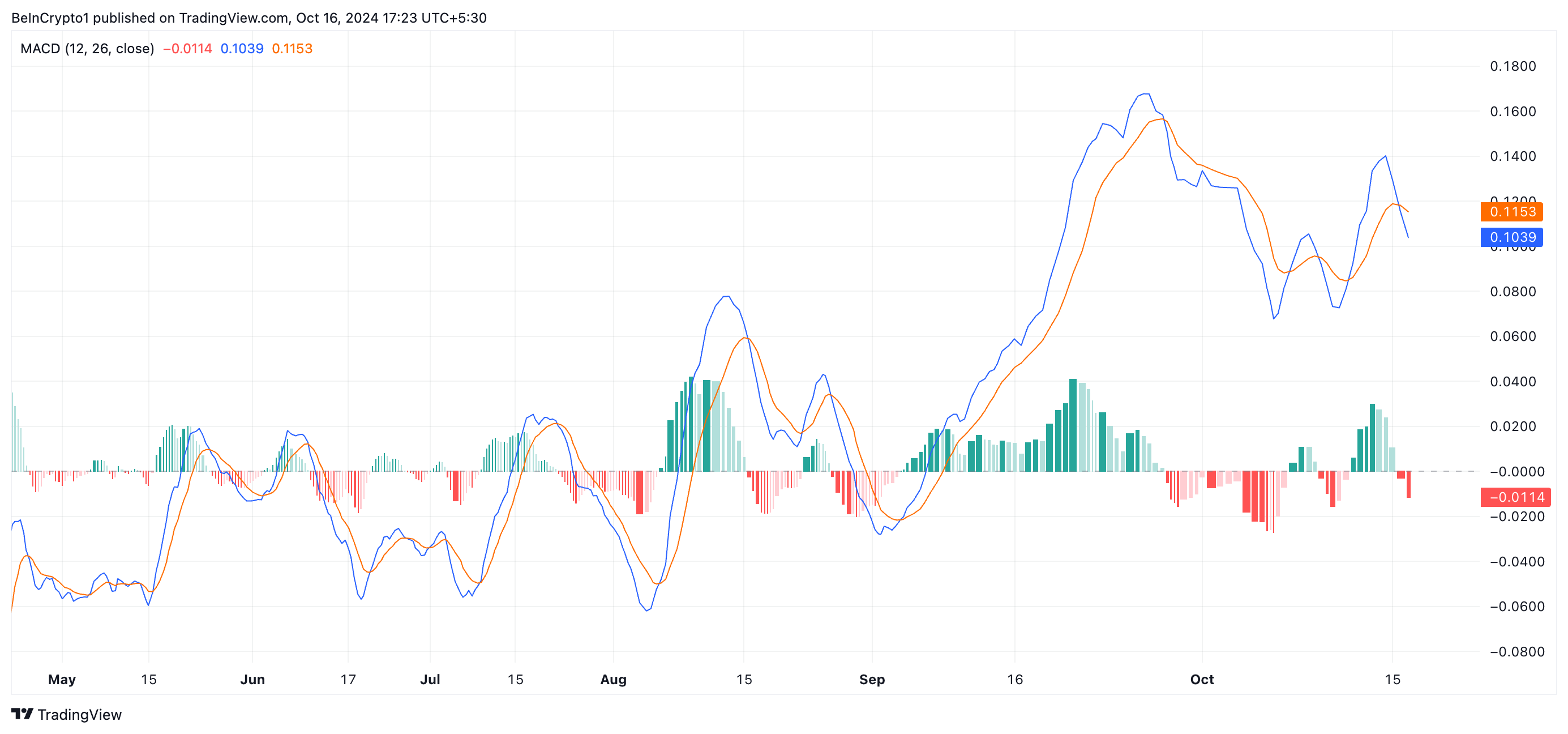

SUI Ichimoku Cloud. Source: TradingViewReadings from SUI’s moving average convergence/divergence (MACD) confirm this bearish outlook. Its MACD line (blue) recently crossed below its signal line (orange), signaling a shift in the market’s sentiment from bullish to bearish.

The cross below the signal line shows that an asset’s shorter-term moving average (represented by the MACD line) is falling faster than the longer-term average (signal line). This typically reflects increased selling pressure in the market, which many traders view as a sign to sell or exit long positions.

SUI MACD. Source: TradingView

SUI MACD. Source: TradingViewSUI Price Prediction: Interest in Coin Has Dropped

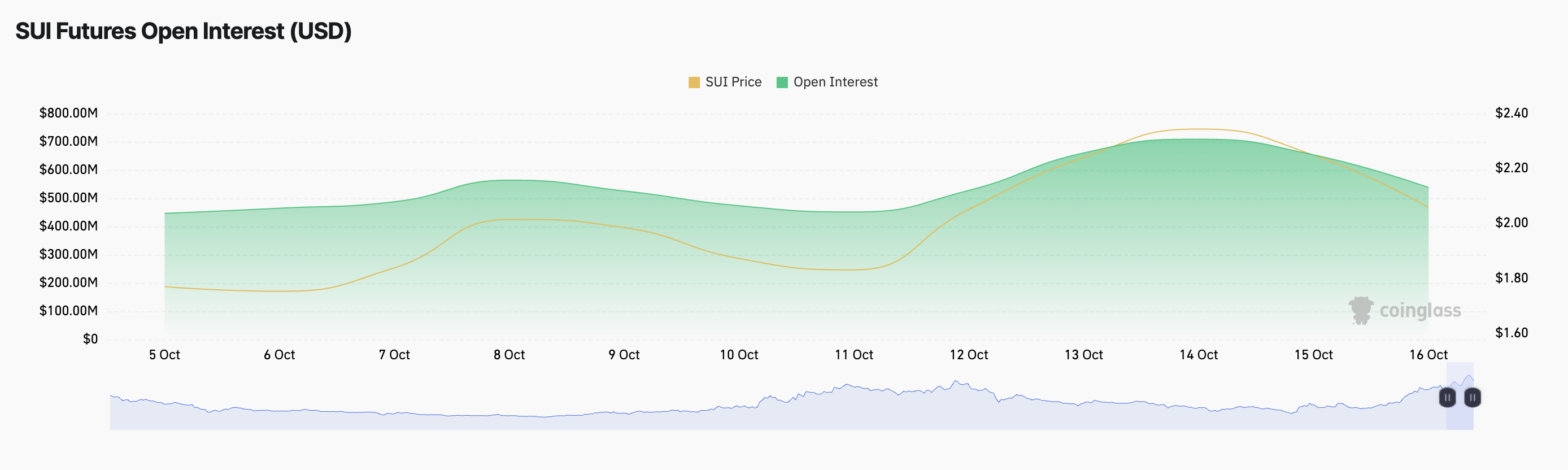

SUI’s declining open interest is another strong indicator of reduced interest in the altcoin. After reaching an all-time high of $709 million on October 14, open interest has steadily trended downward, signaling that fewer traders are maintaining active positions in SUI. It has fallen by 24% in just two days, now at $538 million.

SUI Futures Open Interest. Source: Coinglass

SUI Futures Open Interest. Source: CoinglassThis drop suggests a reduction in market participation and could indicate that investors are closing out positions, potentially expecting further price declines. If the selling pressure increases, SUI’s price may fall by 55% to trade at $0.91.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

SUI Price Analysis. Source: TradingView

SUI Price Analysis. Source: TradingViewHowever, this bearish outlook could be invalidated if new demand enters the market. SUI may reclaim its all-time high of $2.36 and potentially surge beyond it.

The post SUI Set for 55% Correction as Traders Cash Out appeared first on BeInCrypto.

.png)

2 months ago

2

2 months ago

2

English (US)

English (US)