ARTICLE AD BOX

On August 12, Superstate announced the integration of Chainlink’s decentralized computing platform into its Short Duration US Government Securities Fund (USTB).

This collaboration aims to significantly enhance the transparency and utility of Superstate’s flagship tokenized treasury product.

Integrating Chainlink: Securing USTB’s NAV for Consistent Accuracy

The USTB fund now uses Chainlink Data Feeds to bring its net asset value (NAV) on-chain securely. This move ensures the valuation of tokenized real-world assets, such as USTB, remains always up-to-date.

It also guarantees the accuracy of these valuations. Therefore, tokenized assets like USTB benefit from real-time and precise value assessments.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Calculated off-chain by NAV Fund Services and Superstate, the NAV data is now reliably and securely synchronized on the blockchain through Chainlink’s decentralized oracle system. This integration is crucial to Superstate’s strategy, guaranteeing that USTB’s NAV is always accessible and trusted on-chain.

“Asset tokenization enhances efficiency, programmability, and transparency but requires reliable on-chain data to unlock DeFi and automation use cases,” Superstate CEO and Co-founder Robert Leshner explained to BeInCrypto.

Johann Eid, the Chief Business Officer at Chainlink Labs, also praised Superstate’s efforts. He noted that the company plays a crucial role in developing infrastructure and providing services for key aspects of the tokenized asset economy.

“We’re excited to see the new use cases and opportunities Superstate will unlock by integrating the Chainlink platform to bring NAV and AUM data around its tokenized treasury fund USTB on-chain,” Eid said.

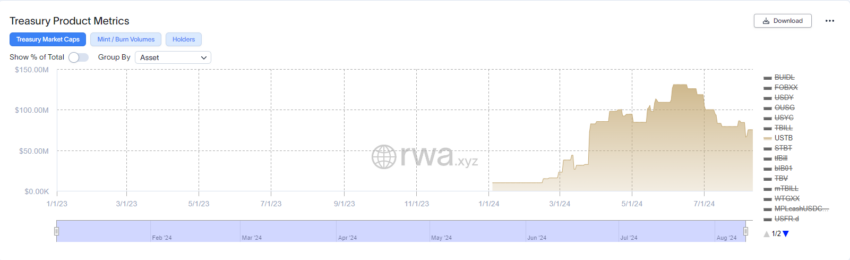

Data from RWA.xyz shows that as of August 11, Superstate’s USTB has a market capitalization of $75.31 million. This figure makes it the seventh-largest tokenized treasury fund in the market. Notably, USTB reached this number in just approximately six months after its debut in February.

USTB Market Capitalization. Source: RWA.xyz

USTB Market Capitalization. Source: RWA.xyzLooking ahead, Superstate also plans to further enhance the transparency of its USTB fund by integrating Chainlink Proof of Reserve. This move will enable on-chain verification of assets under management (AUM) data, further strengthening the security and trust in Superstate’s offerings. However, both companies have yet to reveal the specific date of this initiative.

The rapid growth of the Superstate is not limited to the USTB fund alone. In late July, it introduced the Superstate Crypto Carry Fund (USCC).

Read more: How To Invest in Real-World Crypto Assets (RWA)?

USCC is designed to provide qualified purchasers with compliant exposure to the crypto cash and carry trade, capitalizing on price disparities between spot and futures markets for Bitcoin (BTC) and Ethereum (ETH). By issuing USCC as an ERC-20 token on the Ethereum blockchain, Superstate further enhances the fund’s utility, allowing for peer-to-peer transactions, such as collateral or settlement.

The post Superstate Integrates Chainlink to Enhance USTB Fund’s On-Chain NAV Data Accuracy appeared first on BeInCrypto.

.png)

3 months ago

2

3 months ago

2

English (US)

English (US)