ARTICLE AD BOX

Tokenization is changing the investment world by connecting traditional and digital asset markets. As a part of this transformation, Swarm Markets, a Berlin-based platform, is set to launch gold-backed non-fungible tokens (NFTs).

This product offers a practical and novel application of blockchain technology.

Ensuring Compliance: Swarm Markets’ Approach to Gold-Backed NFTs

Swarm Markets is leading the charge in tokenizing real-world assets (RWAs) with their gold-backed NFTs. This initiative allows individuals to purchase NFTs representing ownership of physical gold securely stored in a London-based Brink’s vault.

By enabling peer-to-peer trading of these NFTs on their decentralized over-the-counter (dOTC) platform, Swarm Markets combines the fluidity of decentralized finance (DeFi) with the value and liquidity of traditional finance (TradFi). This approach enhances accessibility to gold investments. Moreover, it ensures compliance with know-your-customer (KYC) and anti-money laundering (AML) processes.

Read more: What Are Tokenized Real-World Assets (RWA)?

Furthermore, Swarm Markets plans to position its gold-backed NFTs to comply with the upcoming Markets in Crypto-Assets (MiCA) regulation in the European Union (EU). The current MiCA regulation specifies that it does not cover unique, non-fungible crypto-assets, which include digital art and collectibles. The regulation also excludes crypto-assets tied to unique, non-fungible services or physical assets, like product warranties or real estate.

Indeed, regulatory compliance is paramount in the tokenization ecosystem, as emphasized by Alex Malkov, Co-founder of HAQQ Network. Malkov also stresses the importance of transparency, regular audits, and clear communication of security measures to build trust with investors.

“To address cross-border regulatory challenges in asset tokenization, it is crucial to establish common standards and foster international cooperation. Implementing blockchain-based identity verification systems can enhance transparency and security by providing immutable records of transactions and identities, facilitating regulatory compliance,” Malkov explained to BeInCrypto.

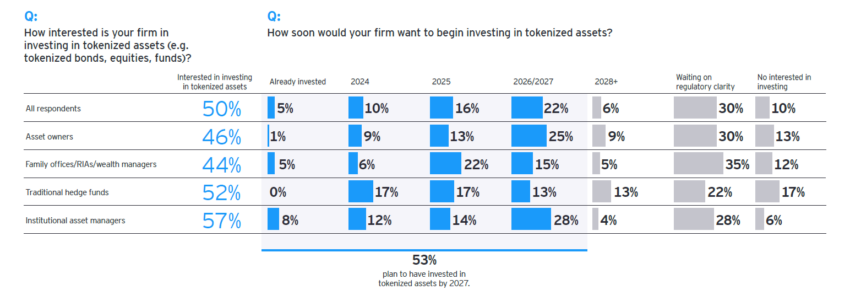

Swarm Markets’ gold-backed NFTs are a tangible manifestation of the broader real-world asset tokenization trend. A recent report from EY highlights that tokenization is gaining traction among institutional investors. Fifty percent of the respondents in the report are keen on investing in tokenized assets.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Institutional Interests in Real-World Asset Tokenization. Source: EY

Institutional Interests in Real-World Asset Tokenization. Source: EY“Across all investor types, 53% wish to invest in tokenized alternative funds, 46% in tokenized public funds, and 38% are interested in investing in tokenized real estate investments. When asked about the top motivation for interest in tokenized assets, portfolio diversification was most important, followed by access to new asset types and greater/increased liquidity,” EY analysts wrote in the report.

The post Swarm Markets’ Gold-Backed NFTs Expand Real-World Asset Tokenization Sector appeared first on BeInCrypto.

.png)

4 months ago

3

4 months ago

3

English (US)

English (US)