ARTICLE AD BOX

As Tax Day rolls around in the United States, it’s time for American cryptocurrency holders and expatriates to ensure their financial affairs are in order. To shed light on navigating tax complexities, we’ve gathered insights from four tax professionals.

The Extension Advantage: Filing Your Taxes

Tax lawyer Robert W. Wood advises taxpayers to consider filing for an extension, allowing them until October 15 to submit their returns. Contrary to popular belief, filing for an extension doesn’t increase the likelihood of an audit. In fact, it may reduce audit risks by providing extra time to accurately prepare returns.

Expatriate Tax Strategies: The Foreign Earned Income Exclusion

Justin Wilcox, partner at FML CPAs, highlights the potential benefits of the Foreign Earned Income Exclusion (FEIE) for expatriates. By meeting certain criteria, expats can exclude a portion of their foreign earnings from U.S. taxation. Understanding residency tests and exclusions can significantly impact tax obligations for expats living and working abroad.

Navigating International Taxation: FEIE vs. FTC

Crystal Stranger, CEO of Optic Tax, emphasizes the distinction between the FEIE and Foreign Tax Credit (FTC) for expats. While the FEIE excludes foreign-earned income from U.S. taxes, the FTC offsets U.S. taxes with foreign taxes paid. Choosing between the two requires careful consideration, as switching from FEIE to FTC carries penalties, and misinformation abounds in this complex area.

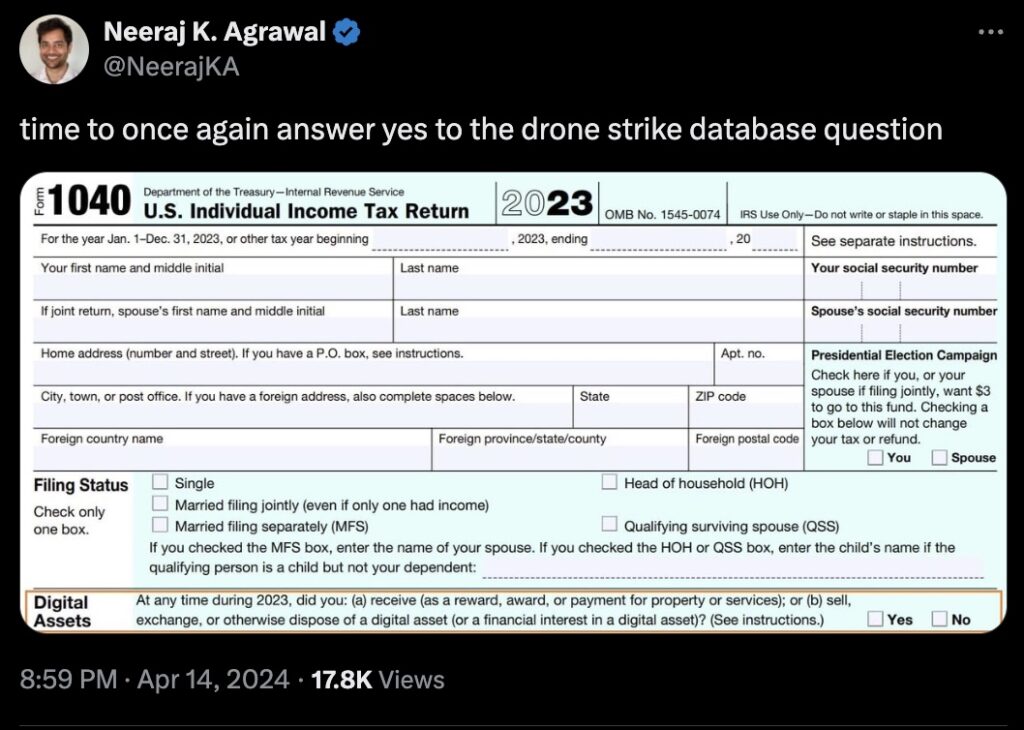

Cryptocurrency Gains and Tax Implications

CPA Tyler Menzer cautions against default settings on online tax-preparation software, especially concerning cryptocurrency gains. While these tools may simplify calculations, default methods like highest-in, first-out (HIFO) may inadvertently increase tax liabilities. Opting for specific identification methods can help minimize tax burdens, particularly for long-term cryptocurrency holdings.

In summary, navigating tax obligations for expatriates and cryptocurrency holders requires careful planning and understanding of available strategies. By seeking professional advice and staying informed, taxpayers can optimize their financial positions while complying with tax laws.

.png)

7 months ago

7

7 months ago

7

English (US)

English (US)