ARTICLE AD BOX

Tether, the issuer of the most capitalized stablecoin, minted $1 billion USDT tokens on Tron today, adding to a stockpile of prints this month.

Blockchain tracker Whale Alert reported the transaction, just a week after a similar $1 billion minting on the Ethereum blockchain.

Tether Adds $1 Billion USDT to Inventory

Paolo Ardoino, Tether’s CEO, explains that this minting is an “USDT inventory replenish,” meaning the tokens are authorized but not yet issued. They are added to Tether’s inventory for future issuance requests and chain swaps. This approach helps ensure sufficient supply for effective liquidity management, with tokens released into circulation when officially issued.

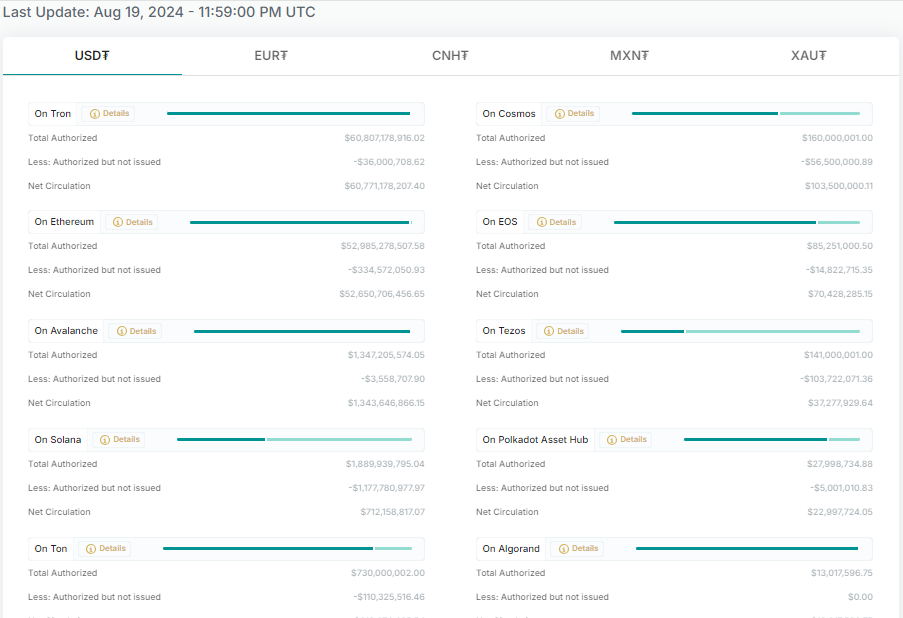

Typically, firms replenish inventory to meet anticipated demand. Tether’s move suggests increasing demand for USDT on Tron, where supply has been running low. As of August 19, Tether’s transparency page shows only $36 million USDT tokens on Tron, all authorized but not issued.

Read more: 9 Best Crypto Wallets to Store Tether (USDT)

USDT on Different Blockchains. Source: Tether Transparency Page

USDT on Different Blockchains. Source: Tether Transparency PageIn case of a sudden demand surge on Tron, Tether can promptly meet this interest. With today’s $1 billion mint, the stablecoin issuer’s total issuance has reached $17 billion since Bitcoin peaked above $73,000. Notably, this continuous minting aligns with recent market rallies, fueling speculation that these issuances may be driving the crypto market’s momentum.

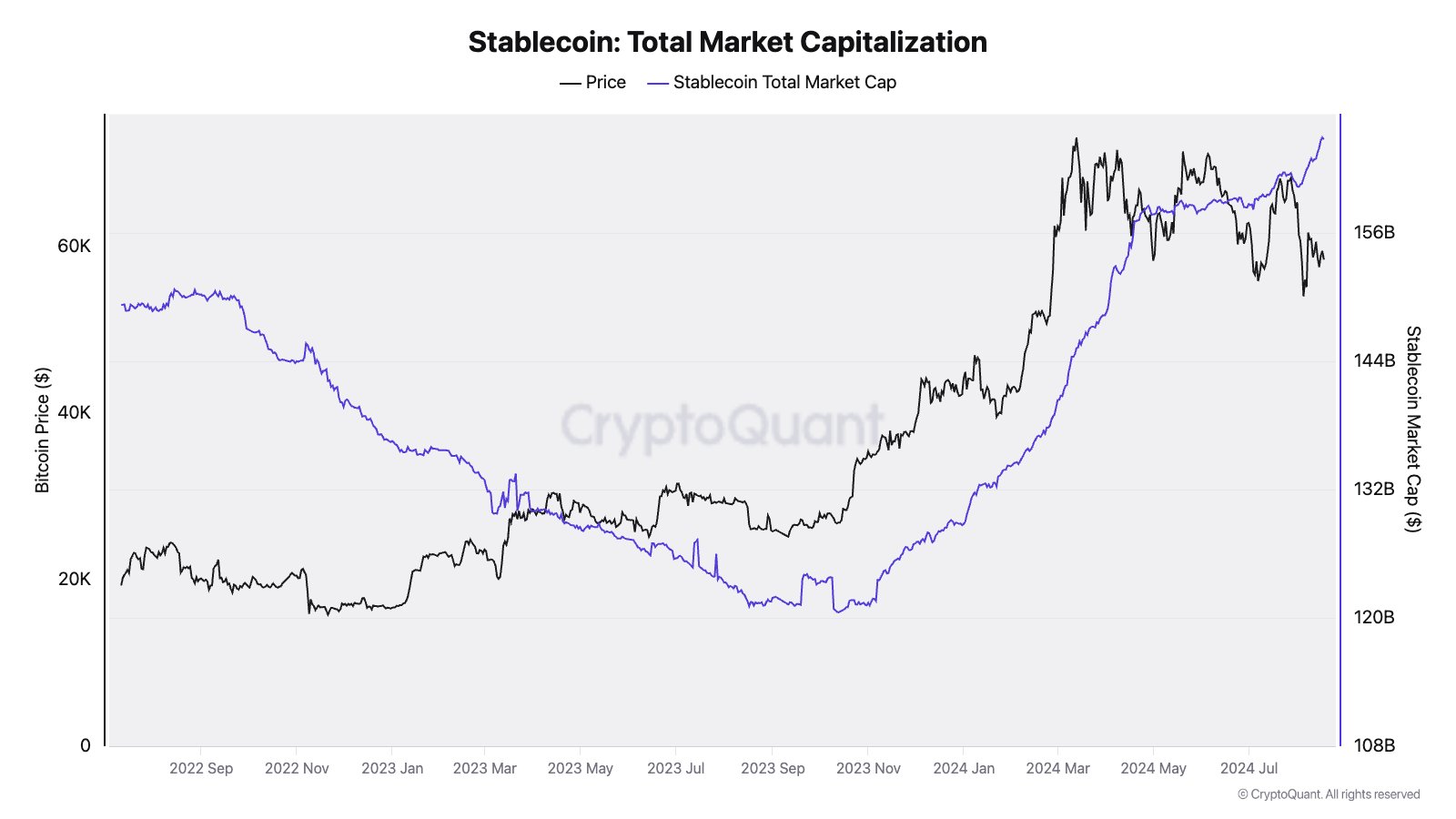

“Everyone talking about global M2 breaking out, but I’m looking at total stablecoin market capitalization: fresh record high above $165 Billion. This implies higher liquidity in the crypto markets,” Julio Moreno, Head of Research at CryptoQuant, stated.

Based on the chart below, the total stablecoin market capitalization (blue) has surged significantly. This growth can enhance crypto market liquidity, making it easier for traders to buy and sell assets. Increased liquidity can improve price stability and market efficiency, potentially driving up demand for other cryptocurrencies and contributing to price appreciation.

On the other hand, it may also signal elevated risk levels in the market, with investors seeking refuge in stablecoins amid market uncertainty or high volatility.

Read more: How to Buy USDT in Three Easy Steps – A Beginner’s Guide

Bitcoin Price Against USDT Market Capitalization, Source: CryptoQuant

Bitcoin Price Against USDT Market Capitalization, Source: CryptoQuantElsewhere, Tether has launched USDT on the Aptos blockchain to improve the stablecoin accessibility. This move leverages Aptos’ advanced architecture, offering exceptional speed and scalability. The integration will also deliver low gas fees, significantly reducing transaction costs.

“We’re building a strong, global, and institution-grade DeFi and payments ecosystem that values speed, decentralization, and interoperability while leveraging Move on Aptos to make it all work. The launch of USDT on Aptos accelerates the availability and utility of real-world value for institutions, Web3 builders, and regular people worldwide,” Head of Grants and Ecosystem at Aptos Foundation, Bashar Lazaar said.

Post-integration, Tether will be able to mint USDT directly on Aptos, just like it does on Tron and Ethereum.

The post Tether Mints $1 Billion USDT, Crypto Market Awaits Impact appeared first on BeInCrypto.

.png)

2 months ago

1

2 months ago

1

English (US)

English (US)