ARTICLE AD BOX

In a significant financial milestone, Tether, the operator of the USDT stablecoin, has reported unprecedented profits of $5.2 billion for the first half of 2024. The company also revealed a substantial increase in its holdings of United States government bonds.

Tether’s Expanding US Treasury Portfolio

Tether’s latest report highlights its impressive US Treasury portfolio, now valued at approximately $97.6 billion. This growth underscores the increasing circulation of Tether stablecoins, which the company asserts are backed 1:1 with liquid US dollar-denominated assets.

Source: Bluechip

Source: BluechipThe figures, verified by independent accounting firm BDO, indicate that Tether’s market capitalization for USDT stands at around $114 billion, with total reserves exceeding $118 billion.

Comparison with Global Governments

Tether’s Treasury reserves have now surpassed those of all but 17 countries worldwide, including major economies like Germany, the United Arab Emirates, and Australia. Notably, Tether ranks as the third-largest purchaser of three-month US Treasurys, following the United Kingdom and the Cayman Islands. The company anticipates potentially becoming the largest holder of these assets within the next year, driven by the continued adoption of USDt.

image

Financial Health and Industry Expansion

As of June 30, Tether’s consolidated net equity, which accounts for all assets minus liabilities, was reported at $11.9 billion. The company issued approximately $8.3 billion in USDT during the second quarter alone. Tether’s robust balance sheet positions it as a leader in the stablecoin market, ensuring stability and liquidity.

Strategic Investments and Industry Impact

Tether is channelling a portion of its profits into various sectors, including sustainable energy, Bitcoin mining, data and AI infrastructure, peer-to-peer telecommunications technology, neurotech, and education. These investments reflect Tether’s broader vision to leverage its expertise across multiple industries.

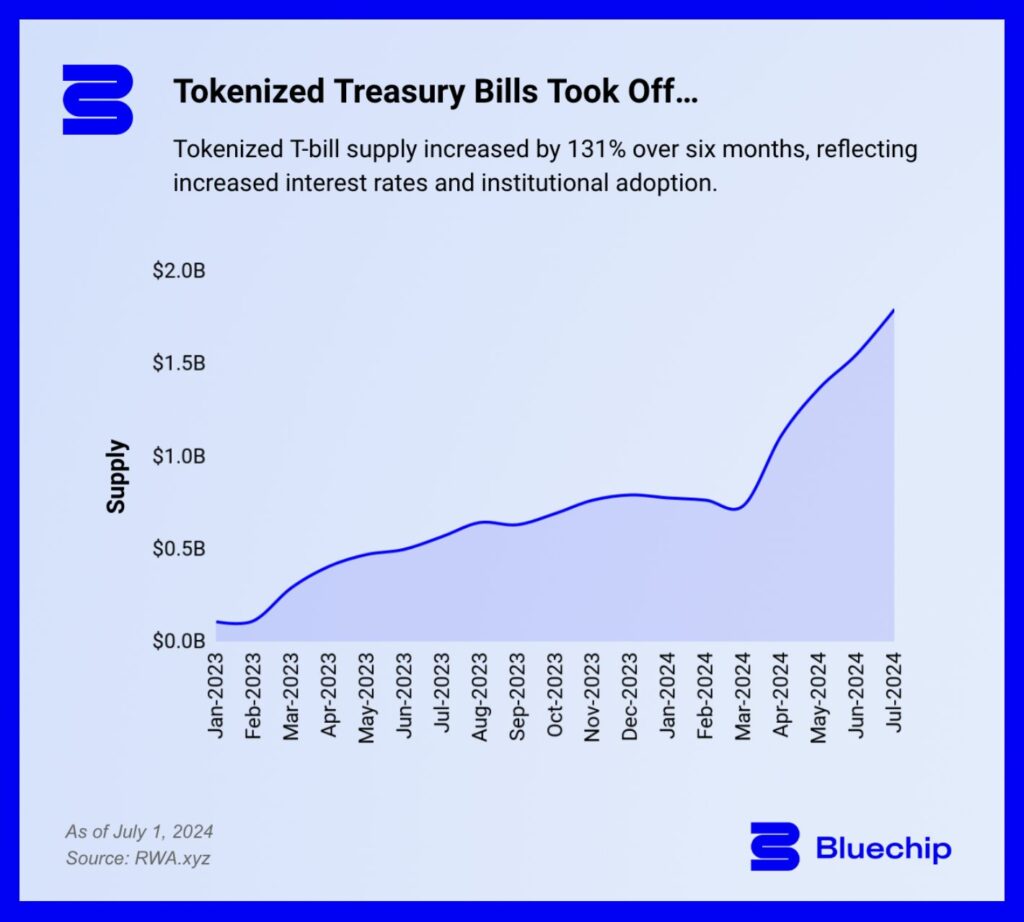

The rapid adoption of stablecoins like Tether and its competitor USD Coin has led to a surge in total payment volumes, surpassing Visa and reaching over $4 trillion. The increasing demand for tokenized real-world assets has positioned cryptocurrency as a significant driver of US Treasury demand. According to research strategist Tom Wan, the market for tokenized US Treasurys is projected to reach $3 billion by the end of 2024.

.png)

5 months ago

4

5 months ago

4

English (US)

English (US)