ARTICLE AD BOX

In recent days, the cryptocurrency market has witnessed significant milestones beyond Bitcoin’s all-time high against the euro. Notably, Tether (USDT), the leading stablecoin, has exceeded the $100 billion mark, alongside the Total Value Locked (TVL) within the decentralized finance (DeFi) space nearing the same symbolic threshold.

The achievement of over $100 billion in circulation for Tether is straightforward to comprehend. Tether issues USDT tokens, each pegged to the value of one US dollar and purportedly backed by equivalent reserves in bank deposits or assets. This week, Tether’s USDT circulation has surpassed 100.484 billion, solidifying its dominance in the stablecoin market. Despite previous challenges from rivals like USD Coin (USDC) and DAI, Tether maintains a firm grip on its position, with other stablecoins trailing significantly behind.

With over $100 billion in circulation, Tether’s influence mirrors that of traditional fiat currencies, overshadowing other global currencies in terms of market share. The closest competitors, USDC and DAI, hold only a fraction of Tether’s dominance.

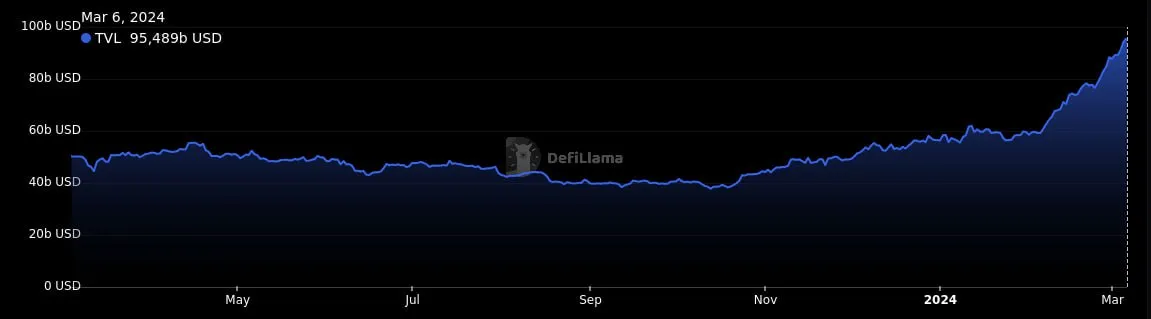

In the realm of DeFi, the Total Value Locked (TVL) represents the capital actively engaged in decentralized financial activities, such as staking, lending, and providing liquidity. While the TVL currently approaches the $100 billion milestone, it’s important to note that this figure isn’t a new record. During the peak of the “DeFi summer” in 2021/22, TVL briefly surged to $180 billion. Nonetheless, crossing the $100 billion threshold signifies significant activity within the DeFi space, indicating substantial capital deployment in decentralized finance protocols.

Source: defillama.com.

Ethereum remains the primary blockchain for DeFi, accounting for nearly 60% of the total value locked in smart contracts. Other platforms like Tron and the Binance Smart Chain also contribute to the TVL, albeit to a lesser extent. Notably, despite its high market capitalization, Solana’s contribution remains minimal, while blockchain projects like Cardano and Polkadot are notably absent from significant participation.

In terms of applications within DeFi, liquid staking emerges as a prominent trend. Liquid staking involves staking native blockchain tokens, such as Ethereum, in smart contracts to earn staking rewards while maintaining liquidity through tokenized representations. This practice, alongside restaking mechanisms, constitutes a substantial portion of the DeFi landscape.

Beyond liquid staking, decentralized lending protocols, cross-chain bridges, and decentralized exchanges (DEX) remain integral components of the DeFi ecosystem. Despite the subdued activity in certain sectors over the past two years, the steady growth and innovation within DeFi continue to shape the cryptocurrency market landscape.

The post Tether USDT Above $100 Billion Marketcap , DeFi TVL Near $100 Billion appeared first on Daily Coin Post.

.png)

8 months ago

5

8 months ago

5

English (US)

English (US)