ARTICLE AD BOX

Lee Bok-hyun, the head of South Korea’s Financial Supervisory Service (FSS), is poised to embark on a pivotal visit to the United States. He will engage in crucial talks with Gary Gensler, chairman of the Securities and Exchange Commission (SEC), centering on the crypto industry and the intricacies of spot Bitcoin Exchange-Traded Funds (ETFs).

Bok-hyun’s discussions with Gensler will likely be pivotal for the future of spot Bitcoin ETFs in South Korea.

South Korea Seeks Alignment With SEC on Crypto Regulation

This year’s meeting, unveiled at a press briefing at FSS headquarters in Seoul, seeks to unify views on crypto regulation.

“There are areas to align our perspectives with Gary Gensler, the SEC chairman, on virtual asset issues, including spot Bitcoin ETFs, this year. The impact of SEC policies on the global stage is now significant,” Bok-hyun said in a press conference.”

Currently, South Korea’s financial giants like Samsung Securities and Mirae Asset Securities face barriers in allowing trading of overseas spot Bitcoin ETFs. The Financial Services Commission (FSC) of South Korea highlighted the legal issues these firms encounter with such instruments. The FSC is also taking steps to increase transparency in the crypto sector as a part of a wider effort to protect the financial ecosystem.

In particular, crypto exchanges in South Korea must now report executive leadership changes. The performance of key staff is also under closer examination. These measures aim to boost the industry’s integrity with a public consultation that invites input on these regulatory frameworks.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Moreover, the Financial Intelligence Unit’s (FIU) crackdown on crypto mixers highlights South Korea’s strict stance on virtual asset transactions. Mixers, often linked to illegal activities, emphasize the global challenge, which necessitates a collective international effort.

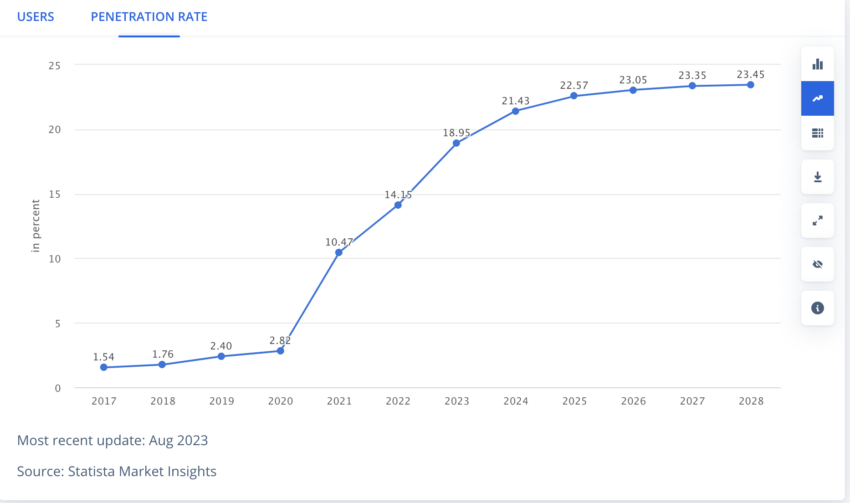

Crypto Users’ Penetration Rate in South Korea. Source: Statista

Crypto Users’ Penetration Rate in South Korea. Source: StatistaAs South Korea emerges as a hub for crypto adoption, the implications of these regulatory dialogues and measures are profound. Especially when considering its remarkable penetration rate, which is projected to escalate in the coming years.

The post The Future of Crypto ETFs: South Korea Seeks Guidance From SEC appeared first on BeInCrypto.

.png)

9 months ago

2

9 months ago

2

English (US)

English (US)