ARTICLE AD BOX

The US Securities and Exchange Commission (SEC) targeted ShapeShift, a crypto exchange that has been operational for a decade. Based in Denver, Colorado, ShapeShift faced allegations from the SEC for acting as an unregistered securities dealer.

Specifically, following the industry-wide collapses in 2022, the SEC has intensified its regulatory oversight of the crypto industry.

How the ShapeShift Crypto Exchange Became the Latest Target of the SEC

The SEC’s charges against ShapeShift came before the firm ceased its exchange activities in the US in 2021. Following these allegations, ShapeShift agreed to a settlement on Tuesday that included a $275,000 fine. Additionally, they committed to avoiding future breaches of the Securities Exchange Act.

ShapeShift was accused of offering “at least 79 crypto assets” to its users. Some of these assets were identified as investment contracts, although the SEC did not specify which were deemed securities. This situation mirrors the charges against other leading US crypto exchanges, such as Coinbase, Kraken, and Binance.US.

According to the SEC, ShapeShift engaged directly with its customers. It bought and sold crypto assets from its own accounts, effectively maintaining an inventory and acting as a buyer and seller on its platform. This practice allegedly continued from 2014 until the company shut down its US exchange operations in 2021.

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

In reaction to the SEC’s proceedings, Erik Voorhees, the founder of ShapeShift, clarified that the firm neither admitted nor denied the allegations. He referenced the Federalist Papers, highlighting the essential balance between government control and the necessity for self-regulation.

“ShapeShift paid $275,000 to settle the matter. There was no admission or denial of wrongdoing,” Voorhees said.

Under the leadership of Chairman Gary Gensler, the SEC has pursued a record number of enforcement actions against the crypto industry. This aggressive approach has caused unease across the sector.

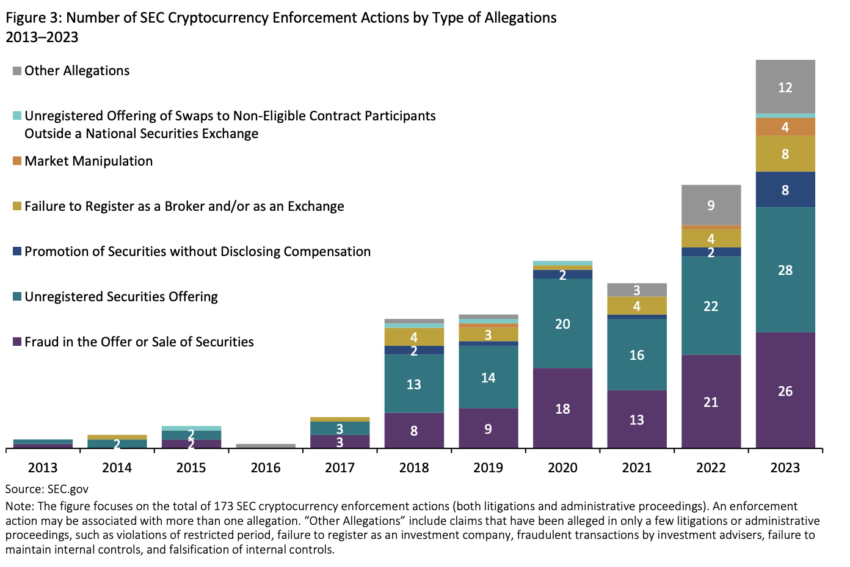

Breakdown of SEC Crypto Enforcements by Alleged Violations. Source: Cornerstone Research

Breakdown of SEC Crypto Enforcements by Alleged Violations. Source: Cornerstone ResearchRecent SEC crackdown includes subpoenas against NovaTech’s leading promoters. The firm allegedly employs a multilevel marketing strategy and drew the SEC’s attention for potential securities law violations.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Furthermore, the SEC’s rigorous enforcement has led to lawsuits within the crypto industry. Lejilex, a cryptocurrency firm based in Texas, and the Crypto Freedom Alliance of Texas (CFAT) initiated legal action against the SEC. They contested the agency’s classification of certain digital assets as securities, arguing for a lack of legal clarity and the imposition of unnecessary regulatory burdens.

This sentiment echoes throughout the crypto industry, which seeks clearer regulatory guidelines.

The post This 10-Year-Old Crypto Firm Hit With $275,000 Unregistered Securities Fine by SEC appeared first on BeInCrypto.

.png)

8 months ago

5

8 months ago

5

English (US)

English (US)