ARTICLE AD BOX

Founders Fund, the venture capital powerhouse led by billionaire Peter Thiel, has made a colossal investment in the two leading crypto assets. As per reports, the firm strategically poured $200 million into acquiring significant stakes in Bitcoin and Ethereum, marking a bold re-entry into the crypto markets.

This decision reflects a growing confidence among institutional investors as they gradually return to crypto investments.

Peter Thiel’s Founders Fund Bets Big on Crypto

Reuters reported that the Founders Fund divided the investment equally between Bitcoin (BTC) and Ethereum (ETH), the top two cryptocurrencies. The firm carried out the acquisition of these assets between late summer and early fall of 2023.

The crypto industry experienced a significant blow last year with the collapse of major players like the FTX, leading to plummeting prices and heightened regulatory scrutiny. However, Founders Fund’s recent investment underscores a potential turnaround for the crypto markets, which have been on a steady recovery path.

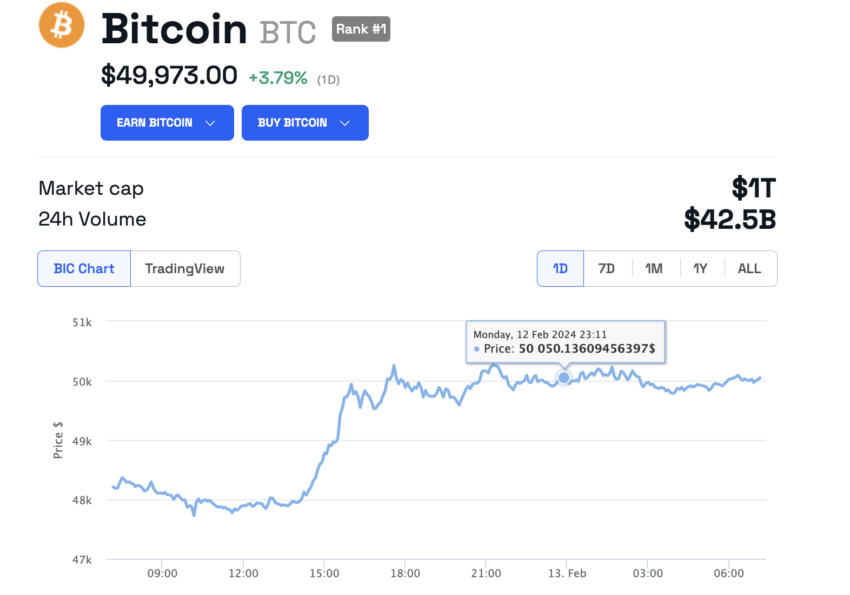

Bitcoin, for instance, hit a two-year high of $50,000 on Monday, reigniting optimism in the sector.

Read more: Bitcoin Price Prediction 2024/2025/2030

Bitcoin Price Performance. Source: BeInCrypto

Bitcoin Price Performance. Source: BeInCryptoFounders Fund’s history with crypto dates back to 2014, when it first ventured into Bitcoin investments. The firm has been known for its early and aggressive moves in the crypto space, culminating in a staggering $1.8 billion in returns by liquidating its holdings before the 2022 crash. This recent investment marks a significant re-engagement with the crypto market, signaling a belief in its long-term potential.

Peter Thiel, a prominent figure in the tech and financial sectors, has been a vocal advocate for crypto, particularly Bitcoin. The billionaire views crypto as a viable alternative to traditional financial systems, offering a hedge against central bank policies. Thiel’s stance on Bitcoin aligns with his libertarian views, emphasizing the importance of innovation and minimal government intervention in technology.

Moreover, Thiel’s criticism of the traditional financial “gerontocracy” — a term he uses to describe the old guard’s resistance to new financial technologies like cryptocurrencies — highlights the broader cultural and ideological clash between emerging digital currencies and established financial institutions. He has specifically called out high-profile figures and institutions for their reluctance to embrace the transformative potential of cryptocurrencies.

“It [Bitcoin] is a movement, and it’s a political question, whether this movement is going to succeed, or whether the enemies of a movement are going to succeed in stopping us,” Thiel said at the Bitcoin 2022 conference in Miami.

Read more: 15 Best Penny Cryptocurrencies To Invest In February 2024

Founders Fund’s re-investment in Bitcoin and Ethereum marks a significant moment for the broader crypto market. The firm has an impressive $12 billion in assets under management and a track record of successful early-stage investments.

The post This Billionaire Spent $200 Million to Buy Two Cryptos appeared first on BeInCrypto.

.png)

9 months ago

2

9 months ago

2

English (US)

English (US)