ARTICLE AD BOX

TL;DR

- Bitcoin Volatility: Bitcoin’s price swings as of late might have led to changes in the BTC Fear and Greed Index.

- Bitcoin Halving Event: The upcoming halving in April 2024 is anticipated to impact the asset’s supply and demand, possibly affecting investors’ sentiment.

No More Greed

The historic approval of spot Bitcoin ETFs in the United States and all the surrounding drama have taken their toll on Bitcoin, which soared to $49,000 on January 11 but later descended to its current level of $42,600 (per CoinGecko’s data).

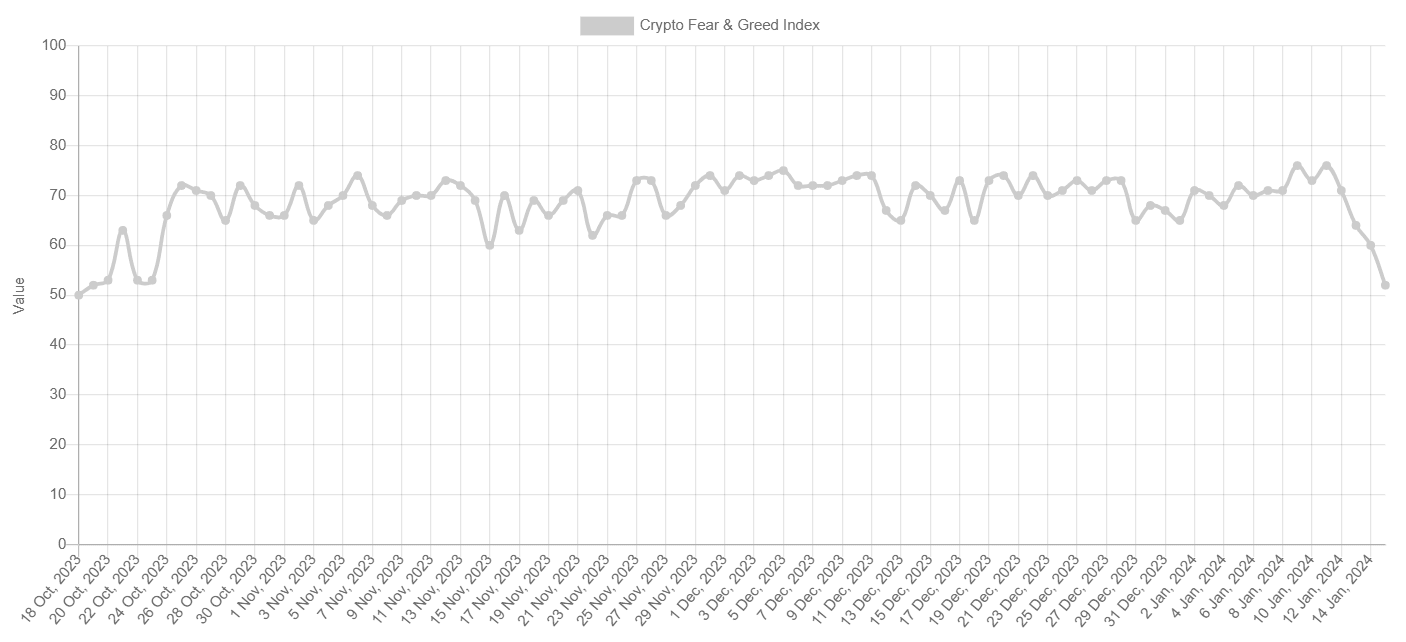

The huge volatility might be one factor that has affected the popular BTC Fear and Greed Index. The metric, whose result is based on social media buzz, surveys, market momentum, and other elements, dropped to a “Neutral” territory today (January 15) for the first time since October 23, 2023.

BTC Fear and Greed, Source: alternative.me

BTC Fear and Greed, Source: alternative.mePrior to that, the index was sitting in the “Greed” or “Extreme Greed” zone because of Bitcoin’s impressive performance in Q4, 2023, and the start of 2024. Recall that the asset’s price soared by over 150% last year, with the final quarter witnessing a 55% increase alone.

Is ‘Greed’ Back on the Horizon?

Being closely related to BTC’s price, one could expect the Fear and Greed Index’s return to “Greed” or “Extreme Greed” should the asset benefit from several upcoming events. A possible pivot from the Federal Reserve on its aggressive anti-inflationary politics is an example.

America’s central bank started raising interest rates in March 2022 in an attempt to bring down the galloping inflation rate in the States. The current benchmark is 5.25% to 5.5%, with rates unchanged following the latest FOMC meeting.

Moreover, the Fed hinted about three cuts this year, sparking enthusiasm among the crypto community. The move is viewed as a bullish factor for the digital asset industry, particularly Bitcoin, as it would make borrowing money cheaper and thus allow more investors to deal with risk-on assets.

Another factor worth noting is the BTC halving scheduled for April 2024. It slashes the miners’ rewards in half, causing a reduced supply growth that could prompt a price rally for the asset (assuming the demand stays the same or rises). Multiple experts, including Robert Kiyosaki (the author of the bestseller “Rich Dad Poor Dad”), have urged people to pay close attention to that event.

Those curious to learn more about it could take a look at our dedicated video below:

The post This Hasn’t Happened to Bitcoin (BTC) in Almost 3 Months appeared first on CryptoPotato.

.png)

11 months ago

5

11 months ago

5

English (US)

English (US)