ARTICLE AD BOX

Ran Neuner’s investment journey underscores the cryptocurrency market’s high stakes and potential pitfalls. Once celebrated as the youngest CEO of a publicly listed company in South Africa, Neuner’s financial trajectory took a devastating turn.

It culminated in a staggering $100 million loss primarily attributed to his investment in Terra (LUNA), a cryptocurrency that experienced a catastrophic collapse.

Losing $100 Million to Crypto

Ran Neuner’s story begins with his early success. He ascended to remarkable heights in the business world, only to face the harsh reality of financial insolvency in 2020. The impact of this loss was profound, affecting just his financial stability and his mental health.

Neuner described this period as one of the darkest in his life. He highlighted the emotional toll of losing hard-earned wealth and the luxury of financial freedom it afforded.

“It sent me into a little bit of a dark depression. It wasn’t real depression. I wasn’t on any meds or anything, but I call that a pity party, and that’s the period of mourning. You have to mourn as part of the human process because that makes you fight back harder,” Neuner said.

The rise of Neuner’s fortune was closely tied to his strategic investments in Bitcoin (BTC) and LUNA. The latter of which formed a significant portion of his portfolio. Indeed, his initial investment in LUNA’s initial coin offering (ICO) and aggressive purchasing at low prices eventually built a portfolio worth over $100 million.

However, this success story took a turn for the worse when LUNA’s value plummeted. It erased the vast majority of Neuner’s wealth in a matter of days. This loss was a financial blow and a profound psychological and emotional challenge.

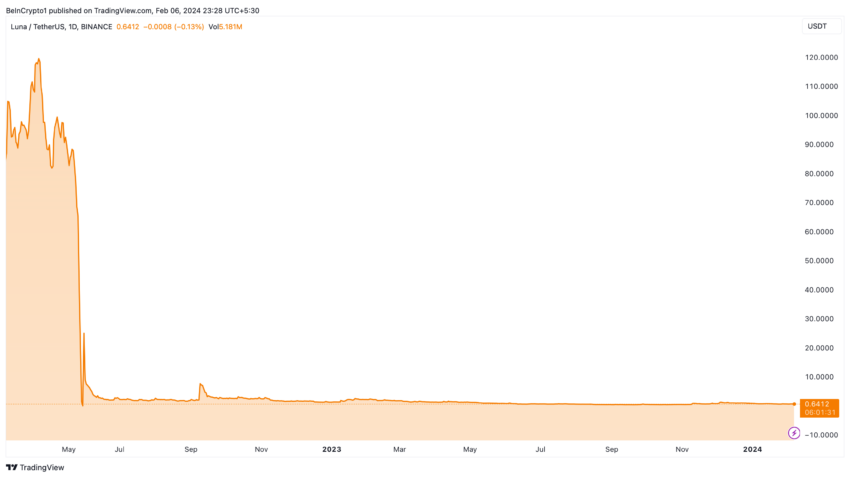

Terra (LUNA) Price Performance. Source: TradingView

Terra (LUNA) Price Performance. Source: TradingViewNeuner’s experience highlights several critical lessons for investors, particularly in cryptocurrency’s high-risk, high-reward domain. He even admited to being blinded by greed and an overcommitment to a single asset, which ultimately led to his downfall.

“I was greedy I thought that the most money that I could make would be on LUNA and the greed landed up destroying me because I took stupid risks,” Neuner added.

Lessons Learned From a Downfall

Neuner’s first mistake was allowing a single token to dominate his portfolio. This decision was driven by greed and the allure of quick profits. More importantly, this approach contradicts the fundamental investment principle of diversification, which is designed to mitigate risk.

His heavy investment in a project that hinged on the stability of its associated stablecoin illustrates the dangers of putting too much faith in one asset or idea.

The second lesson from Neuner’s ordeal is the significance of remaining open to criticism. His initial refusal to heed warnings about the sustainability of his investment choices, particularly LUNA, demonstrates the danger of becoming too emotionally invested in any asset.

“I was so absorbed in the LUNA is going to change the narrative of money worldwide that I would never listen to the critics. I stopped listening to critics and instead of listening to critics I used to fight them back. I do believe in a healthy debate, but what I’ve learned this time round is no matter how small the Twitter account is, I’m going to listen to all the criticisms,” Neuner affirmed.

Read more: 15 Most Common Crypto Scams To Look Out For

Finally, Neuner’s realized that success in investing is not about quick gains. Instead, it is about sustaining wealth over time marks a fundamental shift in approach. The metaphor of the tortoise and the hare aptly illustrates the wisdom of patience and consistency over chasing the latest hype. This mindset shift is crucial for anyone looking to navigate the crypto markets successfully.

Adopting a cautious approach, focusing on long-term stability rather than short-term gains, and ensuring a well-balanced portfolio are key strategies for mitigating risk.

Neuner’s story is a powerful reminder of the risks inherent in cryptocurrency investment. It also highlights the importance of adopting a disciplined, well-considered approach. The lessons he shared are relevant to crypto investors and anyone looking for high-risk investments.

The post This Investor Lost $100 Million to Crypto appeared first on BeInCrypto.

.png)

9 months ago

2

9 months ago

2

English (US)

English (US)