ARTICLE AD BOX

The decentralized finance (DeFi) sector continues to evolve, with several significant launches and updates making waves. BeInCrypto has examined the latest happenings, providing a comprehensive overview of the most noteworthy developments in the DeFi space.

From the launch of dYdX’s Android app to 3Jane’s derivatives yield layer, the sector is brimming with innovation and progress.

Term Structure’s Mainnet Launch

Term Structure has now launched its mainnet on Ethereum (ETH). This marks the debut of the first market-driven, institutional-grade fixed-income protocol. It is changing how lenders and borrowers manage liquidity in DeFi.

This platform lets users borrow tokens at fixed rates and terms using their liquid staking tokens (LSTs) and liquid restaking tokens (LRTs). They can also earn points and staking rewards. The auction mechanism in the primary markets facilitates borrowing and lending.

Additionally, the secondary markets offer a real-time order book. This feature enhances liquidity by supporting the trading of fixed-income tokens.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

With this launch, Term Structure aims to set new global standards in liquidity management. It enables users to lock in a fixed cost of funds. This move is crucial for leveraging opportunities to possibly earn higher floating annual percentage yields (APYs) or capitalize on token price appreciation.

“Our mainnet, designed to cater to institutional clients, traders, and retail investors, marks a pivotal development in DeFi. It allows users to leverage their digital assets with fixed rates and terms,” Jerry Li, Term Structure CEO, said.

Term Structure is a fixed-rate lending and borrowing protocol powered by a customized zero-knowledge (ZK) rollup, zkTrue-up. The Taiwanese DeFi platform specializes in non-custodial fixed-income protocols for peer-to-peer borrowing and lending.

dYdX Android App Launch and Chain Upgrade

On another front, dYdX, a perpetual trading decentralized exchange (DEX), now offers its app on Android. The app contains all the current features of the dYdX chain.

“dYdX Chain for Android includes some of your favorite features like 24/7/365 markets, 20x leverage, 65 Markets and counting, low gas fees, and so much more,” the dYdX team noted.

Additionally, dYdX revealed its upgrade to dYdX Chain v5.0. This software upgrade was scheduled for block 17,560,000 around June 6 at 15:16 UTC.

This decision followed a dYdX community vote, with 90% supporting the upgrade to version 5.0 and 98.5% voting in favor. The upgrade introduces several improvements: Isolated Markets, Batch order cancellation, Protocol-enshrined liquidity provider (LP) Vault, Slinky Sidecar/Vote Extension, Performance Enhancements, Soft Open Interest Cap, and Full Node Streaming. As per DefiLlama data, dYdX Chain’s total value locked (TVL) stands at $146.28 million as of this writing.

dYdX TVL. Source: DefiLlama

dYdX TVL. Source: DefiLlama3Jane Revolutionizes Restaking with Derivatives Yield on EigenLayer

3Jane, a derivatives yield protocol, is live on EigenLayer. It unlocks a novel derivatives yield layer by enabling the collateralization of restaked ETH in derivatives contracts.

Chudnov Glavniy, founder of 3Jane, announced the protocol launch. According to Glavniy, the protocol unlocks a new derivatives yield layer for restakers by enabling the collateralization of restaked ETH in derivatives contracts, specifically call options.

“3Jane is the first ETH yield source for all EigenLayer assets and the first step towards ‘financializing’ EigenLayer by sourcing yield not just from [Actively Validated Services] AVS security but also from financial derivatives,” Glavniy explained.

The protocol enables collateralizing all exotic yield-bearing ETH and Bitcoin (BTC) variants across EigenLayer, Babylon Chain, and Ethena in options contracts. Users can wrap natively restaked ETH, restaked LSTs, ether.fi Staked ETH (eETH), Renzo Restaked ETH (ezETH), Ethena Staked USDe (sUSDe), and Savings DAI (sDAI) on 3Jane to earn additional options premium yield. 3Jane Vaults sell deep out-of-the-money options and accrue premiums to wrapped deposits.

Everclear: Connext’s Rebranding and Clearing Layer Introduction

Interoperability protocol Everclear has introduced the first “Clearing Layer” after rebranding from Connext. These layers coordinate transactions between chains, netting fund flows before settling them on the underlying chains and bridges. The live test net begins today.

The Chain Abstraction stack aims to solve fragmentation by eliminating the need for users to care about the chain they are on. However, it faces challenges in rebalancing and settling liquidity between chains.

Everclear addresses this issue by creating Clearing Layers. These layers coordinate market actors to net funds flows between chains before settling with underlying chains and bridges. They form the foundation of the Chain Abstraction stack, enabling seamless liquidity and permissionless chain expansion for protocols built on them.

Everclear reduces the cost and complexity of rebalancing by up to 10 times. The system is built as an Arbitrum Orbit rollup (via Gelato RaaS) and connects to other chains using Hyperlane with an Eigenlayer Interchain Security Module (ISM).

On average, about 80% of daily cross-chain capital flows are nettable. For every $1 bridged into a chain, $0.80 is bridged out. If solvers, market makers, and centralized exchanges coordinated, they could reduce bridging fees by more than five times.

TrueFi’s Deployment on Arbitrum

TrueFi is now live on Arbitrum, marking a significant expansion in partnership with Cicada Credit to bring on-chain credit to Arbitrum with market-neutral borrowers. The TrueFi team explained several reasons they chose Arbitrum.

“Arbitrum is the largest Layer 2 by TVL, number of DeFi protocols, and balance of stablecoins. According to L2beat, Arbitrum is the furthest along the path of decentralization. They are investing significant funds from their treasury into [real-world assets] RWAs, as seen in their recent STEP program, where we have also applied with Adapt3r Digital,” the team outlined.

In the coming days and weeks, TrueFi will share more about the pools’ specific configuration and details on each of the borrowers. The first two pools will be with Gravity Team and AlphaNonce, and many more will come.

Nostra’s NSTR Tokenomics and Launch Events

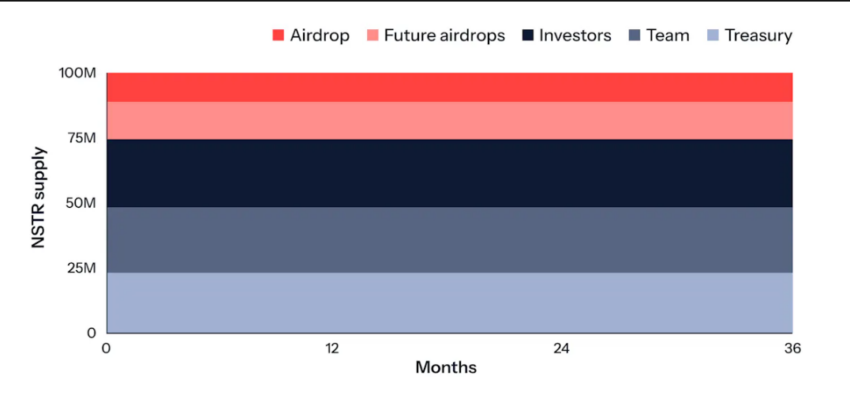

Nostra revealed their tokenomics for NSTR, featuring a total supply of 100 million tokens unlocked entirely at launch. NSTR will serve as the governance token for the Nostra ecosystem.

They plan to distribute 11% to the community through an airdrop. Launch events include an upcoming Snapshot, a Liquidity Bootstrapping Pool (LBP) running from June 10 to 13, and the Token Generation Event (TGE) on June 17.

NSTR Supply. Source: Nostra

NSTR Supply. Source: NostraNostra claims NSTR will be the fairest launch in DeFi. The Liquidity Bootstrapping Pool (LBP) pre-listing event aims to fund DEX liquidity.

They will airdrop tokens to the most active users and community members. All proceeds will go towards Treasury-owned DEX liquidity.

Solv Protocol Integrates Ethena for Yield Vault

Solv Protocol, a platform for optimizing yield and liquidity across major assets, has integrated Ethena to introduce the first yield vault for SolvBTC. This vault will enable users to earn yields from Ethena’s strategies while retaining exposure to Bitcoin.

Users can earn attractive yields with SolvBTC through two methods. Firstly, by utilizing Solv’s Yield Vaults, users can deposit their SolvBTC into these vaults to access premium yield sources such as BTC staking, restaking, and delta-neutral trading strategies.

Secondly, users can explore DeFi opportunities using SolvBTC across diverse DeFi protocols. This allows access to various yield-generating options, maximizing earnings within the vibrant DeFi ecosystem.

The ‘SolvBTC Yield Vault – Ethena’ is the first of many planned collaborations by Solv Protocol. These partnerships aim to introduce new yield sources and strategies to the expanding SolvBTC ecosystem.

MakerDAO’s New Proposal: Etherfi’s weETH into SparkLend

MakerDAO has opened a new proposal to onboard Etherfi’s weETH into SparkLend. weETH is the largest Liquid Restaking Token (LRT) on the market. It is also the only large LRT with fully enabled withdrawals, ensuring stable liquidity and a strong peg to ETH.

Phoenix Labs has proposed listing weETH to increase DAI borrowing on SparkLend, given the low competition for borrowing USD stablecoins using LRT collateral. The initial parameters and risk assessment are based on current market and liquidity conditions for weETH:

- Loan to Value: 75%

- Liquidation Threshold: 73%

- Supply Cap: 5,000 weETH

“If approved, this change will be part of an upcoming Executive Vote in SparkLend,” the MakerDAO team said.

Read more: Identifying & Exploring Risk on DeFi Lending Protocols

These advancements emphasize the evolution of the DeFi sector, showcasing the relentless innovation and progress that are propelling the industry forward. With projects like dYdX, 3Jane, and MakerDAO continually breaking new ground, the future of decentralized finance appears exceptionally promising.

The post This Is What’s Happening in DeFi: dYdX, 3Jane, MakerDAO, and More appeared first on BeInCrypto.

.png)

5 months ago

2

5 months ago

2

English (US)

English (US)