ARTICLE AD BOX

Deutsche Borse, a leading bank in Germany, has recently witnessed its subsidiary, Crypto Finance, gain further regulatory clarity and approval to commence crypto trading operations.

This comes amid Deutsche Borse gearing up to introduce its digital exchange, DBDX, targeting institutional investors.

Deutsche Borse Expands Presence in Crypto Market

A recent report indicates that Crypto Finance, a subsidiary of Deutsche Borse, has obtained four key licenses from the German Federal Financial Supervisory Authority (BaFin).

The entity will now be allowed to provide crypto trading, settlement and custody services to institutional investors in Germany.

Meanwhile, it highlights that Crypto Finance has already secured regulatory approval in Switzerland, adding another feather to its portfolio.

Deutsche Borse initially acquired Crypto Finance in 2021 to bolster its crypto presence throughout Europe.

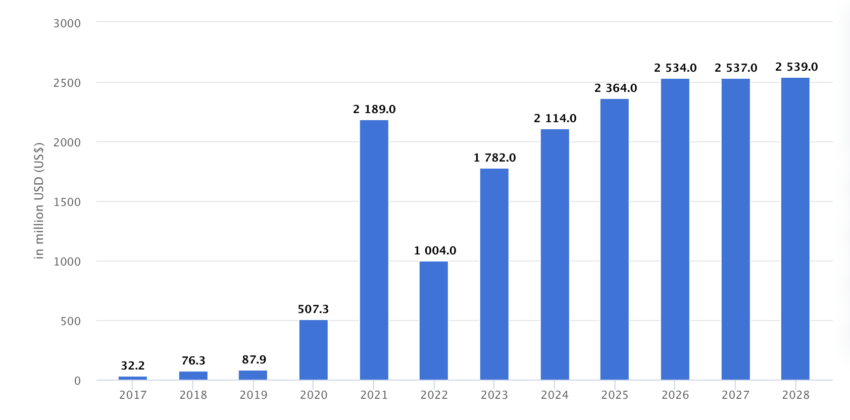

Recent data from Statista suggests a promising outlook for the crypto industry in Germany, projecting annual revenue to reach approximately $2.5 billion by 2028.

Germany’s cryptocurrency revenue forecast, 2017-2028. Source: Statista

Germany’s cryptocurrency revenue forecast, 2017-2028. Source: StatistaOn November 15, BeInCrypto reported that Frankfurt-based Commerzbank AG has received approval from BaFin to run a crypto custody business.

Meanwhile, BaFin recently said that full-service banks like Commerzbank must get an expanded license to offer digital asset services.

Read more: Top 5 Crypto Companies That Might Go Public (IPO) in 2024

On the other hand, enforcement continues for illicit activity with Bitcoin within the nation.

On January 31, German authorities declared the seizure of 50,000 Bitcoins acquired through copyright law violations and money laundering.

Germany’s Enforcement Action on Crypto

Three different enforcement agencies collaborated to dismantle operations valued at almost $2.13 billion at the time of publication.

“the Public Prosecutor’s Office in Dresden, the State Criminal Police of Saxony, and the Tax Investigation Unit of the Leipzig II Tax Office.”

However, the German government’s intentions for the substantial Bitcoin holdings remain uncertain, causing apprehension and speculation among Bitcoin holders. Concerns arise, particularly if the German authorities opt to sell, potentially impacting Bitcoin’s price.

Read more: 11 Best Altcoin Exchanges for Crypto Trading in January 2024

Meanwhile, from an industry standpoint, Germany continues to hold a strong position in the crypto industry.

Coinbase recently announced Germany as a regional talent hub, in an effort for preparing for its expansion across the European region.

In October 2023, Coinbase announced that it had doubled its employee growth over the 12-month period.

“Our German operation has grown from strength to strength, and over the last 12 months, has been our fastest growing office, more than doubling in headcount.”

The post This Major German Bank Has Just Received Four Crypto Licenses appeared first on BeInCrypto.

.png)

9 months ago

3

9 months ago

3

English (US)

English (US)