ARTICLE AD BOX

This week, the crypto market had a tumultuous start. On Monday, the total market capitalization dropped by 7%, sparking over $1 billion in liquidations.

While the market participants tackle fear, CoinGecko has issued a calming perspective. The crypto data aggregator contends that the recent Bitcoin and broader crypto market dip is minor, far from signaling a severe downturn.

Crypto Market Has a History of Huge Market Corrections

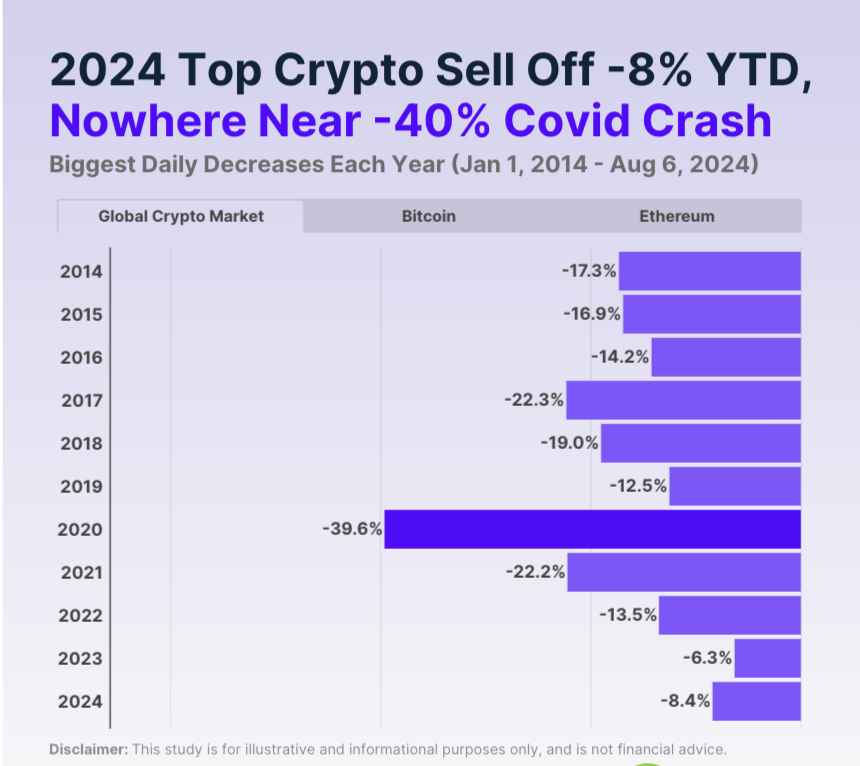

CoinGecko asserts that this week’s market sell-off does not qualify as a crypto correction, which it defines as a decline exceeding 10%. Compared to the historic -39.6% crash on March 13, 2020, sparked by COVID-19 fears, this week’s movements were relatively subdued.

Analyzing the data, CoinGecko points out that even the largest sell-off this year—an 8.4% drop in March—did not reach the correction threshold. It emphasizes that since the FTX collapse in November 2022, the market has been notably stable, avoiding any true correction days.

Read more: Cryptocurrency Trading Courses Tailored for Beginners

Historical Crypto Market Corrections. Source: CoinGecko

Historical Crypto Market Corrections. Source: CoinGeckoHistorically, the crypto market has shown a pattern of quick recoveries and brief downturns. Remarkably, the longest corrections have lasted only two days, with merely three such instances since 2014. These short-lived declines often followed significant market highs or were triggered by external shocks like regulatory changes or security breaches.

The crypto market’s resilience is further highlighted by its overall performance over the past decade. Only 1.6% of the days during this period experienced official corrections, with the average market correction sitting at -13.0%. This figure is just above the 10% mark, demonstrating the market’s ability to rebound quickly from setbacks.

Meanwhile, the broader market sentiment continues to be fearful. The crypto fear and greed index stands at 20, suggesting extreme fear.

Crypto Fear and Greed Index. Source: Alternative.me

Crypto Fear and Greed Index. Source: Alternative.meExperts also share this sentiment, suggesting that traders remain cautious. Markus Thielen from 10X Research points to the absence of new capital inflows, which he believes turns trading into a high-risk, zero-sum game. Recent liquidations, he notes, have significantly reduced the available leverage, urging traders to reassess their risk management strategies.

Read more: Crypto Portfolio Management: A Beginner’s Guide

Furthermore, Eugene Ng Ah Sio, another seasoned market analyst, draws attention to the structural weaknesses exposed by recent market actions.

“Market structure for all majors are either broken or look extremely bleak. I don’t typically want to remain aggressively long when there is this much uncertainty + weakness in the market,” Eugene Ng Ah Sio stated.

The post This Was Just a Mild Bitcoin Dip, Nothing to Worry About: CoinGecko appeared first on BeInCrypto.

.png)

3 months ago

1

3 months ago

1

English (US)

English (US)