ARTICLE AD BOX

This week has been super exciting for Solana (SOL) and the broader crypto community. While the week started with rumors about Solana’s criminal investigation, it ended with VanEck filing for a spot Solana exchange-traded fund.

Meanwhile, analysts are also discussing the much-awaited altcoin season. As the market consolidates, institutional investors such as BlackRock retain a high interest in the tokenization of real-world assets (RWA). Binance continues to face regulatory challenges, and it had to turn off copy trading in the European Union (EU) region.

Rumors Suggest Solana Under Criminal Investigation

This week began with unsettling news in the crypto sphere. Influential crypto personality Crypto Bitlord disclosed that Solana might be under criminal investigation.

Following the SEC’s classification of SOL as a security, the timing of this investigation caused ripples of concern among investors. Details about the probe are scant, but the implications could be significant for the altcoin’s future.

“We are hearing rumors that SOL is under investigation and a huge case is about to become public. This has been brewing for weeks now and could not come at a worse time. If what we heard is true, start praying for Solana,” Bitlord noted.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

Top Analysts Predict Altcoin Season’s Start

Bitcoin’s dominance in the market has been undeniable, reaching new all-time highs. However, retail investors are eagerly anticipating the altcoin season.

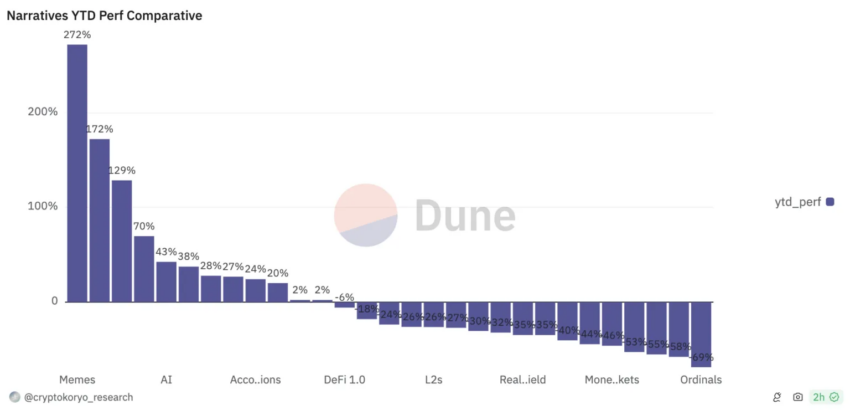

Analyst Miles Deutscher has observed that altcoins are not keeping pace with Bitcoin (BTC). He suggests that the market is still very much driven by Bitcoin, overshadowing other cryptocurrencies. Moreover, other narratives, such as meme coins, have fragmented the liquidity that would have instead gone to fundamentally strong altcoins.

“This has been a Bitcoin-narrative led cycle… Specific narratives have significantly outperformed (with majors lagging). Memes, AI, and RWA have been the clear leaders so far this cycle,” Deutscher said.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Crypto Narratives Performance. Source: Dune

Crypto Narratives Performance. Source: DuneConversely, CryptoQuant CEO Ki Young Ju sees potential for Ethereum to kickstart the altcoin season, noting its improving market value to realized value (MVRV) ratio compared to Bitcoin.

“Given the current ETF situation, this might be an ETH-only season. Historically, when ETH surges, other alts tend to follow,” Ju wrote.

Binance Disables Copy Trading in the European Union

On the regulatory front, Binance has ended its copy trading services in Europe as the new Markets in Crypto Assets (MiCA) regulations loom. Set to provide uniform crypto regulations across the EU; these rules prompted Binance to direct users to close their copy trading positions by late June 2024.

The MiCA regulation aims to enhance market integrity and investor protection.

Read more: What Is Markets in Crypto-Assets (MiCA)?

Binance Notification of Copy Trading Restrictions in the EU. Source: Binance

Binance Notification of Copy Trading Restrictions in the EU. Source: BinanceBlackRock and Franklin Templeton Spearhead RWA Surge

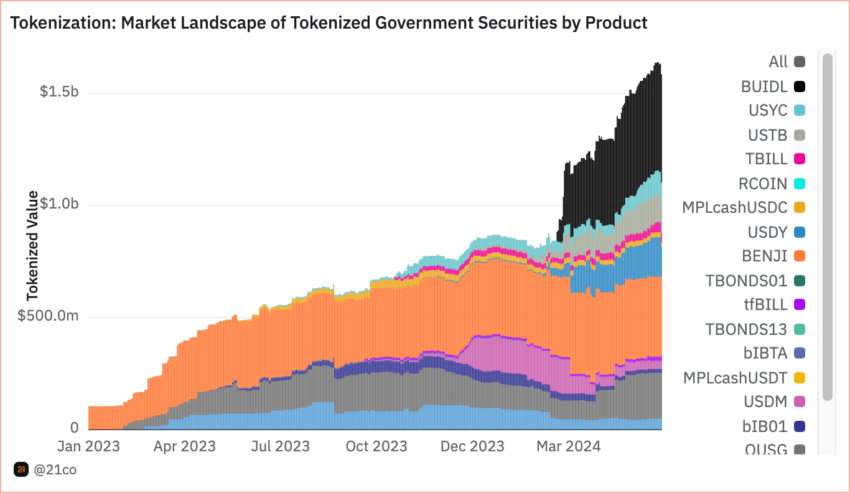

The market for tokenized US Treasuries has exploded, driven by high interest rates and the appeal of secure, high-yielding on-chain assets. BlackRock and Franklin Templeton are leading this surge and managing the largest tokenized funds.

In fact, tokenized US Treasury products have surged by over 1,000% since early 2023. As of June 26, their market capitalization has hit $1.63 billion. This growth highlights the blending of traditional financial assets with blockchain technology, which promises enhanced liquidity and more efficient transactions.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Value of Tokenized Government Security Products. Source: Dune/21co

Value of Tokenized Government Security Products. Source: Dune/21coVanEck Files for First Solana ETF in the US

The week also saw a significant development as VanEck filed for the first spot Solana ETF. This filing could pave the way for institutional investors to gain more straightforward exposure to Solana.

If approved, the ETF would represent a significant evolution in Solana’s market status, potentially broadening its investor base and influence. Crypto market maker GSR predicted that the ETFs could drive Solana’s price by up to 9x. While GSR believes that Solana ETF could be next, it says that Cardano (ADA) or XRP ETF approvals might not come anytime soon.

“We can adjust our relative flow estimates under the various scenarios for Solana’s relative size to Bitcoin’s 2.3x increase due to the spot ETFs. Doing so suggests Solana may increase 1.4x under the bear flows scenario, 3.4x under the baseline scenario, and 8.9x under the blue sky scenario,” GSR analysts predicted.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

This Week’s Crypto Top 10

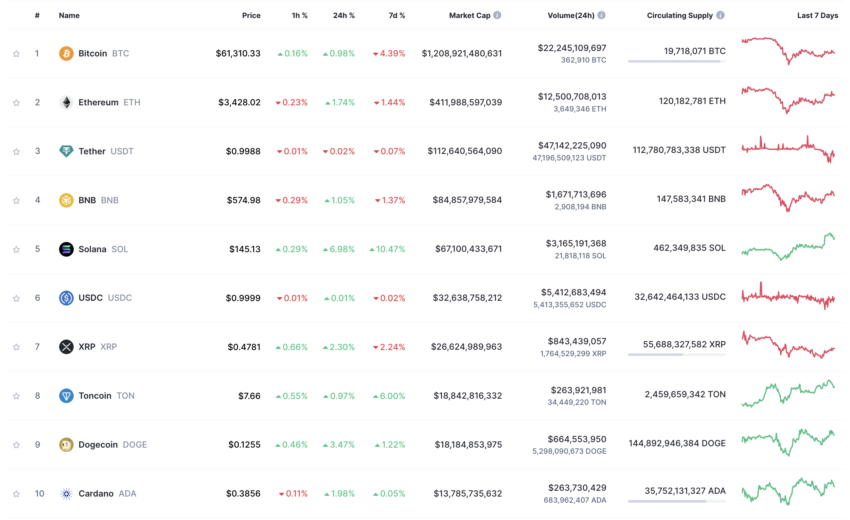

Despite a general downturn in the market this week, with total market capitalization falling from $2.35 trillion to $2.28 trillion, Solana stood out with a notable increase of 10.47%. In contrast, Bitcoin and Ethereum experienced declines. Meanwhile, Toncoin rose in the rankings, surpassing Dogecoin to become the eighth-largest cryptocurrency by market cap.

Top 10 Crypto Assets by Market Capitalization. Source: CoinMarketCap

Top 10 Crypto Assets by Market Capitalization. Source: CoinMarketCapFrom regulatory changes and market shifts to significant new potential ETFs, these events are critical in shaping the crypto ecosystem. They reflect broader economic trends and technological advancements, drawing keen interest from diverse stakeholders within the financial ecosystem.

The post This Week in Crypto: Solana Investigation, Altcoin Season, and BlackRock’s Tokenization appeared first on BeInCrypto.

.png)

4 months ago

16

4 months ago

16

English (US)

English (US)