ARTICLE AD BOX

Bitcoin price has faced immense selling pressure lately, as witnessed by its recent dip. As of writing, the BTC price has slipped below the $64,000 level, sparking concerns over a potential crash to $60K, or even below that.

Meanwhile, amid this, investors are looking for potential reasons behind the sluggish trading and the dip in BTC price. So, let’s take a quick tour of the top three reasons that are likely driving the Bitcoin price dip today.

Why Is Bitcoin Price Falling?

The recent market sentiment indicates that the investors are staying on the sideline. A flurry of reasons appears to have weighed on the risk-bet appetite of the investors, potentially impacting the BTC price as well as the broader crypto market.

Here are the top three reasons behind the recent Bitcoin price dip:

Bitcoin Options Expiry

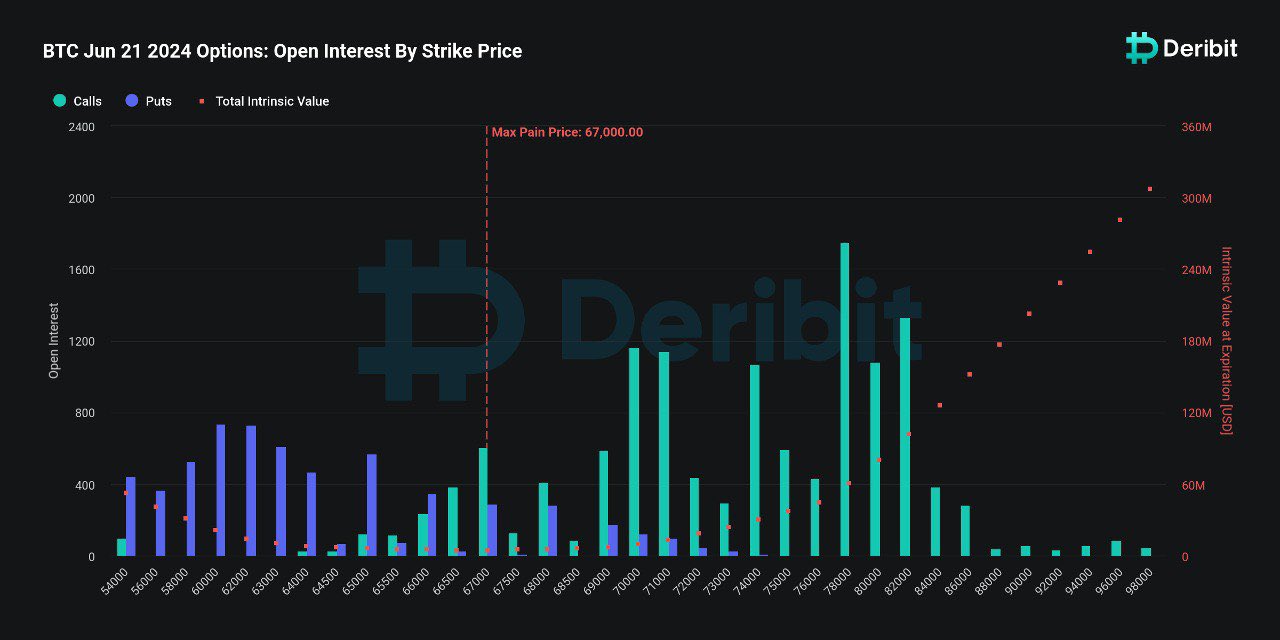

Bitcoin’s price dipped today amid the looming expiration of $1.96 billion worth of Bitcoin (BTC) and Ethereum (ETH) options. This substantial expiry, involving $1.26 billion in Bitcoin options with a put-to-call ratio of 0.46 and a max pain point of $67,000, has heightened market volatility.

Source: Deribit, X

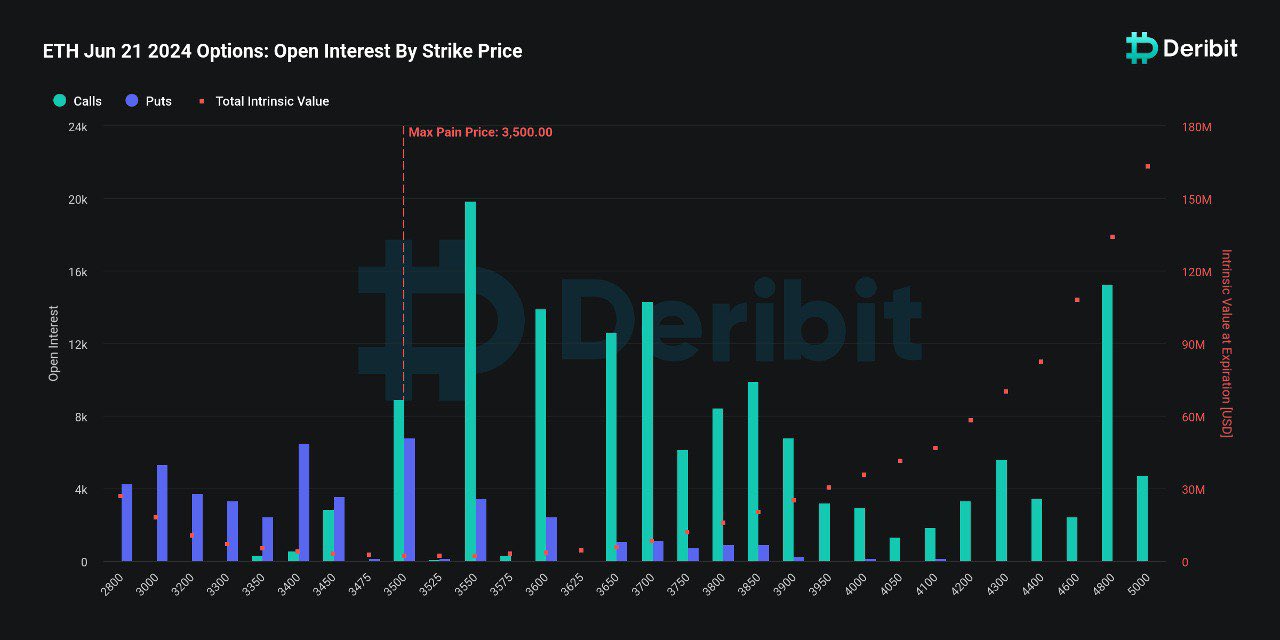

Source: Deribit, XOn the other hand, Ethereum’s expiring options, valued at $693.37 million with a put-to-call ratio of 0.32 and a max pain point of $3,500, further contribute to the uncertainty. The anticipated market movements surrounding these expirations are influencing traders and investors, prompting closer scrutiny of price trends.

Source: Deribit, X

Source: Deribit, XUsually, the market faces heightened volatility during the options expiry. However, despite the anticipated short-term volatility, the options expiry typically provides stability in the market in the long run.

US PMI Impact

The U.S. PMI by S&P Global, a monthly survey of business activities that tracks the manufacturing and services sector, is scheduled to be released later today. The investors will keep a close track of the data for clarity on the U.S. economic health. Notably, this data could shape the future trajectory of the broader financial market, let alone the Bitcoin price.

Notably, in May, the S&P Global Composite PMI increased at a rapid pace to 54.5 from 51.3 in the prior month. Besides, the U.S. Manufacturing PMI increased to 51.3 last month from 50 in April.

However, the upcoming S&P Global U.S. Services PMI data for June is expected to show a slower expansion of 54 from 54.8 in April. In addition, the manufacturing PMI is also expected to edge lower to 51 in June. It’s worth noting that a reading over 50 indicates an expansion in the sector’s business-related activities.

Meanwhile, with the recent macroeconomic pressures and the U.S. Fed sticking to their policy rate plans, the Bitcoin price has noted gloomy trading. Having said that, today’s S&P Global PMI data would play a crucial role in shaping the future of Bitcoin.

Also Read: Bitcoin Whale Activity, Germany’s $3 Billion BTC Holdings on Radar

Bitcoin ETF Outflow

The U.S. Spot Bitcoin ETF has continued to witness significant outflows over the past few days. After a robust inflow noted over the last few weeks, the momentum seems to have faded in recent days.

On June 20, the U.S. Spot Bitcoin ETF noted an outflow of nearly $140 million, led by GrayScale’s GBTC with $53.1 million outflux. This week, the total outflow totaled about $440 million through Thursday.

Bottom line

Bitcoin’s price faces continued pressure, as noted by prominent crypto analyst Rekt Capital. Despite recent attempts to recover, Bitcoin encountered a strong rejection from the Lower High resistance, suggesting the cryptocurrency isn’t ready to break its June downtrend. In other words, Rekt Capital anticipates more decline in Bitcoin price, indicating a dip towards $60,000, before a further reversal.

Source: Rekt Capital, X

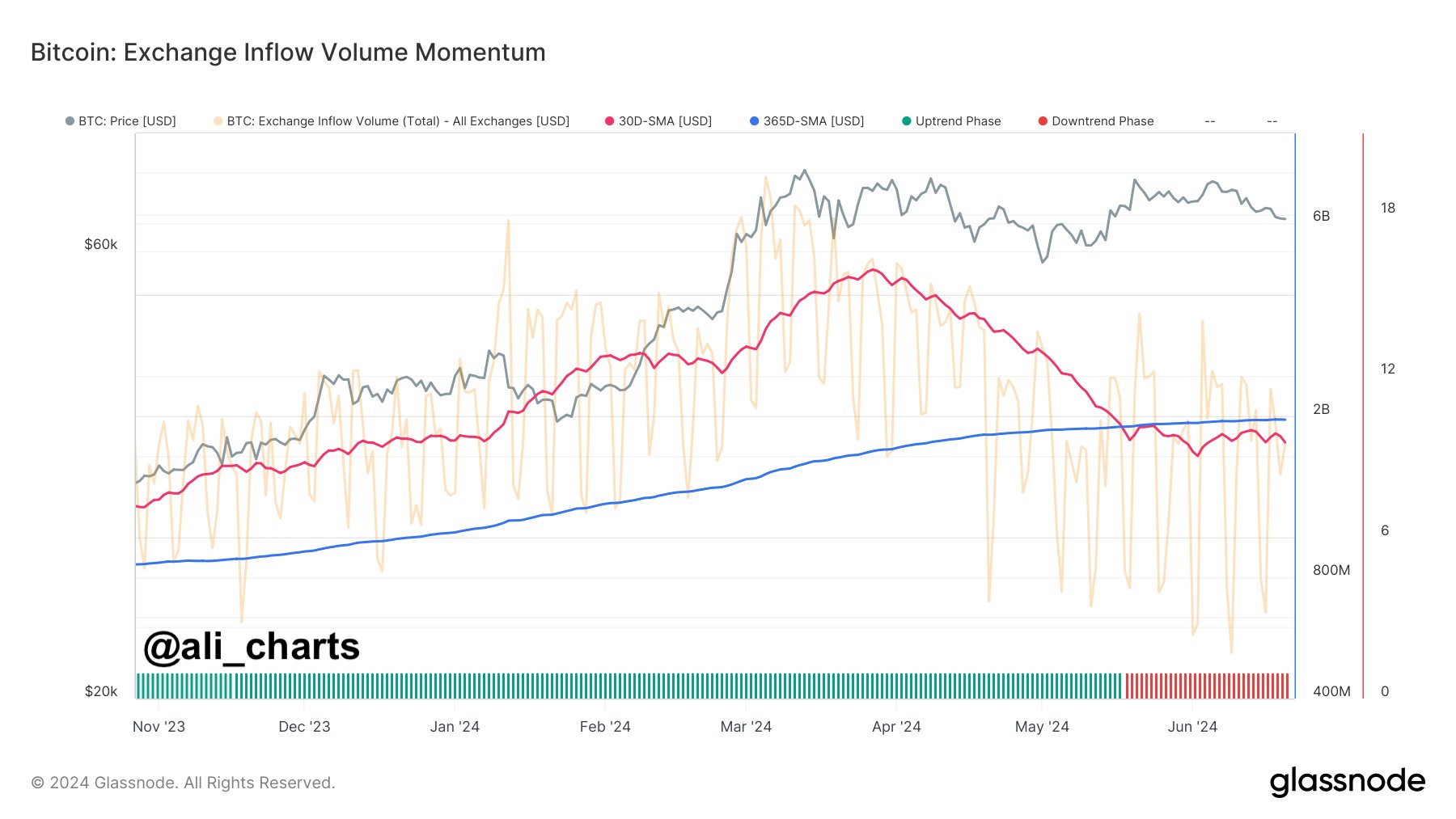

Source: Rekt Capital, XSimilarly, analyst Ali Martinez observed a downturn in exchange-related on-chain activity, highlighting reduced investor interest and network usage. This decline in activity further signals that Bitcoin might remain subdued until market sentiment shifts and activity picks up again.

Source: Ali Martinez, X

Source: Ali Martinez, XBoth analysts suggest monitoring these resistance levels and on-chain metrics closely for signs of a trend reversal in the near future. Besides, Ali Martinez has previously said that if Bitcoin fails to stay above $66,254, BTC could see a potential correction to $61,000.

As of writing, Bitcoin price fell nearly 3.6% and traded at $63,5887.92, while its trading volume rose 31.74% from yesterday. Besides, the Bitcoin Futures Open Interest plummeted 1.95% over the last 24 hours and 0.75% in the four-hour time frame to 532.30K BTC or $34.05 billion.

Also Read: Binance Enables USDT Integration on TON Network, TON Price Rally Ahead

The post Top 3 Reasons Why Bitcoin Price Crashing Towards $60K appeared first on CoinGape.

.png)

6 months ago

12

6 months ago

12

English (US)

English (US)