ARTICLE AD BOX

Renowned crypto journalist Colin Wu predicts several key projects from various sectors are gearing up for their token generation events (TGEs) in the second half of 2024.

Wu’s list comprises multiple categories, including staking, restaking, and liquid staking, among others.

Babylon and Symbiotic: Top Staking and Restaking Projects with Potential TGE

One project that stands out from Wu’s potential TGE list is Babylon, a prominent player in the Bitcoin staking protocol sector. Recently, the protocol launched a new testnet phase, Cap 3, featuring a fee adjustment mechanism. This milestone follows Babylon’s impressive $70 million funding round, backed by major investors like Binance Labs and Paradigm.

Read more: What Is Liquid Staking in Crypto?

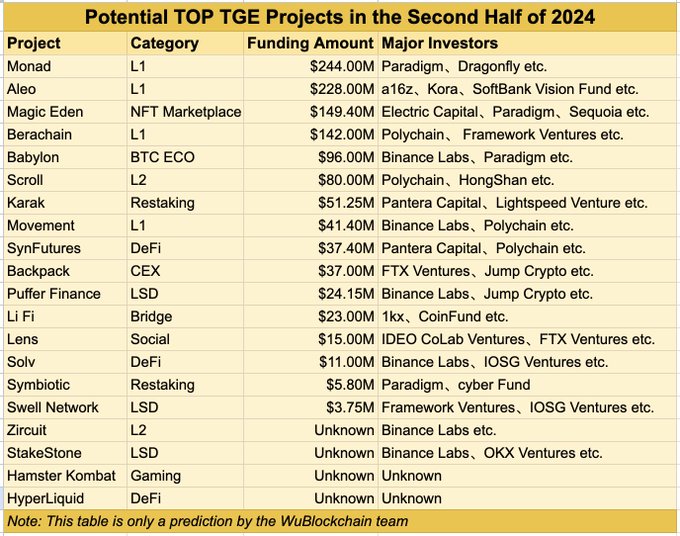

Top Crypto Projects with Potential TGEs in H2 2024. Source: X/WuBlockchain

Top Crypto Projects with Potential TGEs in H2 2024. Source: X/WuBlockchainFor the restaking projects, Wu includes Karak and Symbiotic in his potential TGE list. Notably, Karak has garnered $51.25 million from notable investors such as Pantera Capital and Lightspeed Venture. Meanwhile, Symbiotic has backing from Paradigm and Cyber Fund.

Puffer Finance, Swell Network, and Stake Stone lead the charge in the liquid staking derivatives (LSD) sector. Wu noted that Puffer Finance has secured $24.15 million with backing from Binance Labs and Jump Crypto. Additionally, with $3.75 million in funding from Framework Ventures and IOSG Ventures, Swell Network seeks to unlock liquidity and boost staking rewards.

StakeStone also sets itself as a promising LSD project, with support from Binance Labs and OKX Ventures. The project aims to revolutionize the LSD space with solutions that enhance staking liquidity and rewards. Although detailed information about StakeStone’s funding and features remains scarce, its inclusion in Wu’s list highlights its potential.

Experts have noted staking and restaking, particularly liquid staking and liquid restaking, as the next big crypto narratives in 2024. An April report by Coinbase highlighted that restaking could reshape validator incentives, potentially unlocking new opportunities and introducing complex risks. Therefore, the crypto community would highly anticipate the TGE of these staking-related projects due to their potential to reshape the decentralized finance (DeFi) ecosystem.

Despite the optimism of these tokens’ potential TGEs, it is worth noting that venture capital firms back some of the aforementioned projects. Venture capital firms often “exit” their investments in crypto startups after they have appreciated over time to realize returns.

In crypto, exits also happen through token launches, which are harder to quantify but represent many VC liquidity events. Several major crypto projects have been labeled as being “VC controlled” through their tokenomics.

Additionally, a recent finding by pseudonymous crypto researcher Flow revealed that over 80% of tokens listed on Binance have dropped in value since their listing over the past six months. Interestingly, these new listings are tokens supported by top-tier venture capital firms and introduced at high valuations.

Read more: Ethereum Restaking: What Is It And How Does It Work?

“More often than not, tokens launching on Binance are not investment vehicles anymore – all their upside potential is already taken away. Instead, they represent exit liquidity for insiders who capitalize on retail lack of access to quality early investment opportunities,” Flow stated.

The post Top 6 Staking, Restaking, and Liquid Staking Projects with Potential TGEs in H2 2024 appeared first on BeInCrypto.

.png)

4 months ago

14

4 months ago

14

English (US)

English (US)