ARTICLE AD BOX

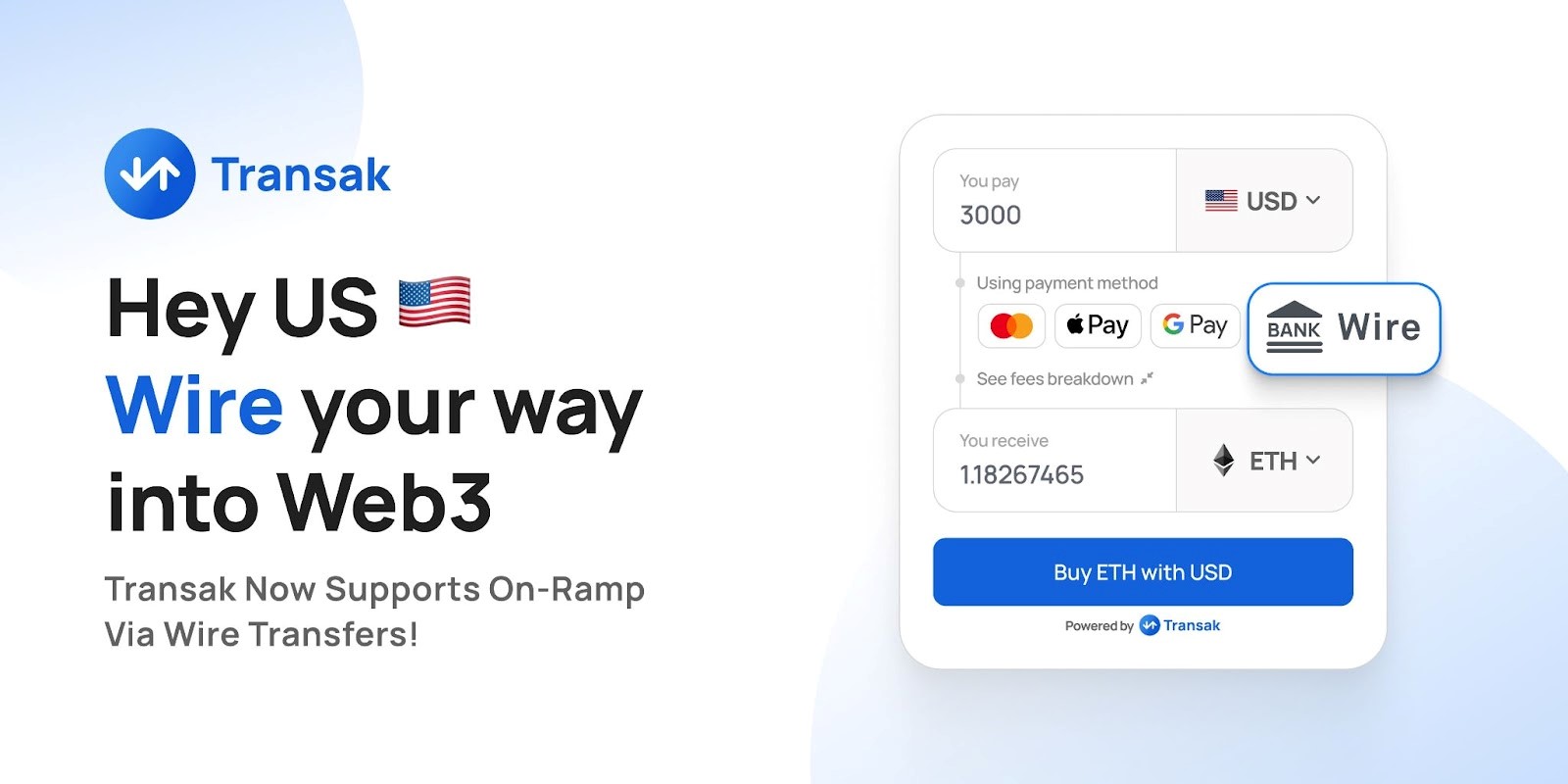

Leading Web3 payments infrastructure provider Transak has officially introduced wire transfers as a new payment option for US customers to buy cryptocurrency. For crypto aficionados throughout the country, the addition of wire as a payment option for purchases is a significant step toward improved accessibility and convenience.

Transak has redefined user choice and freedom by becoming the first and only fiat-to-crypto on-ramp to allow this payment option.

Wire transfers were added by Transak to provide more flexible payment options, enhancing the customer experience overall. Transak wants to make sure that everyone can find a comfortable way to conduct cryptocurrency transactions by supporting universal accessibility across a range of currencies and payment methods. Wire transfers are often associated with bank transactions for customers in the United States, therefore this innovation fits in well with their financial practices.

Notably, Transak wire transfers have already shown to be a popular choice for high-value transactions. With a $2,000 minimum order requirement, wire transfers have an average order value that is 16 times larger than other payment options on the platform. This contrast emphasizes how wire transfers may make large cryptocurrency investments possible.

Since its launch, wire transfers have attracted a lot of attention from Transak’s partner network; 13 partners, including Binance.US, have joined.

The affordability of wire transfers on Transak is among its most alluring features. For a little 1% charge, wire transfers are a much more cost-effective choice when considering US payment options like credit cards and Apple Pay.

Yeshu Agarwal, Co-Founder, Transak stated:

“Being the first to offer wire transfers for crypto purchases is a significant milestone for Transak. This achievement reflects our commitment to innovation and providing our users with more convenient and secure payment options. We’re thrilled to lead the way in expanding accessibility and enhancing the user experience in the crypto space.”

Transak has made sure that a wide range of US consumers may easily access wire transfers. As long as they fulfill the $2,000 minimum transaction requirement, anybody who has completed level 2 KYC verification on the platform may use this payment method to buy cryptocurrencies valued up to $25,000 per day.

Why Transak is the Only On-Ramp Provider of Wire Transfer Support

Handling Difficult Processes

Complex procedures must be followed in order to implement wire transfers for cryptocurrency transactions, from managing bank transfers to guaranteeing precise money reconciliation. This is not a simple undertaking; it calls for a thorough and drawn-out product development procedure. Transak has shown its dedication to delivering a flawless customer experience by devoting a substantial amount of work to developing a comprehensive system that guarantees smooth money movement.

Preferred for High-Value Transactions

Because bank transfers are user-friendly and safe, they are often the method of choice for high-value transactions. When compared to alternative payment options like as cards and Apple Pay, bank transfers yield four times the transaction volume, according to data from Transak’s UK operations. Realizing this, Transak brought wire transfers to the US market, providing customers with a dependable and accustomed mode of payment.

Customized Geographic Expansion

The incorporation of wire transfers is a strategic move that aligns with Transak’s goal of global expansion. It is especially designed to serve areas where this mode of payment is extensively used and practical for large-scale transactions. This step is in line with Transak’s objective of expanding its payment choices by making big transactions easier and more affordable for consumers.

Elevated Intent and Strengthened Security

All payment methods have robust security features, but since wire transfers need a high level of purpose, they are especially safe. Layers of verification are added throughout the multi-step process of adding beneficiaries, transferring payments, and authorizing transactions. This intricacy considerably lowers the possibility of fraud while also enhancing the method’s security.

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)