ARTICLE AD BOX

The UK Law Commission has published a consultation paper proposing that ‘crypto-tokens and cryptoassets’ fall under a new category of property. The paper follows an initial report sent to the government in June 2023 as UK crypto regulations evolve.

The UK Law Commission says that crypto can be accommodated in the common law system of England and Wales if it is recognized as a third category of property.

UK Considers Technical Aspects

The Commission says that a new category of personal property could ‘better recognize, accommodate, and protect the features of digital assets.’ It suggests that courts enlist an industry panel to decode new crypto intricacies to ensure that the legal system responds sensitively ‘to the complexity of emerging technology.’ It also recommends that a multi-disciplinary team help market participants better protect their assets.

The Commission first recommended a ‘digital objects’ category to complement two other property categories last June.” This recommendation came after Prime Minister Rishi Sunak to assess the suitability of current laws. Before becoming Prime Minister, Sunak said he wanted to make the UK a crypto hub.

The new legislation seems geared in part to fulfill those ambitions. The Commission said such in a summary of its latest proposal.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

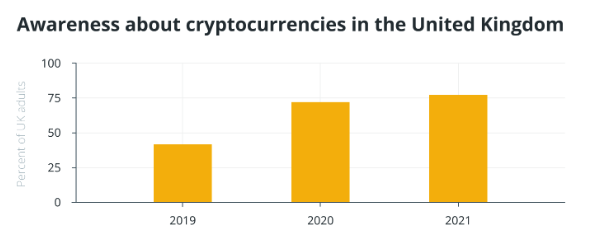

Awareness of cryptocurrencies in the UK | Source: UK FCA

Awareness of cryptocurrencies in the UK | Source: UK FCA“Our recommendations also support the Government’s goal of attracting technological development to cement the position of England and Wales as a global financial hub for crypto-tokens and crypto-assets,” the government body said.

So far, the UK has several crypto firms registered in the region. These include Archax, Ziglu, Gemini, Fidelity Digital Assets, and Zodia Custody.

How the UK is Advancing Crypto Regulations

The new draft legislation adds another piece to the UK’s crypto regulations. The UK already treats crypto trading as a regulated financial activity, following the royal assent to the Financial Services and Markets Bill last year. Later, rules from the Financial Conduct Authority demanded that crypto advertisers only market through authorized companies.

Economic Secretary to the Treasury, Bim Afolami, hopes to fast-track stablecoin and crypto staking regulations over the next six months. Regulators in South Africa, the US, and Hong Kong could also table new stablecoin regulations this year. Bank of England Governor Andrew Bailey said last year that comprehensive regulations could arrive by April 2024.

In the meantime, the Bank of England has struggled to find a value proposition for a central bank digital currency. Its proposal that ‘Britcoin’ deposits would not earn interest at banks and planned limits on how much each household and person can hold has failed to convince UK citizens.

Read more: What is Distributed Ledger Technology?

That indifference, coupled with recent economic contractions and the developing crypto regulations, could see the region’s CBDC ambitions falter. BeInCrypto has reached out to the UK’s Financial Conduct Authority, the expected watchdog for the crypto industry, but has yet to hear back at press time.

The post UK to Label Crypto as Property: What Does It Mean? appeared first on BeInCrypto.

.png)

8 months ago

2

8 months ago

2

English (US)

English (US)