ARTICLE AD BOX

A recent UN report casts a stark light on the cryptocurrency giant, Tether, revealing its significant role in Southeast Asia’s crypto crime wave. Amid this concern, Tether’s market cap has soared, nearing a monumental $100 billion and securing a dominant 73% market share.

Tether’s position in the crypto sector has always been paradoxical and contentious. As a stablecoin pegged to the US dollar, it offers fluidity for traders to move in and out of cryptocurrency trades with ease.

UN Puts Tether on Blast for Role in Cyber Crime

It is this very characteristic, however, that has also made it a tool of choice for money launderers and fraudsters in Southeast Asia, as highlighted by the UN’s Office on Drugs and Crime. The report details Tether’s involvement in “pig butchering” scams. This refers to a deceitful strategy where false romantic connections are used to trick victims into transferring large sums of money.

The appeal of Tether to criminal enterprises is rooted in its capacity for fast, irreversible transactions. This feature is particularly exploited in illegal online gambling platforms, now a common vehicle for cryptocurrency-based money laundering.

The report underscores the sophisticated use of Tether in these high-speed laundering operations.

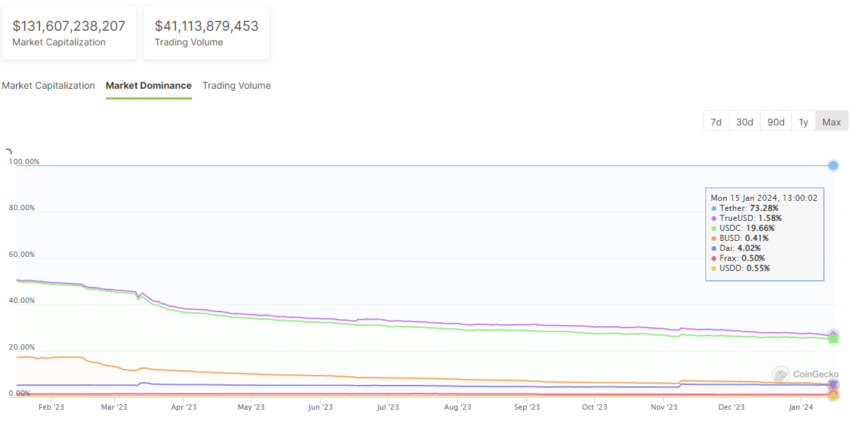

Despite facing regulatory challenges and scrutiny, Tether’s market dominance remains unshaken. It significantly overshadows its closest competitor, Circle’s USDC stablecoin, which boasts a market cap of $25.5 billion.

Tether Leads USD Stablecoins by Market Share. Source: CoinGecko

Tether Leads USD Stablecoins by Market Share. Source: CoinGeckoThis disparity underlines Tether’s entrenched position, even as it navigates through various legal and ethical quandaries.

Tether Takes Steps Toward Compliance and Transparency

In 2021, Tether grappled with allegations from the US Commodity Futures Trading Commission over misleading statements regarding its dollar reserves, culminating in a $41 million fine.

Recognizing the need for tighter control, Tether has since collaborated with US authorities to curb the illicit use of its token. This initiative has led to a notable increase in blacklisted Tether wallets, as reported by industry data provider CCData.

Number of Blacklisted Tether Wallets by Year. Source: CCData / FT

Number of Blacklisted Tether Wallets by Year. Source: CCData / FTThe UN report’s revelations about Tether’s involvement in financial crimes and its unwavering market growth paint a complex picture. While Tether continues to be a cornerstone in the crypto market, its use in criminal activities poses significant concerns. These developments highlight the urgent need for more robust regulatory frameworks and international cooperation to tackle the challenges.

Overall, Tether’s story is a reminder of the dual nature of cryptocurrencies. While they revolutionize financial transactions, they also open up new avenues for criminal activities.

Read more: 7 Best Crypto Wallets to Store Tether (USDT)

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

The post UN Report: Tether Leads in Asia’s Crypto Crime Wave as Market Share Hits 73% appeared first on BeInCrypto.

.png)

10 months ago

4

10 months ago

4

English (US)

English (US)