ARTICLE AD BOX

The post Uniswap (UNI) Price Set for 30% Surge? Key Levels to Watch appeared first on Coinpedia Fintech News

UNI, Uniswap’s native token, appears bullish and is poised for massive upside momentum after a prolonged price decline and bearish market trend. This shift in sentiment occurred as the overall crypto market began experiencing a price reversal and forming bullish price action.

Uniswap (UNI) Technical Analysis and Upcoming Levels

According to expert technical analysis, UNI appears to be forming a bullish double-bottom price pattern on the daily timeframe. So far, UNI’s daily chart has shown two bottoms, but the asset is still in the process of forming the second leg of the pattern.

In addition to this bullish pattern, UNI has also formed a bullish divergence, where its Relative Strength Index (RSI) is making a higher low, signaling a potential price reversal.

Source: Trading Vieew

Source: Trading VieewBased on recent price action and historical patterns, if UNI holds above the $5.75 level, there is a strong possibility it could initially soar by 15% to reach the neckline of the double-bottom pattern at $7.15. However, if this bullish momentum continues and UNI breaches the neckline, closing a daily candle above $7.15, it could rally another 15%, reaching the $8.25 level in the future.

UNI’s Current Price Momentum

At press time, UNI is trading near $6.21 and has gained over 4% in the past 24 hours. However, during the same period, due to reduced interest from traders and investors, the asset’s trading volume dropped by 25% compared to the previous day.

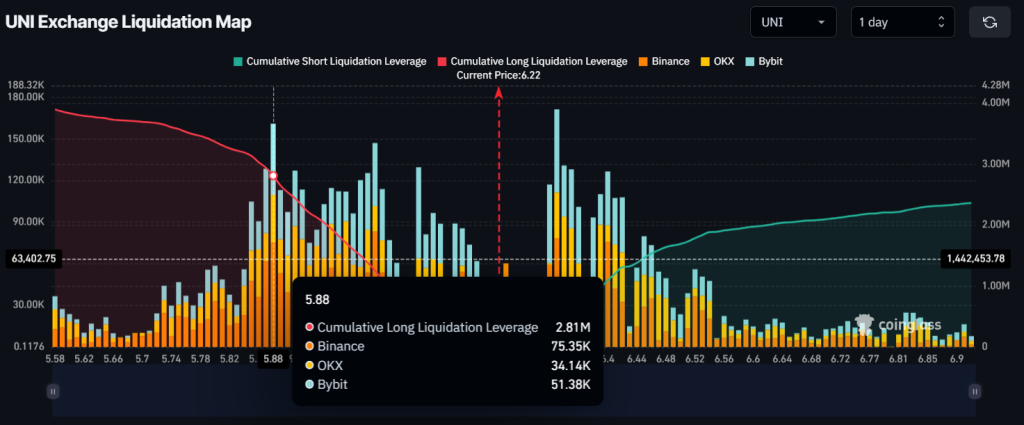

$2.80 Million Worth Long Position

With this bullish market outlook, intraday traders appear to be following the same momentum, as reported by Coinglass data.

Source: Coinglass

Source: CoinglassThe UNI exchange liquidation map revealed that traders are currently over-leveraged at $5.88 on the lower side and $6.33 on the upper side, with $2.81 million and $400K worth of long and short positions, respectively.

This strong and massive bet on the long side reveals traders’ bullish market sentiment.

.png)

1 day ago

3

1 day ago

3

English (US)

English (US)