ARTICLE AD BOX

The possibility of a Bitcoin ETF approval in the US triggers widespread speculation on Bitcoin’s future. The potential green light for a Bitcoin ETF stands at a promising 90%, sparking diverse price predictions and market expectations.

Institutional Entry and Exchange Evolution

The impact of a Bitcoin ETF goes beyond price predictions, poised to transform institutional engagement and crypto exchange operations. The ETF’s approval may present a seamless avenue for institutions to enter the crypto sphere, revolutionizing market liquidity and dynamics.

Predictions Galore: Bitcoin’s Price Outlook

Projections regarding Bitcoin’s price post-ETF approval range from conservative estimates to exuberant surges, reflecting diverse expert opinions and market dynamics.

The cryptocurrency sphere buzzes with anticipation as the possibility of a US-approved Bitcoin ETF looms. Analysts project that such a move could significantly influence Bitcoin’s valuation, with predictions ranging from conservative to incredibly bullish.

If approved, a spot Bitcoin ETF could mark a fundamental shift in institutional involvement in cryptocurrency. This regulatory green light would pave a compliant path for US companies, potentially attracting significant trading firms and enhancing market dynamics and liquidity.

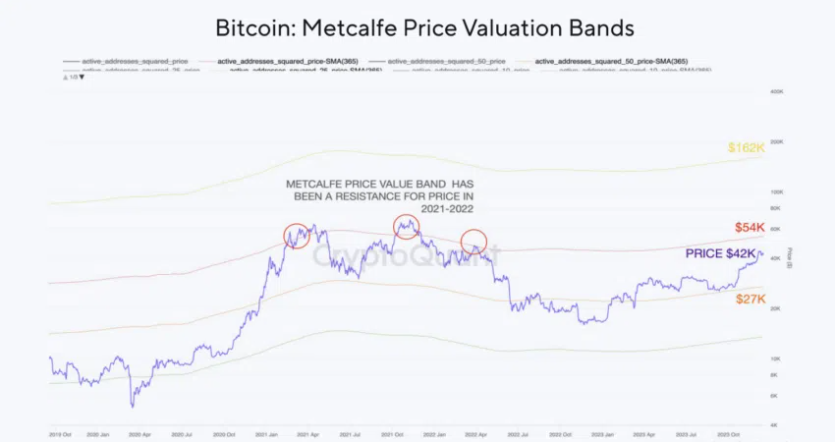

Source: CryptoQuant

Source: CryptoQuantMoreover, an ETF introduction might prompt a restructuring of cryptocurrency exchanges, driving competition and cost efficiency in trading. The prediction of unlocking advised wealth worth $30 trillion for Bitcoin signifies a vast potential investor base previously unable to engage in Bitcoin.

Price forecasts post-ETF approval vary widely. Conservative estimates hover between $42,000 and $100,000, while more optimistic projections reach heights of $160,000 to even $1 million. These forecasts are shaped by various factors, including institutional inflow and supply considerations.

While some experts predict a surge to $100,000, others, like CryptoQuant, anticipate Bitcoin surpassing $160,000, citing increased demand from multiple ETFs, the Bitcoin halving event, and broader market trends.

Amid these varied predictions, caution remains paramount. The speculative nature of these forecasts emphasizes the need for thorough research and prudence, considering the cryptocurrency market’s inherent volatility and the unpredictability of regulatory decisions.

.png)

1 year ago

10

1 year ago

10

English (US)

English (US)