ARTICLE AD BOX

Trading volume for USDC stablecoin has soared to $23 billion a year. This growth comes amid a growing demand for transparency as traders gravitate towards regulated stablecoin alternatives.

MiCA framework’s implementation was an important development, with qualified stablecoin issuers receiving a fully revamped manual.

USDC Leads Demand For Regulated Stablecoins With $23 Billion Trading Volume

A Kaiko report indicates that the weekly trading volume for Circle’s USDC stablecoin has surged in 2024. This more than doubles the $9 billion recorded last year and nearly five times the $5 billion seen in 2022.

The growth in trading volume has propelled USDC to challenge the 14% market share that the reserve-backed stablecoin First Digital USD (FDUSD) boasts. Based on the report, centralized exchanges (CEX) account for most of these volumes, compared to decentralized (DEX) alternatives.

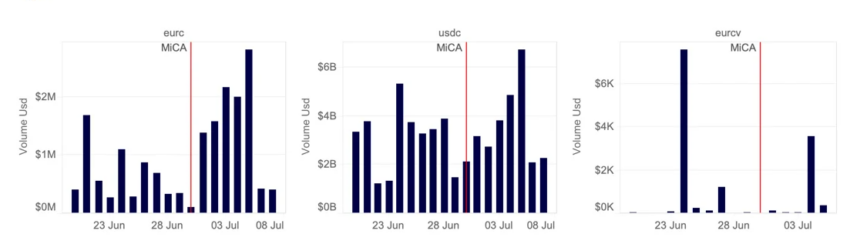

According to the report, USDC and its sister, the Euro-denominated EURC stablecoin, have witnessed the strongest daily trading volume since June 30, when the first part of the MiCA framework went into effect in the European Union.

SocGen’s Euro CoinVertible (EURCV) stablecoin also saw significant volume. However, it was not as much as the EURC, given it is only available on Bitstamp exchange.

MiCA Compliant EUR Stablecoin, Source: Kaiko Report

MiCA Compliant EUR Stablecoin, Source: Kaiko ReportNotable volume upticks, coupled with the role of CEXes in driving the interest, suggest a growing interest in compliant stablecoins. This is compared to their non-compliant counterparts, which currently dominate the market with 88% of total stablecoin volume. Nevertheless, the report alludes to the possibility of MiCA turning the tables in favor of the compliant stablecoins.

“The share of compliant stablecoins has increased over the past year, suggesting increased demand for transparency and regulated alternatives. So far, this trend has mostly benefited USDC,” an excerpt in the Kaiko Research read.

Also Read: What Is Markets in Crypto-Assets (MiCA)? Everything You Need To Know

MiCA Framework Could Shift the Balance in Favor of Compliant Stablecoins

The MiCA framework’s implementation in Europe on June 30 was a landmark development in the stablecoin market. With its implementation, stablecoin issuers received a fully revamped manual with specific requirements like “whitepaper publication, governance, reserves management, and prudential standards.”

Circle secured an Electronic Money Institution (EMI) license on July 1, a day after MiCA implementation. EMI license is a requirement for any issuer looking to offer dollar- and euro-pegged crypto tokens in the EU. It permits the firm to “onshore” its Euro-denominated EURC stablecoin to customers within the bloc.

Indeed, MiCA compliance is driving the popularity of the USDC stablecoin. The stamp of trust provides more tailwinds for more usage of the stablecoin for perpetual futures settlement, Kaiko Research noted. Institutional investors, for instance, who have their own compliance requirements when participating in derivatives markets, may look to such thresholds when exploring stablecoin choices.

“USDC’s market share in these perpetual markets is just a fraction of USDT’s. Its growing usage for perpetual settlement speaks to investors’ changing preferences as stablecoin regulations come into effect.”

A webinar hosted by SOLIDUS LABS indicated that the second part of the framework would address the prevention and prohibition of market abuse. It will be fully applicable by December 30, 2024. To navigate these regulatory changes successfully, engaging in proactive preparation, establishing strong internal policies, and implementing sophisticated surveillance systems will be critical.

Jeremy Allaire said the two stablecoins are primed to thrive under the new framework based on the firm’s compliant track record. According to the Circle CEO, this record of accomplishment positions both stablecoins for more success in the stablecoin market.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

USDC’s main market rival in the stablecoin market, Tether’s USDT, is not EMI-licensed. Its CEO, Paolo Ardoino, is still unconvinced by MiCA’s expectation of 60% backing in bank cash.

The post USDC Leads Regulated Stablecoins with $23 Billion Volume appeared first on BeInCrypto.

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)