ARTICLE AD BOX

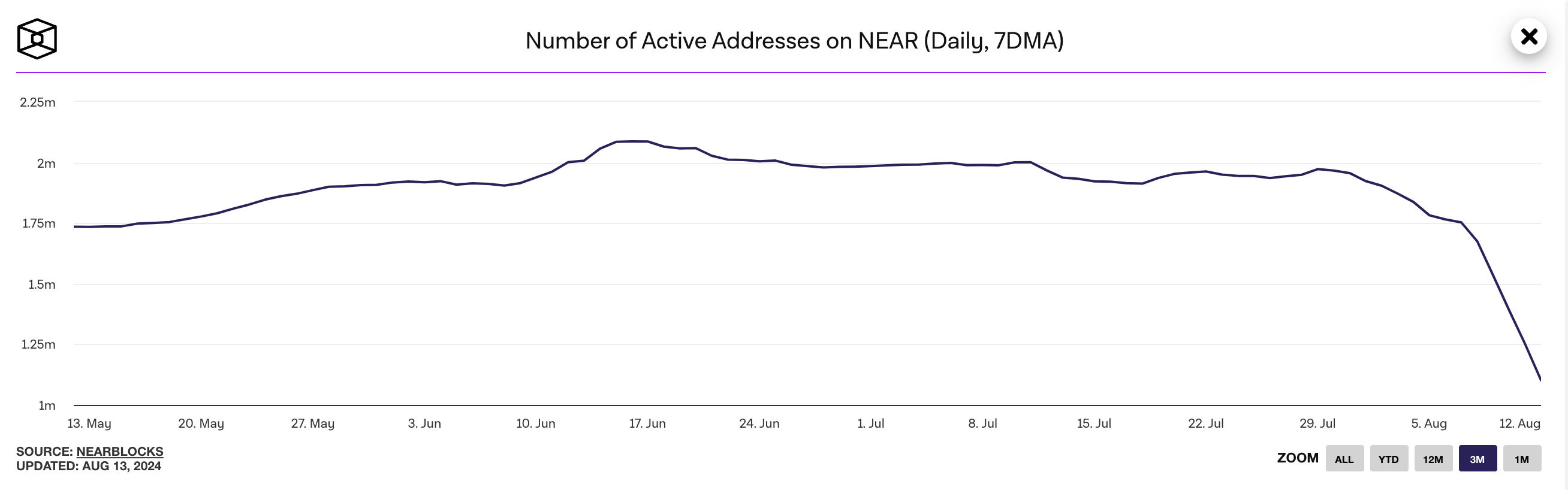

The network demand for Layer-1 (L1) blockchain Near Protocol (NEAR) has dropped to its lowest level since March. On-chain data shows a steady decline in daily active addresses and transaction counts on the network since late July.

Similarly, NEAR, the network’s native coin, is facing bearish pressure, making a significant price rally unlikely in the near term.

Near Sees User Exodus

The daily count of unique addresses transacting on the Near Protocol began to drop on July 30. It peaked at 2 million addresses that day and has fallen by 43%.

A natural implication of fewer users on a network is a resulting decline in its transaction count. Assessed using a seven-day moving average, the daily number of transactions on the NEAR blockchain has fallen by 36% in the past month.

Near Daily Active Addresses. Source: The Block

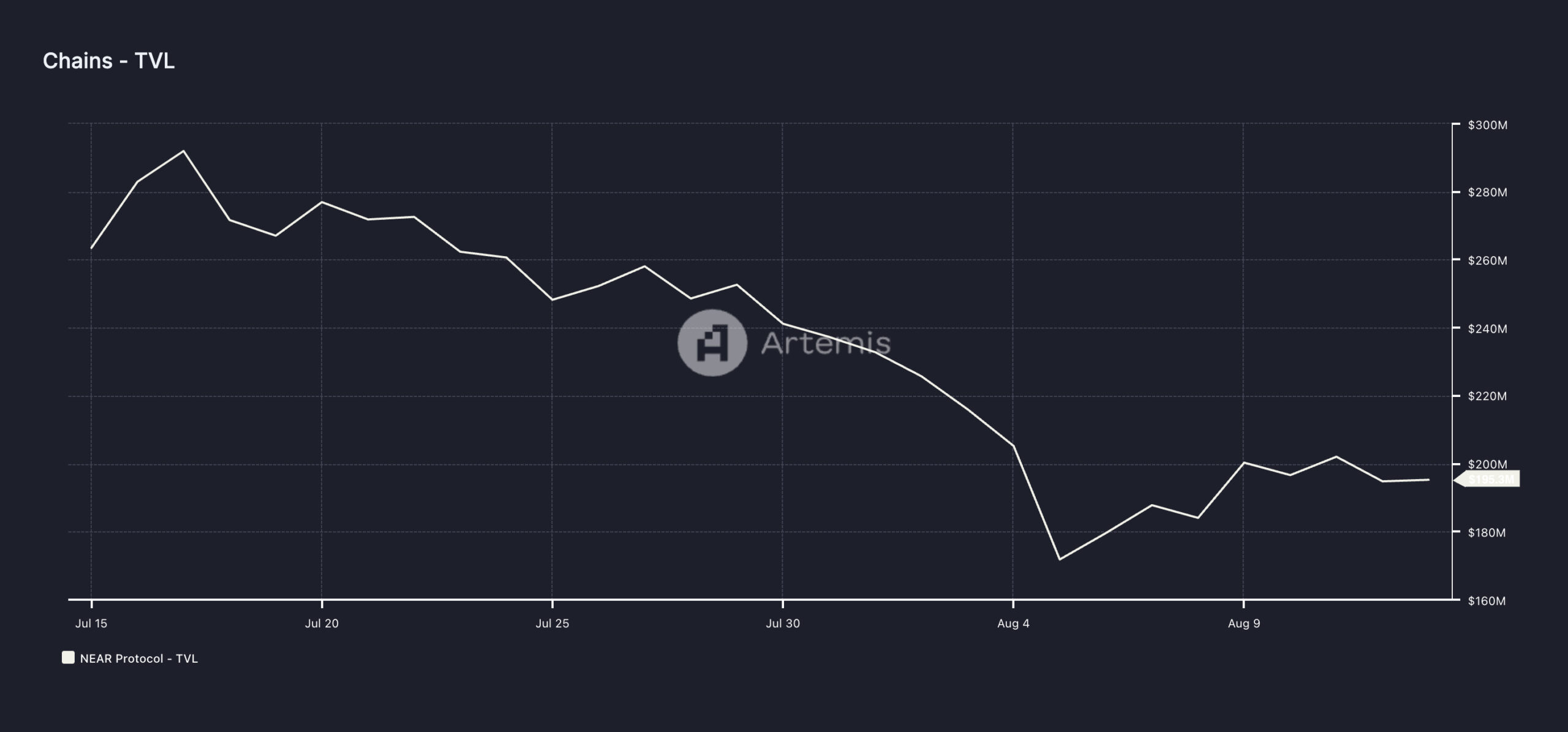

Near Daily Active Addresses. Source: The BlockThe drop in user activity on the Near protocol is reflected in the declining total value locked (TVL) within its decentralized finance (DeFi) ecosystem.

Since July 17, Near’s TVL has steadily declined, hitting a five-month low of $172 million on August 6. While the TVL has since rebounded to $206 million, it still represents a 26% drop over the past 30 days.

Read more: What Is NEAR Protocol (NEAR)?

Near Total Value Locked. Source: Artemis

Near Total Value Locked. Source: ArtemisAdditionally, activity across the decentralized exchanges (DEXes) housed within the L1 has also been reduced. Artemis’ data shows this has fallen 54% over the past 30 days.

Due to the low demand for Near, its fees and the revenue derived from the same recently fell to seven-month lows. On August 11, the total fees for using Near fell to $11,000, while network revenue was $9,000. These figures represent the protocol’s lowest since February 10.

NEAR Price Prediction: Roadblocks Lie Ahead

As of this writing, NEAR trades at $4.26. Although the coin’s price has surged by double digits in the past seven days, it may be unable to extend these gains.

On a one-day chart, NEAR’s price movements show that the altcoin is trading below its Ichimoku Cloud. The Ichimoku Cloud helps identify trend direction, gauge momentum, and determine critical levels for an asset.

When an asset’s price drops below the cloud, the market trend turns bearish. Trading below the cloud suggests that the price is under both short-term and long-term averages, indicating weakness in the trend.

Read more: Which Are the Best Altcoins To Invest in August 2024?

NEAR Price Analysis. Source: TradingView

NEAR Price Analysis. Source: TradingViewIf NEAR falls further below these key levels, its next price target is $3.07, representing a 28% drop from its current price level. However, if the altcoin rallies past the “cloud,” it may trade at $5.30.

The post User Activity on Near (NEAR) Falls to Multi-Month Low appeared first on BeInCrypto.

.png)

3 months ago

2

3 months ago

2

English (US)

English (US)