ARTICLE AD BOX

- VegasMorph proposes to burn 8 million USTCs of Terra Luna Classic to align with community deflation targets.

- Price drop in LUNC and USTC following proposal; community seeks stability and confidence in crypto market.

VegasMorph, an influential Terra Luna Classic member, proposes a drastic measure: burn all 8 million TerraClassicUSD (USTC) from the community pool. This idea comes in parallel to the discussion of burning 800 million USTC from the Risk Harbor Multisig purse, a proposal also pushed by VegasMorph.

Reasons Behind the Burn Proposal

The strategy is to burn approximately 8 million USTC, sending it to a burn address through a spending proposal. The community pool currently holds 7.95 million USTC, according to StakeBin.

The goal is to use these USTCs, which are not essential for current community projects, to reduce the circulating supply. In turn, the community has 3.3 billion LUNC, ensuring sufficient resources for future activities.

VegasMorph Vision: Engagement and Responsible Management

VegasMorph emphasizes the importance of this action

“Burning this amount of USTC reflects our dedication to self-sufficiency and prudent resource management. This initiative goes hand-in-hand with our deflation goals and highlights our proactive approach to the development of Terra Luna Classic.”

Challenges and Opportunities: Rejecting the 800 Million USTC Burn

The community, on the other hand, has rejected the idea of burning 800 million USTCs, seeking more viable alternatives for the reduction of these stablecoins. It was recently revealed that Risk Harbor lost access to its wallet, which has sparked a debate about the management and security of the funds.

Market Impact: LUNC and USTC Price Analysis

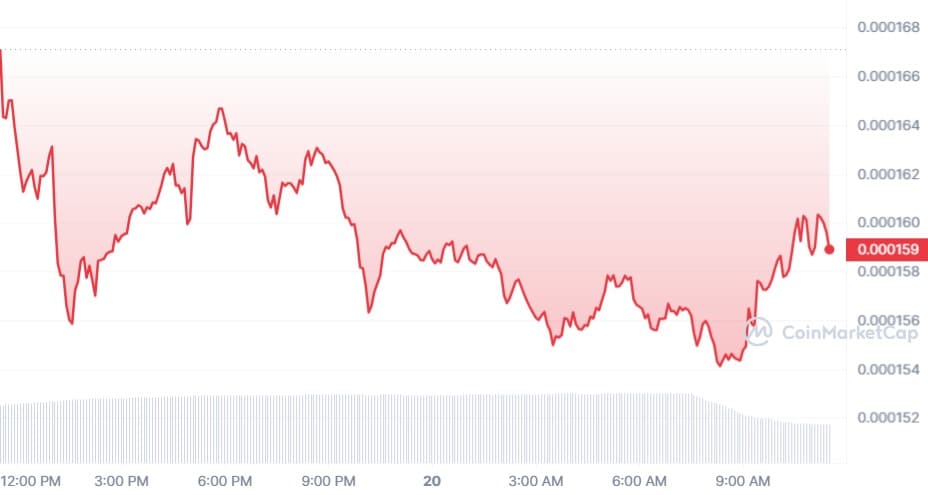

LUNC’s share price has experienced a 3% drop in the last 24 hours, settling at $0.000159.

Coinmarketcap: LUNC- 1D – graph

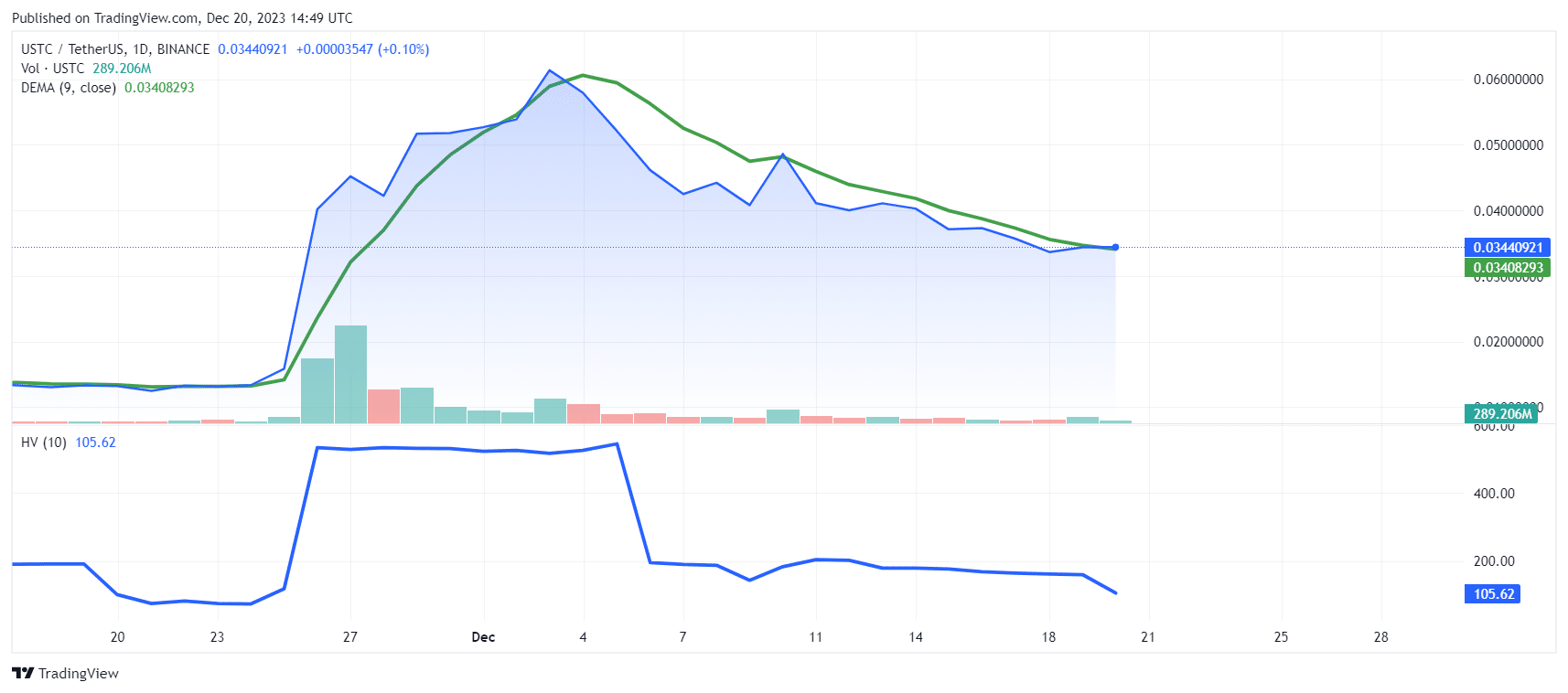

Trading volume, however, has climbed 141%. On the other hand, USTC shows a 6% decline, trading at $0.0334, after declining 15% the previous week.

Tradingview: USTCUSDT – 2023-12-20

- Historical Volatility (HV): The historical volatility indicator (at the bottom) has had a steep drop recently. Historical volatility measures the dispersion of returns for a given period and a decline may suggest that the market is stabilizing after a period of more erratic price movements.

- Exponential Moving Average (EMD): EMD helps smooth out price movements to identify trends. In this case, the EMA is above the current price, which could suggest that the price is in a short-term downtrend.

- Technical Analysis: The convergence of the DEMA and the price line could be an indication of a possible trend reversal if the price crosses the DEMA and stays above it. However, since the price is below the DEMA and there is a visible downtrend, it could be an indicator that the market could continue in that direction in the short term.

what lies ahead for Terra Luna Classic?

The proposed USTC burn is a turning point for Terra Luna Classic. Although the price fluctuation reflects uncertainty, these measures could usher in an era of stability and confidence.

This action plan highlights the community’s focus on self-sufficiency and responsible management, key elements for recovery and empowerment in a dynamic and challenging market.

The global cryptocurrency community is watching closely as Terra Luna Classic navigates these changes, setting a precedent for crisis management and reinvention in the cryptocurrency world.

.png)

1 year ago

15

1 year ago

15

English (US)

English (US)