ARTICLE AD BOX

- VeChain (VET) has dropped 7.40% in a week and 24% in a month but remains up 12% year-over-year, showing mixed market signals.

- Analysts are split on VET’s future as it faces resistance at $0.0876, with open interest soaring 70% despite bearish sentiment.

VeChain (VET) is facing a turbulent market, declining 7.40% on weekly charts, with a 24% decline in the past month. Despite these drops, the asset has remained up 12% year-over-year since February 2024. While some analysts see the potential for a rebound, the broader market struggles to find momentum.

The overall crypto sector has yet to show any signs of recovery. Since the market slumped earlier this month, bearish pressure has pushed assets downward. VET is no exception, with investors growing cautious about the near-term outlook. A combination of macroeconomic factors, including geopolitical tensions and economic policy shifts, has influenced market sentiment.

Adding to the uncertainty, US President Donald Trump’s recent decision to impose additional tariffs on steel and aluminum spooked investors. The move and threats of tariffs on foreign goods made traders more hesitant about riskier assets like cryptocurrencies. The market reacted negatively, leading to further losses across multiple sectors.

Can VeChain Overcome $0.0876 Resistance?

VeChain is currently priced at $0.0342, showing a promising 7.42% daily gain. Analysts remain divided on whether this momentum will hold. Some predict a Wave 3 push could drive VET to $0.12 by April 2025, representing a massive 250% increase. The recent 62% retracement aligns with Elliott Wave theory, suggesting a foundation for a potential uptrend.

Source: Crypto_James

Source: Crypto_JamesIf bullish momentum is sustained, VET’s first key resistance will sit at $0.0876, a level that would mark a 156% increase from current prices. Several factors, including a broader crypto rally, geopolitical shifts, or institutional interest, could accelerate this growth. However, skeptics warn that the $0.07-$0.08 range has been a historical hurdle, with previous attempts failing to hold gains.

Macroeconomic factors will play a crucial role in determining VET’s trajectory. Inflation rates, Federal Reserve policies, and global liquidity conditions will likely impact investor sentiment. Meanwhile, Bitcoin’s performance remains a key indicator—if BTC surges past $100,000, altcoins like VET may follow suit.

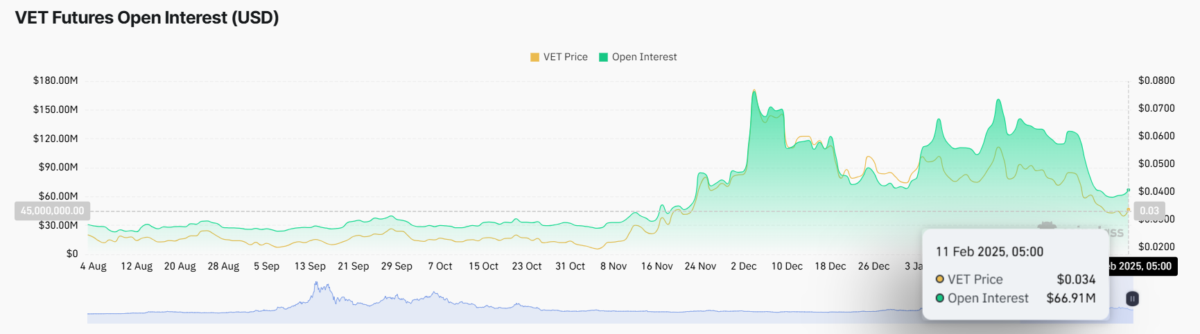

VET Open Interest Soars 70% in 3 Months

VET futures open interest has surged 70% in the last three months, reaching $66.91 million as of February 11, 2025, reflecting a bullish sentiment despite recent volatility. The VET price stands at $0.034, down from its December peak near $0.07. Open interest had hovered below $60 million before breaking out in late November.

Source: CoinGlass

Source: CoinGlassSince August, open interest has climbed from $30 million, more than doubling amid strong trading activity. The December peak saw open interest exceed $150 million, a sharp rise from November’s $60 million level. Price movements have mirrored this trend, hitting $0.08 before cooling off to the current level.

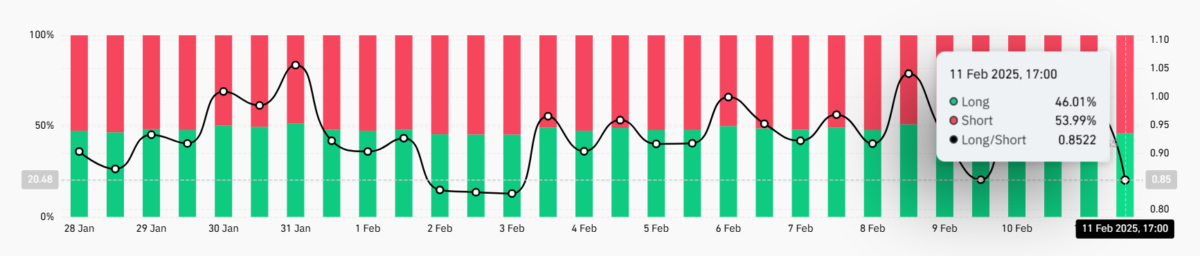

Source: CoinGlass

Source: CoinGlassDespite some optimism, the broader market positioning suggests caution. On February 11, 2025, at 17:00, short positions on VET jumped to 53.99%, outweighing long positions at 46.01%. The Long/Short ratio fell to 0.8522, indicating a prevailing bearish sentiment. This shift highlights increased skepticism among traders who hedge against further declines.

.png)

2 hours ago

4

2 hours ago

4

English (US)

English (US)