ARTICLE AD BOX

Venture capitalists have been reaping massive gains on a select group of altcoins. However, recent indicators suggest that these investors may be considering selling their holdings soon.

This outlook highlights the need for cautious optimism among token holders. While decisions to hold or sell the altcoins can significantly impact the overall profitability of these VCs, the ripple effect will likely extend to the other investors.

High Dump Pressure: VCs May Sell Altcoins with 1,100% Gains

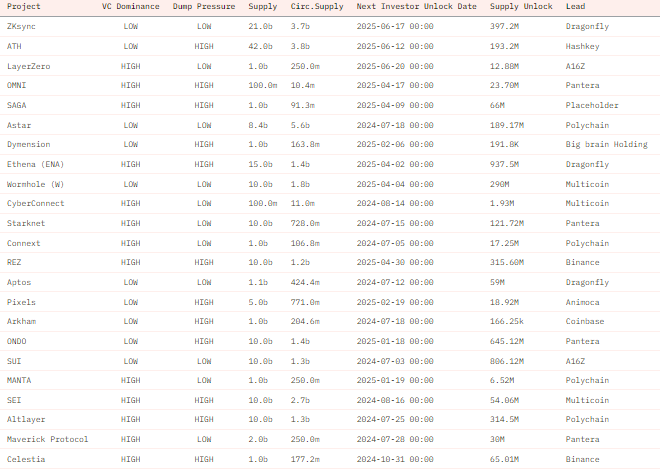

Ethereum Name Service (ENA), Renzo (REZ), Ondo Finance (ONDO), Dymension (DYM), Saga (SAGA), and Celestia (TIA) token holders could be treading on dangerous ground. The data platform Dune Analytics shows that VCs are sitting at 1,100% unrealized profit on these altcoins, creating high dump pressure.

A high dump pressure indicates strong selling sentiment in the market or perceived risks associated with altcoins. This could result in losses for token holders as the VCs reassess their investment strategies and consider rebalancing portfolios.

Read more: Best Crypto To Buy Now: Top Coins To Keep an Eye on in July 2024

VC Holdings. Source: Dune VC printer

VC Holdings. Source: Dune VC printerSpecifically, as dump pressure weighs heavy, they could diversify into other assets, adjust their risk exposure, or implement hedging. These strategies, which would protect them against market downturns, could affect token holders who are not forward-looking.

“There are better ways to make money in this market than to wait for the inevitable dump from high FDV/Low Market cap Tokens,” crypto researcher Emperor Osmo warned.

VCs typically invest in emerging crypto projects, which often see a significant increase in value during the altcoin season following Bitcoin’s peak.

Venture Capitalists Flock to 2024 Hot Narratives

A close look at the altcoins shows that they participated in some of the hottest narratives in 2024. Among them, ONDO was central the Real World Assets (RWA) narrative, with Congress gathering for tokenization talks. This year, the sector has gained mainstream attention. Crypto-focused companies, global bankers, and asset managers like BlackRock are leading this interest.

Ethereum Name Service has also been a hot topic in 2024. The protocol allows humans to use easy-to-remember domain names for their cryptocurrency addresses. As the future of Web3 takes center stage, ENS, built using Ethereum’s smart contracts, has recorded growing adoption. In tandem, open interest for the token rose to multi-year highs on Monday.

For REZ, a liquid staking token, interest in the Renzo protocol surged after crypto exchange Binance added it to Launchpool program. The staking narrative also played a part in Celestia, with TIA token price reacting to top crypto exchanges enabling token staking.

Read more: Which Are the Best Altcoins To Invest in July 2024?

On the other hand, SAGA, a GameFi Layer 1 blockchain token, came to the limelight with tailwinds from an airdrop campaign involving partnerships with over 100 projects.

Infrastructure firms attracting the most early-stage investments during hot sector seasons make sense. As the hype around these narratives eases, and with new themes coming up, VCs may identify new interesting projects to

The post Venture Capitalists Hold 1,100% Gains on These Altcoins, But They Might Dump Soon appeared first on BeInCrypto.

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)