ARTICLE AD BOX

Venture capital firms have invested over $90 million in related projects to show their belief in the fusion of artificial intelligence (AI) and blockchain.

These investments are part of a larger trend that reflects the increasing interest in leveraging the synergies between these two advanced technologies.

AI Innovation Gets a Boost: Compute Labs and Sentient Labs Secure Major Funding

Compute Labs, a Solana-based protocol focusing on GPU tokenization, recently announced a $3 million pre-seed funding round. Protocol Labs led the round, which included participation from notable investors, such as Blockchain Coinvestors, MH Ventures, and OKX Ventures.

The company plans to use the funds to expand its core project team and complete the development of its first round of GNFT vaults, which is slated for mid-July. These developments will further solidify the company’s position in the market and attract additional interest from investors.

Read more: AI in Finance: Top 8 Artificial Intelligence Use Cases for 2024

Compute Labs, incubated by NVIDIA Inception VC Alliance, aims to tokenize enterprise-grade GPUs. This mechanism will make them accessible to a broader range of investors through its GPU Restaking solution. Albert Z., founder and CEO of Compute Labs, highlighted the company’s mission to democratize access to these resources, enabling regular investors to participate in the computing economy.

Meanwhile, earlier this week, Sentient Labs, an AI startup that Sandeep Nailwal co-founded, raised $85 million from investors. Peter Thiel’s Founders Fund led this seed funding round, and Pantera Capital and Framework Ventures also participated.

Sentient Labs is developing an open-source platform that will enable developers to get paid for their contributions to emergent AI tools, such as chatbots and enterprise software. The company plans to launch a testnet for the Sentient platform in the third quarter, marking a significant milestone in its development.

The company aims to reward engineers for tasks such as labeling and refining data, which are crucial for training AI models. The platform is being built using Ethereum layer-2 (L2) Polygon software.

Investors Bet Big on AI-Blockchain Synergy

The success of these funding rounds signals continued interest in AI and computing infrastructure. It also reflects broader investor optimism about the potential of AI-blockchain projects to reshape the financial sector.

Cristian Mogodici, founder and CEO of Zaya AI, emphasized the transformative potential of combining AI and blockchain. He believes this combination significantly enhances the functionality and security of smart contracts. Additionally, Mogodici noted that blockchain’s decentralized architecture democratizes AI technologies, making them more scalable and accessible.

“These models benefit from the collective computational power of blockchain nodes, facilitating large dataset distribution and processing across the network. This collaborative approach enhances AI scalability and reduces dependency on centralized data centers, broadening AI resource availability. Moreover, blockchain’s transparency and immutability support ethical AI deployment. Recording AI decision-making on a blockchain ensures accountability and traceability, addressing AI biases and ethics concerns,” he elaborated to BeInCrypto.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

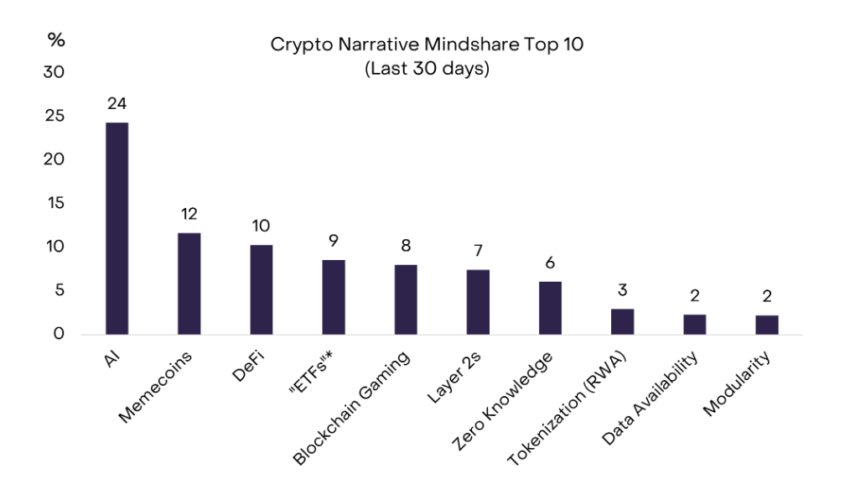

AI Dominates Crypto Market Theme. Source: Grayscale

AI Dominates Crypto Market Theme. Source: GrayscaleGrayscale’s latest report also highlights that AI has emerged as a pivotal theme in the industry, particularly in the Smart Contract Platforms and Utilities & Services sectors. Experts’ insights and these investments solidify the potential of the convergence of AI and blockchain. This combination fuels innovation, attracts significant investment, and drives market performance.

The post Venture Capitalists Pour Millions into AI-Blockchain Projects, Signaling Growing Optimism appeared first on BeInCrypto.

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)