ARTICLE AD BOX

This week, the crypto ecosystem has been filled with significant events, from Ripple’s large-scale XRP transfers to Binance’s delisting actions and Notcoin’s price surge.

Moreover, as Bitcoin (BTC) hovers around $71,000, a veteran analyst has set a target of $150,000 for the bull market peak. Similarly, asset manager VanEck gave a humongous target of $22,000 for Ethereum. VanEck believes that ETH might hit the target by 2030.

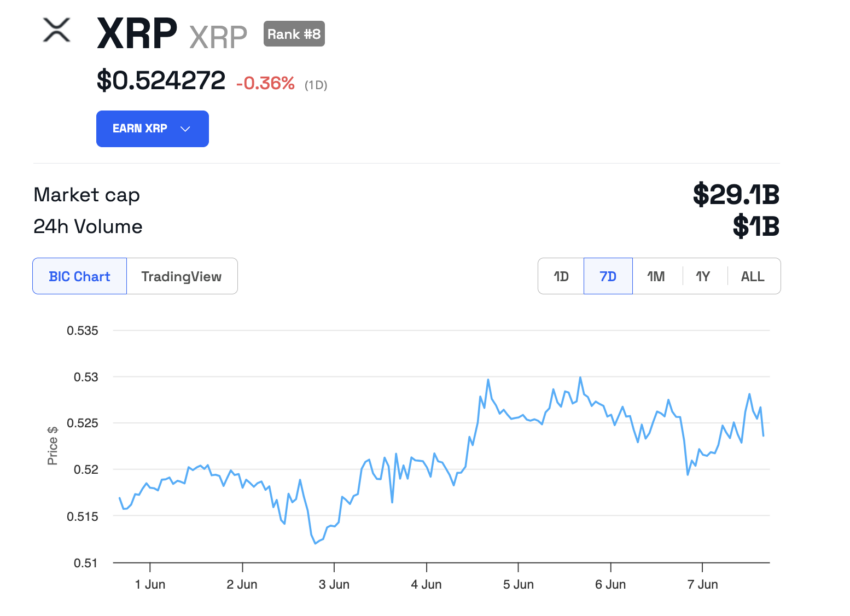

Ripple’s XRP Transactions Raise Eyebrows

This past weekend, Ripple initiated the transfer of 3 billion XRP tokens, stirring significant discussions in the crypto community. Notably, these transactions, valued at approximately $1.5 billion, deviated from Ripple’s typical monthly release of about 1 billion tokens.

According to crypto analyst Michael Nardolillo, these movements primarily involved internal transfers for escrow management. Despite the substantial volume, XRP’s price has remained relatively stable at around $0.5242, reflecting the market’s tempered response to these developments.

“Majority of these are internal movements and escrow relock ups. Everyone it says ‘unknown’ account the bot was wrong and it was still a Ripple account,” crypto analyst Michael Nardolillo explained.

Read more: Ripple (XRP) Price Prediction 2024 / 2025 / 2030

XRP Price Performance. Source: BeInCrypto

XRP Price Performance. Source: BeInCryptoBinance Delists 4 Altcoins

On Monday, Binance announced it would delist four altcoins – OMG Network (OMG), Waves (WAVES), Wrapped NXM (WNXM), and NEM (XEM), effective June 17, 2024. This decision is part of Binance’s routine assessment to ensure a high-quality trading environment.

“When tokens no longer meet our listing criteria or significant changes occur in the industry environment, we conduct a thorough project review and may delist them,” Binance said.

Consequently, the prices of these coins have sharply declined, with OMG, WAVES, and XEM experiencing significant drops, whereas WNXM has seen only a slight decrease.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

OMG, WAVES, WNXM, and NEM Price Performance. Source: TradingView

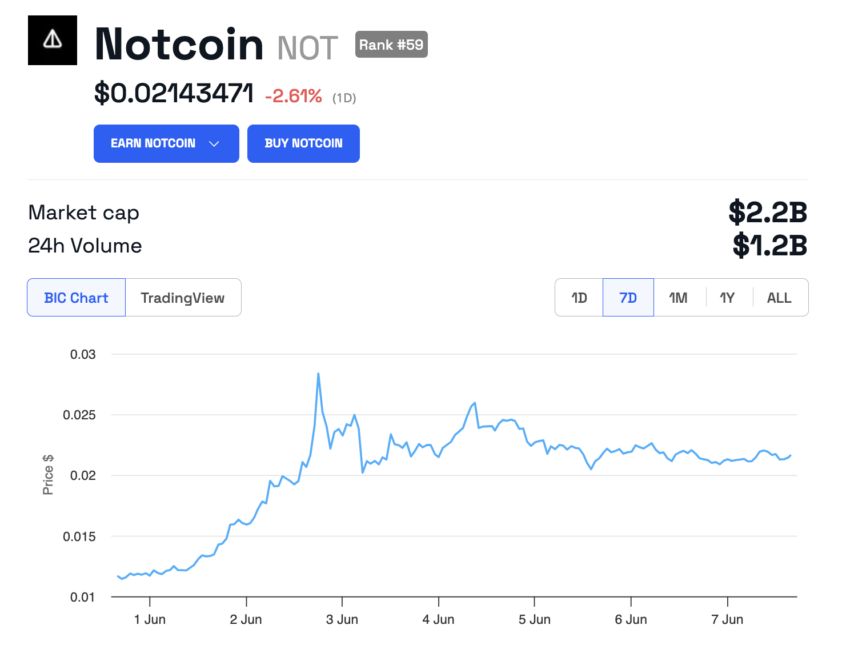

OMG, WAVES, WNXM, and NEM Price Performance. Source: TradingViewNotable Surge for Notcoin

In contrast to four altcoins delisted by Binance, Notcoin (NOT) has recently captured the market’s attention with an impressive 80% rise in the past week. After its initial release at $0.012 and a subsequent price drop, NOT rebounded dramatically, achieving a peak of $0.029.

This surge propelled Notcoin’s market capitalization near the top 50 cryptocurrencies, driven by strategic staking functions and token burns. However, after the highs at $0.029, Notcoin has been down by over 25%, currently trading at $0.021.

Read more: What is Notcoin (NOT)? A Guide to the Telegram-Based GameFi Token

Notcoin (NOT) Price Performance. Source: BeInCrypto

Notcoin (NOT) Price Performance. Source: BeInCryptoBitcoin’s Future: A Lofty Prediction

A seasoned trader, Peter Brandt, predicts that Bitcoin could climb to $150,000 by September 2025. His forecast hinges on the historical market cycles and Bitcoin’s halving events, which often signal the start of bullish phases.

Although Brandt remains cautious about the certainty of this prediction, he advises investors to monitor Bitcoin’s trends closely, especially if it struggles to set new highs.

“It should be noted that the highs of past bull markets line up quite well against an inverted parabolic curve. Should this tendency also continue, the high of this bull market cycle could be in the $130,000 to $150,00 range. The X on the chart marks the probably high date and price level,” Brandt wrote.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Bitcoin Price Performance in Every Halving Cycle. Source: Peter L. Brandt

Bitcoin Price Performance in Every Halving Cycle. Source: Peter L. BrandtVanEck’s Bold Ethereum Prediction

VanEck, a leading asset manager, projects that Ethereum could reach $22,000 by 2030, assuming continued approval of crypto-related financial products like exchange-traded funds (ETFs).

This optimism stems from Ethereum’s growing utility in various sectors, positioning it as a potential disruptor in the financial and technological landscapes. VanEck’s scenario suggests significant growth potential for Ethereum, predicated on its ability to maintain a dominant position among smart contract platforms.

“The centerpiece asset of this financial system is the ETH token, and in our updated base case, we believe it to be worth $22,000 by 2030, representing a total return of 487% from today’s ETH price, a compound annual growth rate (CAGR) of 37.8%,” VanEck stated.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

| Base Case | Bull Case | Bear Case | |

| Ethereum Terminal Smart Contract Market Share | 70.00% | 90.00% | 15.00% |

| ETH Price Target | |||

| Estimated Revenue 2030 ($M) | $78,501 | $361,641 | $2,477 |

| Global Tax Rate on Crypto | 15% | 15% | 15% |

| Validator Cut | 1.00% | 1.00% | 1.00% |

| FCF to Tokenholders in 2030 ($M) | $66,058 | $304,321 | $2,084 |

| FCF Terminal Multiple | 33.33 | 50 | 20 |

| ETH FDV ($M) | $2,201,945 | $15,216,032 | $41,681 |

| ETH Supply in 2030 | 100.07 | 98.85 | 115.73 |

| Token Price 2030 (USD) | $22,000 | $154,000 | $360 |

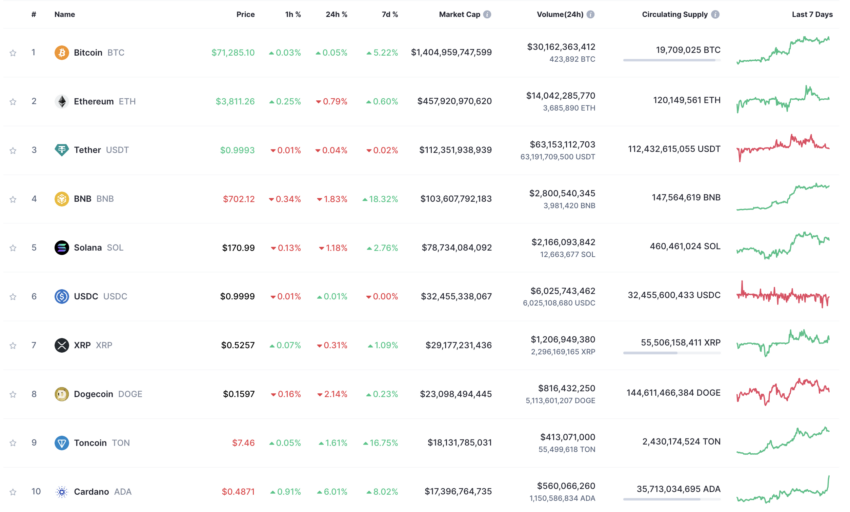

This Week’s Crypto Top 10

This week, among the top 10 crypto with the highest market capitalization, BNB was the top-performing asset with an 18.32% increase. In fact, on Wednesday, BNB reached a new all-time high, surpassing $700.

Bitcoin has shown strong performance, up by 5.22% this week. Conversely, Ethereum posted modest gains, up by just 0.60% in the same timeframe.

Read more: Which Are the Best Altcoins To Invest in June 2024?

Top 10 Crypto Assets by Market Capitalization. Source: CoinMarketCap

Top 10 Crypto Assets by Market Capitalization. Source: CoinMarketCapThis week, Toncoin (TON) surged by 16.75%, flippening the market capitalization of Cardano (ADA). As of writing, the market cap of TON stands at $18.13 billion, whereas the market cap of ADA stands at $17.39 billion.

The rest of the cryptocurrencies have maintained their ranking compared to last week.

The post Week in Crypto: Ripple Transfers XRP, Binance Delists Altcoins, and Notcoin Surges appeared first on BeInCrypto.

.png)

5 months ago

4

5 months ago

4

English (US)

English (US)