ARTICLE AD BOX

- Cardano trading volume surged by nearly 120%, while open interest in ADA futures rose 6.38% indicating growing interest in long positions.

- Large holders (whales) are accumulating ADA and moving assets off exchanges, signaling long-term confidence and a potential price increase.

Cardano (ADA) price has seen a major recovery in recent trading sessions, showing signs of potentially reversing losses incurred over the last few weeks. ADA price had previously fallen by 4% on a weekly basis and recorded a 5% decline for the month.

However, recent 24-hour data indicates a slight shift in sentiment, with Cardano posting an 8% gain, hinting at a substantial upward momentum in its price.

Cardano Whale Data & Potential Price Impact

The recent behavior of large ADA holders, or “whales,” appears to support this shift. Rather than continuing to offload assets, whale investors have turned to holding. It’s indeed an indicator of long-term confidence in ADA price action.

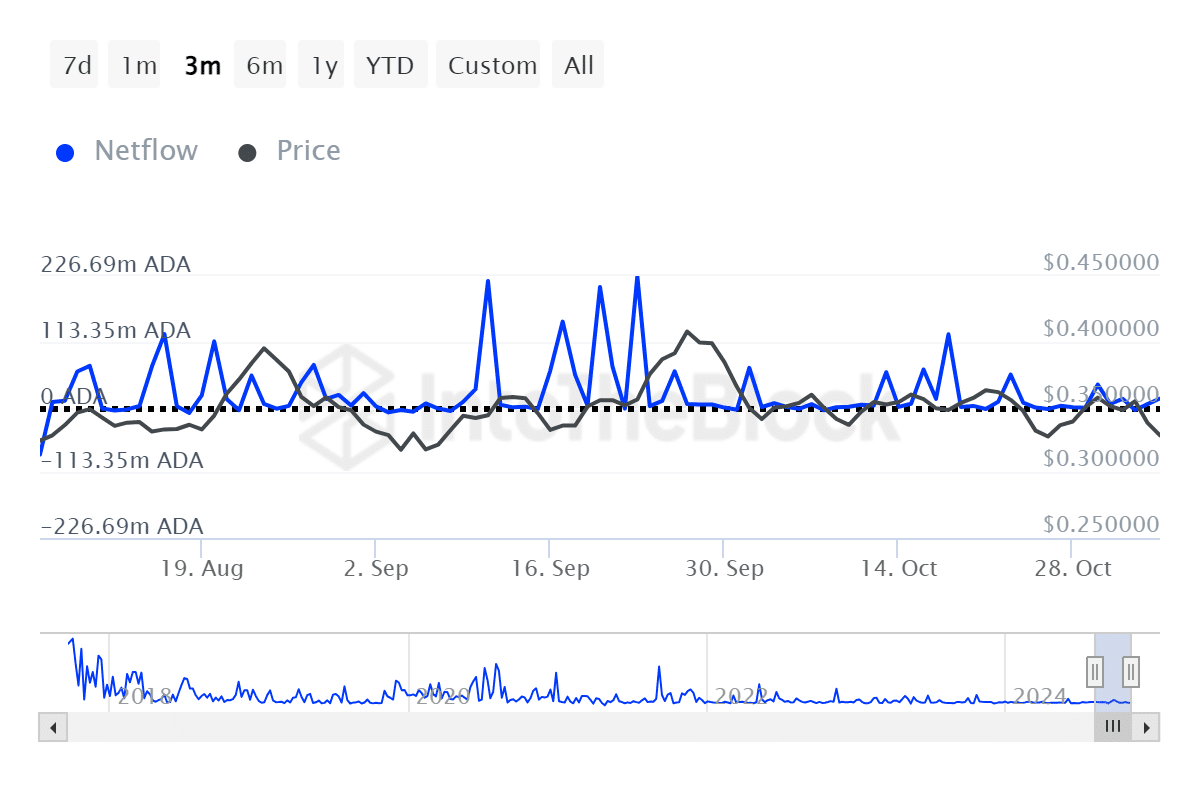

Source: IntoTheBlock

Source: IntoTheBlockData from IntoTheBlock shows a notable change in the Large Holder Netflow for Cardano, a metric that monitors the inflow and outflow of ADA among major holders controlling at least 1% of the total supply. This key metric has shown a dramatic decline with the netflow turning negative by 1,181.52% in just one week.

This sharp drop suggests that large holders are transferring ADA from exchanges to private wallets, suggesting massive accumulations. This pattern could tighten ADA’s supply and support upward price pressure.

In terms of trading volume, Cardano has also exhibited considerable activity among high-value holders. In the 24-hour window, ADA’s trading volume has surged by a whopping 119.67% to $552.87 million. While large transaction volume can imply either positive or negative market sentiment, the context of holding activity among large investors leans toward a bullish outlook.

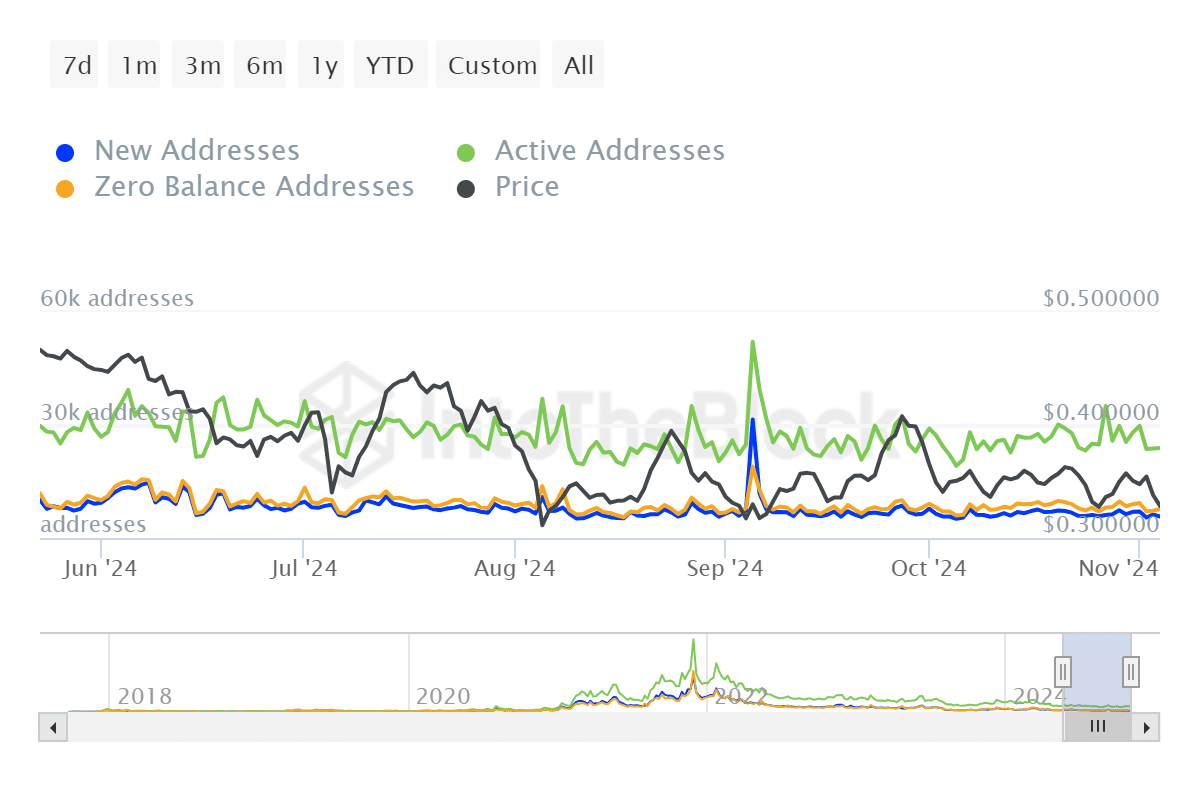

Additionally, a slight decrease in the number of Daily Active Addresses (DAA) was noted. This change, paired with the ADA price uptick, signals reduced short-term selling. The trend of accumulation among major holders could create further favorable conditions for ADA price movement in upcoming sessions.

Source: IntoTheBlock

Source: IntoTheBlockA Look At the ADA Futures Market

A rise in Open Interest (OI) in ADA futures, as per Coinglass data, further adds to this narrative. Open interest in Cardano increased by 6.38% to $236.50 million in the last day, reflecting an uptick in new long positions. This could again reinforce positive sentiment in the short term for the Cardano price, reported CNF.

Nevertheless, other metrics have shown a more neutral outlook for ADA’s broader ecosystem. The Total Value Locked (TVL) within the ADA DeFi space, as reported by Defillama, remains relatively stagnant at $235.06 million.

TVL is an indicator of the capital staked or invested within the platform, and it often correlates with market sentiment. A rise in TVL might signal increased bullishness, but the current flat reading suggests that overall sentiment remains cautious. Despite ADA price gains, the lack of a TVL increase reflects uncertainty among the broader investor base.

Also, the 24-hour long and short liquidations for Cardano stand at $713,120 and $793,120, respectively. While the short liquidations, which suggest a buying pressure as traders move to mitigate losses, are slightly higher, the impact is almost neutralized due to high long liquidations.

.png)

2 weeks ago

2

2 weeks ago

2

English (US)

English (US)