ARTICLE AD BOX

The SEC’s landmark approval of a spot Bitcoin exchange-traded fund (ETF) marks a pivotal moment for cryptocurrency, potentially bringing in a new era of legitimacy for BTC.

As industry experts speculate on the future trajectory of Bitcoin’s price after this event, attention is also turning to which low-cap coins could benefit.

Among these, Bitcoin Minetrix (BTCMTX), a promising new Stake-to-Mine platform, looks well-positioned to capitalize on the momentum seen throughout the crypto market after ETF approval.

A Rollercoaster Week Leading Up to Spot Bitcoin ETF Approval

The week leading up to the historic approval of a spot BTC ETF in the US was nothing short of a rollercoaster for the industry.

It began with a surge of excitement and speculation as major firms like BlackRock filed critical amendments in their final push for Bitcoin ETFs.

The hype then reached fever pitch, causing a spike in crypto prices and drawing widespread attention from seasoned investors and the general public.

However, the hype experienced a huge dip when the SEC’s Twitter account was compromised on Tuesday.

The hacked account erroneously announced the approval of spot Bitcoin ETFs, leading to widespread confusion and concern among the investor base.

Fears then arose that the SEC might delay or even withhold approval for the ETFs in the wake of this security breach.

Despite these challenges, the SEC announced the approval of multiple spot Bitcoin ETFs yesterday.

The SEC’s approval of 11 applications, including those from BlackRock and ARK Investments/21Shares, is seen as a strong leap toward the institutionalization of BTC.

How Could Bitcoin React Post-ETF Approval?

As investors navigate the aftermath of the SEC’s ETF approval, and with Bitcoin currently priced at $46,250, the crypto community is buzzing about the coin’s prospects.

This pivotal moment has investors questioning where Bitcoin’s price could go in the weeks and months ahead.

Historically, Bitcoin has reacted strongly to significant regulatory changes, often experiencing wild price swings.

The approval of a spot BTC ETF, a long-awaited milestone, could trigger a surge in demand, especially from institutional investors.

This influx of new capital could propel Bitcoin to new all-time highs, surpassing 2021’s peak.

However, the saying “buy the rumor, sell the news” frequently holds true in the crypto market.

In this scenario, the actual event of ETF approval might lead to Bitcoin’s price dropping as early investors cash in on the news.

While the long-term outlook remains bullish, the days ahead might see heightened volatility and a possible pullback.

Bitcoin Minetrix Benefits from ETF Approval Hype & Hits $8.1M Funding Milestone

It’s not just Bitcoin that is likely to be affected by the SEC’s ETF approval – other altcoins, like Bitcoin Minetrix (BTCMTX), could see value shifts.

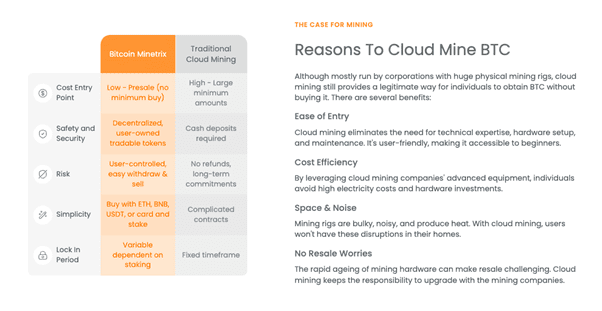

Bitcoin Minetrix introduces an innovative “Stake-to-Mine” model designed to streamline the process of BTC mining.

By allowing users to earn Bitcoin mining rewards through staking BTCMTX tokens, this model aims to bypass traditional barriers associated with the mining process, such as high electricity expenses.

Already generating significant buzz, Bitcoin Minetrix has raised over $8.1 million in its presale, demonstrating the crypto community’s strong interest in more accessible mining solutions.

The SEC’s green light to spot Bitcoin ETFs could be a massive positive for Bitcoin Minetrix.

Such approval is expected to unlock billions of dollars in capital into the broader crypto market, potentially boosting BTC’s price in the long run.

As a consequence, related tokens like BTCMTX could also experience a surge, riding the wave of hype in the crypto market.

Additionally, any rise in the price of BTC could lead to more interest in crypto mining as investors seek ways to generate a passive income stream.

This heightened interest might benefit Bitcoin Minetrix, as the Stake-to-Mine model offers a cost-effective entry point into the mining sector.

As more and more investors opt to join Bitcoin Minetrix’s Telegram community, the platform could see a surge in user engagement – making it one of the many altcoins that look set for an exciting few months ahead.

Visit Bitcoin Minetrix Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post What Next for Bitcoin Price as SEC Approves ETF, Could Bitcoin Minetrix Also Benefit? appeared first on CryptoPotato.

.png)

11 months ago

15

11 months ago

15

English (US)

English (US)