ARTICLE AD BOX

The cryptocurrency market is bracing for a significant event this Friday, July 26, as an unusually large Bitcoin options expiry looms. With approximately 61,200 Bitcoin options contracts valued at around $4.26 billion set to expire, the market is already showing signs of retreat. This event raises the question: will the market decline further?

Massive Bitcoin Options Expiry

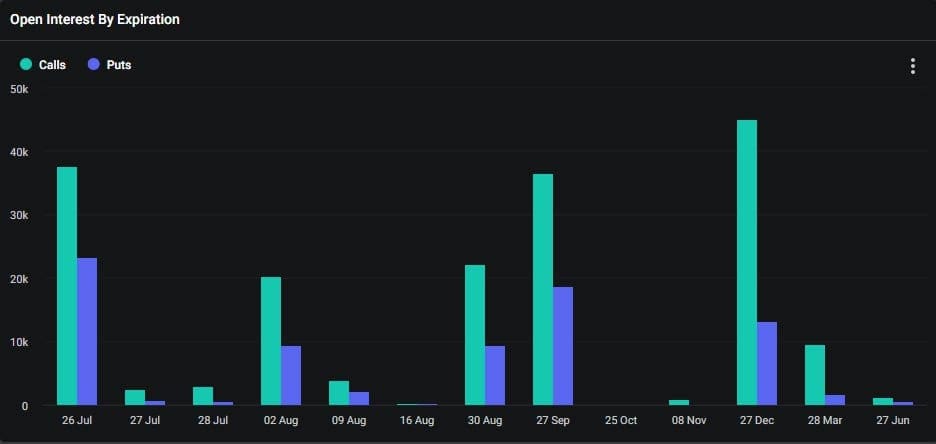

Friday’s expiry event is notable not only for its size but also because it coincides with the end of the month, typically a period of higher volatility. The current put/call ratio for these Bitcoin derivatives stands at 0.61, indicating that nearly twice as many long contracts are expiring compared to short ones.

This bullish sentiment is further highlighted by significant open interest at higher strike prices, with $942 million at $70,000 and an impressive $1.3 billion at the $100,000 strike price. On the downside, there is around $500 million in open interest at the $60,000 strike price.

Source: Deribit

Source: DeribitEthereum Options Expiry and Market Dynamics

In addition to the Bitcoin contracts, around 500,000 Ethereum options contracts, with a notional value of $1.76 billion, are also set to expire on the same day. The put/call ratio for these contracts is even more bullish at 0.46, suggesting a stronger preference for long positions. The largest open interest for Ethereum is at the $4,000 strike price, amounting to over $520 million.

Combined, these crypto options expiries total approximately $6 billion, marking one of the largest expiry events this year. This substantial expiry could lead to increased market volatility, influencing both Bitcoin and Ethereum prices.

Market Reaction and Future Prospects

The crypto markets have already started to feel the impact. Spot markets have seen a decline of about $120 billion this week. Bitcoin, after failing to break through the $68,000 resistance earlier, has retraced to $64,000 as of July 25. Despite a brief recovery to $67,000 during Friday morning’s Asian trading session, the market sentiment remains cautious.

Ethereum has experienced a more significant downturn, falling 11% since the launch of spot Ethereum ETFs in the United States. The price dipped to $3,100 on July 25 before recovering slightly to $3,250 in Asian trading on Friday.

Conclusion

As the expiry event approaches, market participants are closely watching the developments. The large volume of expiring contracts and recent spot market trends suggest that further volatility could be on the horizon. Whether the market will see a significant downturn remains to be seen, but the current indicators point to a cautious sentiment among traders.

Also Read: Bitcoin Faces Key Resistance as $2 Billion in Options Contracts Expire

.png)

9 months ago

9

9 months ago

9

English (US)

English (US)